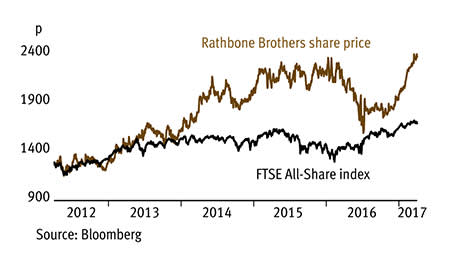

With a growing proportion of its revenue derived from regular management fees rather than commission, Rathbone Brothers (RAT) is a good quality fund manager. Despite some nervousness among retail investors last year, the fund manager was able to outperform the sector in growing its funds under management. What's more, although its share price has risen more than a third in the past six months, the shares still trade at a discount to rivals.

- Shares rated below sector average

- Growing importance of discretionary fund management

- Net inflows into unit trusts

- Distribution network being broadened

- Volatile commission income declining

- Uncertainty of retail investor sentiment

Rathbone Brothers has been shifting its business towards discretionary fund management - where clients hand over the day-to-day management of their portfolio - during recent years. As a result, more of its revenue is derived from investment fee income than commission, which depends on the volume of transactions carried out. Fees are based on a tiered scale applied to the value of a client's funds at the end of each quarter. Last year, fee income accounted for almost three-quarters of total revenue, growing 15 per cent to £185m. However, commission continues to dwindle, declining 10 per cent to £39m during the same period.

The defensive benefits of the fee-earning model were demonstrated during the past 12 months. Within Rathbone's core investment management arm, the existing operations brought in an extra £0.8bn to manage - marginally more than 2015's increase of £0.7bn - and £0.4bn of funds were brought in via acquisitions. Management said at the time that retail investor sentiment - which so easily blows hot and cold - had taken a knock from the uncertainty related to the UK's vote for Brexit and the US presidential election. However, few clients removed their funds.

Besides, the weakness of sterling following the UK referendum helped equity market performance. As a result, the investment management side made £2.9bn in investment gains, compared with a flat performance in 2015. This helped push the division's funds under management to £30.2bn from £26.1bn, representing annual growth of 17 per cent. This meant the division outperformed the WMA Balanced Index, which aims to proxy private investors' investment preferences; this grew 13.6 per cent during the same period. Against a backdrop of net redemptions across the industry, the unit trust business also gained net inflows of £259m, taking funds under management to £3.3bn.

Distribution channels are also being broadened beyond its investment managers and referrals from existing clients. Rathbone is targeting national IFAs and has been investing in a combined sales and business development team. Management says this is starting to pay off, with 12 partnerships now signed up. It expects to generate around £200m of inflows this year. The next step will be to target lawyers and accountants. Management also plans to launch a managed portfolio service, to be distributed through intermediaries for clients who have lower levels of funds to invest. This will be an execution-only service based on Rathbone's multi-asset portfolio funds.

RATHBONE BROTHERS (RAT) | ||||

|---|---|---|---|---|

| ORD PRICE: | 2,360p | MARKET VALUE: | £1.20bn | |

| TOUCH: | 2,356-2,360p | 12-MONTH HIGH: | 2,408p | LOW: 1,577p |

| FW DIVIDEND YIELD: | 2.9% | FW PE RATIO: | 15 | |

| NET ASSET VALUE: | 641p | |||

| Year to 31 Dec | Turnover (£m) | Pre-tax profit (£m) | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|---|

| 2014 | 201 | 61.6 | 102 | 52 |

| 2015 | 229 | 70.4 | 117 | 55 |

| 2016 | 251 | 74.9 | 122 | 57 |

| 2017* | 280 | 82.3 | 136 | 63 |

| 2018* | 314 | 93.7 | 153 | 68 |

| % change | +12 | +14 | +13 | +8 |

Normal market size: 200 Matched bargain trading Beta: 0.4 *Numis Securities forecasts, adjusted profit and EPS figures | ||||