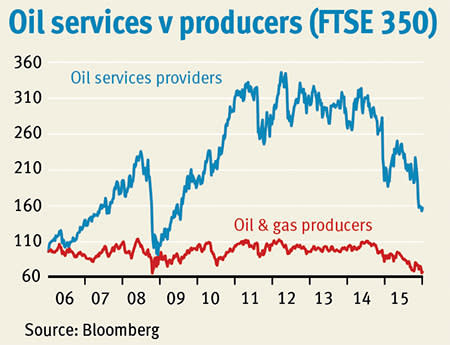

We’ve long been advocates of the ‘pick-and-shovel’ investment angle. The argument runs that you’re probably more likely to profit from investments in companies that provide essential equipment for a given industry, rather than investments directed at the industry's end product. The accompanying chart, plotting the rebased performance of two FTSE 350 capital-weighted energy indexes, certainly bears this out. The figures, which go back to the start of 2006, indicate that oil services providers easily outperform oil and gas producers during periods of capital expansion, but are prone to dramatic sell-offs when the tide starts running against them.

The value of the FTSE 350 Oil Equipment Services index halved in the two-month period subsequent to Lehman Brothers filing for Chapter 11 bankruptcy protection in September 2008. The index also contracted by around 38 per cent in the second half of last year, once it became obvious that the global rig count was under real pressure. And although the index rallied strongly during the second quarter of 2015, it has been in retreat ever since. Nonetheless, the oil services providers have clearly outperformed the producers over the period, although it’s conceivable that relative performance rates will coalesce if Saudi Arabia doesn’t peg back its production at some point in 2016.

Limited incentives at $40 a barrel

Brent crude at $40 a barrel doesn’t provide much in the way of an incentive for capital investment, particularly in maturing or marginal fields. Only a handful of producers have released their 2016 budgets to date, but early estimates point to a 35-38 per cent contraction in industry capital expenditure from its high-water mark in 2013. Chevron Corp (NYSE:CVX), the second-largest energy company in the US by revenue, recently revealed that it will pare back its capital expenditure by a quarter through 2016 – we expect other integrated majors to follow suit.

Analysts from Wood Mackenzie estimate that large-scale projects with contingent reserves equivalent to 20bn barrels of oil have been put on ice during the current downturn. Once deferred, these projects cannot be reinstated overnight. And although big oil companies still need to replenish their reserves, we suspect that many of the top rank will be looking to shore up their dividend cover, rather than financing replacement barrels – at least until oil markets move back into equilibrium. Even then, weakened cash-flows could hamper the ability of oil and gas companies to increase capital expenditure.

Severe housekeeping measures

The oil services sector has responded to the fall-away in remits by driving through some harsh austerity measures of its own. Market leader Schlumberger (NYSE:SLB) cut 20,000 jobs in 2015, while scaling back spending in response to weak crude prices. Closer to home, Amec Foster Wheeler (AMFW) recently announced that it was halving its dividend and pushing through another $55m in cost savings. The decision by the oil services engineer put a jolt through markets, but with negative free cash-flow yield expected in the current accounting year, the decision to reduce cash commitments seems prudent. Meanwhile, Hunting (HTG), a long-term favourite of the IC, axed over a quarter of its workforce and has warned that operating profits are set to plummet for 2015.

Other sector constituents may struggle to match existing dividend pay rates through the bottom line. After all, analyst consensus is modelling a deeper decline in sector earnings compared with the market downturns in 1997 and 2008. Persistent overcapacity in the industry will continue to weigh on profitability through the year, but there are other effects in the offing.

M&A in the face of faltering markets

M&A activity is also likely to increase as companies with stronger balance sheets look to vertically integrate their operations or gain wider exposure along the supply chain. A tendency exists, certainly among larger sector constituents, to consolidate in the face of faltering markets. The theory runs that by up-scaling their operations, companies can outlast their smaller rivals when the going gets tough, although in some cases, companies will pursue consolidation simply as a means of reducing debt financing costs – a heightened consideration given tightening senior debt markets. Credit options were accessible midway through this year, but with crude prices continuing to trail-off, and price hedges evaporating in the early part of 2016, the incentives to effectively dilute operational risk are increasing.

Certainly, one of the most high-profile deals of recent years was the proposed merger between US oil services giants Baker Hughes (NYSE:BHI) and Halliburton (NYSE:HAL), although the companies are still wrangling with the US Dept of Justice over antitrust issues. Neither of these companies was faced with any existential threat, yet the proposed tie-up may eventually be seen as emblematic of an industry trend if oil price anxieties feed through into a spate of takeover activity. We shall see.

FAVOURITES:

Companies that offer services designed to optimise rig performance, or those with a business mix skewed towards maintenance remits, have proved to be more resilient during the prolonged oil price slump. KBC Advanced Technologies (KBC) falls into the former category, while both Cape (CIU) and Gulf Marine Services (GMS) have been insulated against the worst effects of the oil price slump because of a bias towards maintenance contracts. Typically these types of contracts are lower margin, but they provide earnings visibility at a time when markets are in a state of flux. Both companies enjoy a significant presence in the MENA (Middle East and North Africa) regions, where drilling activity has been relatively solid. And in the case of GMS, a relatively high proportion of contract work for National Oil Companies provides another predictable revenue stream. Despite a recent warning on margin pressure, we plump for GMS as our preferred option in the sector. The company trades on a lowly forward multiple of six, yet it has been able to maintain high utilisation rates across its fleet of self-propelled self-elevating support vessels (SESV), and it has also commenced its first decommissioning project - a potentially lucrative corner of the oil services market.

OUTSIDERS:

The collapse in Hunting’s market value has mirrored the fall-away in the rotary rig count. Hunting, a specialist oil equipment provider, has been hit harder than most by the decline in exploration and appraisal drilling, while demand for the group’s proprietary technology for use in directional drilling rigs has been constricted by a softening in the North American shale market. To the group’s credit, it has moved decisively to streamline the business model in order to weather the storm. And the group’s Subsea, Electronics and Dearborn divisions give cause for encouragement. However, Hunting now anticipates a 90 per cent decline in operating profits for 2015, while the cash-margin is expected to more than halve to around 8.2 per cent. The good news for Hunting shareholders is that once the oil market eventually moves into balance, the quickest rebound in capital expenditure is likely to come from the US onshore unconventional complex because of the shorter capital/cash-flow payback cycle - that's positive for Hunting's specialist directional drilling kit.

IC VIEW:

There's an awful lot of bad news priced into energy and oil at the moment – but we’re unlikely to witness any thaw in investor sentiment towards the oil service sector until crude oil markets move towards equilibrium. Most industry analysts don’t see any hope of this prior to the third quarter of next year at the earliest, but the extent of capital retrenchment means there is a genuine chance that the market could slip into deficit rather more quickly than many would have thought possible. Recent individual decisions to cut big-ticket capital projects could have a marked aggregate effect on prices when markets tighten. It is worth bearing in mind that with Opec operating near full-capacity, the average daily surplus in global production stands at around 1.9m barrels per day, which is only slightly above the increase in new demand through 2015 – this implies that the surplus could dissipate by 2017. It means that North American unconventional producers, which are able to initiate, halt or re-commence production rapidly and at low cost, are set to become the industry’s new swing producers.

THE ANALYST VIEW:

The European oil services sector has re-rated since February and now sits at the long-term price/earnings (PER) multiple. Unlike the 2009 re-rating, though, the rally since February has not been accompanied by any oil price recovery. With earnings still on a downwards trajectory as operators plan ever-greater cost/capex savings, we believe that the sector has more down than upside risk.

Unfortunately we do not expect a quick turn-around in the oil price. The current 2014/15 cycle continues to struggle to find a floor, and on our latest oil price assumptions the recovery is expected to be muted for some months yet. Fundamentals need to improve quickly if there is to be a further sector rally, and we do not think that this is compatible with our near-term oil price assumptions or capex forecasts for the supermajors.

The oil services sector has been a horrific place to be invested since the oil price rolled over in mid 2014. We are bullish long term but with the main recovery occurring on a 2H17+ timeframe.

The problem is that in 2008/9 the recovery in the PER multiple coincided with a recovery in the oil price, which ultimately drove higher earnings to validate the multiple. This makes us nervous in terms of the sector and convinced that we are better served waiting for fundamentals to show some sort of improvement before “buying the sector”. As it stands, we see no immediate turnaround in fundamentals.

We forecast capex to fall yet again for the super-majors in 2016, continuing the downward trend that began in 2014. Oil price volatility during the current budgeting cycle only serves as an additional reason to push through further cuts, in our view. Evidence so far is that the super-majors are positively surprising on the amount of capex they are bringing through; for example BP has set out a plan to spend US$17-19bn per annum from 2016 onwards, which suggests some downside to the consensus estimate for next year of $19bn.

Produced by analysts at Macquarie Capital