Highlights:

- Bitcoin is drawing mainstream attention after rallying from $4,000 to $40,000 in less than a year

- We explain how to buy bitcoin and how to get in on the hype without buying it directly

Last November, Megan Thee Stallion gave her fans one of the most acclaimed hip-hop albums of 2020. One month later, she offered them $1m in bitcoin. The 25-year-old Texan rapper tweeted saying she would send units of the digital currency to those who responded with their username on Cash App, a payment app that allows you to trade bitcoin. “Bitcoin is a really smart investment and increases over time,” she added.

The tweet – which has received as many as 10,000 replies – made Megan Thee Stallion the latest in a growing number of celebrities to get behind the cryptocurrency. Fans who followed her 'advice' have been getting richer. The day she sent her tweet in December, a single bitcoin was worth more than $20,000 (£14592.9), after trading as low as $3,867 at one point in March. This month, it reached almost $42,000, although it has since fallen about a fifth from that peak.

As scores of millennials ride high on this rapid ascent, more seasoned investors may be left with a serious case of what the young’uns like to call FOMO (Fear Of Missing Out). While bitcoin’s giddy fluctuations will be enough to leave many feeling light-headed, even the most responsible investors may find the dizzying highs a little tempting.

In fact, unlike bitcoin’s last peak in 2017, it is believed much of the recent rally is now being driven by institutional investors pouring their millions into the fray. Ruffer, an investment management firm known for its “conservative” strategy, recently built up a £550m bet on the cryptocurrency.

Meanwhile, analysts at JP Morgan (US:JPM) have suggested a long-term price target of $146,000, suggesting bitcoin is akin to “digital gold” for the millennial generation. Those who similarly argue for holding bitcoin as a hedge against inflation point to the security stemming from its digital encryption, its independence from government control and the cap enforced on its supply.

But most of the investment establishment has remained wary, as bitcoin trading platforms look to draw in more and more new investors through relentless marketing campaigns. After the 2017 peak, bitcoin went on to lose over 80 per cent of its value within a year. The Financial Conduct Authority has warned investors to be prepared to lose all their money, after it introduced a ban on trading cryptocurrency derivatives earlier this month.

Those who like to keep a cap on the carbon footprint of their portfolio should also be aware of the huge environmental impact of the digital infrastructure behind bitcoin. In 2019, the University of Cambridge calculated its energy consumption was greater than the whole of Switzerland.

For many, however, the biggest barrier to entry is uncertainty of what bitcoin actually is (for a concise explainer on this, click here). Most stores don’t accept payments in it, so it is not really useful as a currency. This means bitcoin is hardly linked to the real economy, making estimations of its inherent value speculative to say the least.

Trading bitcoin also requires different online tools to buying stocks or other currencies – we outline how to use them here. But we also explore some of the ways you can get exposure to the hype using more traditional platforms and without buying it directly.

Buying directly

Bitcoin can be bought on cryptocurrency exchanges, including Binance, Coinbase and Kraken, as well as new share-trading apps including Robinhood and eToro. Through such apps, investors can exchange pounds and other currencies for multiple bitcoins, a single bitcoin, or a fraction of a bitcoin. Like other platforms you may use for trading shares, they will charge a fee for each transaction.

The fees are highly variable and will depend on the amount of money you plan to invest, as well as the platform you use. Many people may have settled on an app because they already use it for other services, or perhaps because it was plugged by their favourite rapper.

As well as choosing an exchange you’ll need to pick a virtual wallet for storing the amount of bitcoin you own. If you want to go for the simplest option, many of the exchanges also come with a wallet that does this automatically.

But bitcoin purists would recommend getting an external wallet, some of the most popular of which are available through apps including Blockchain.com and Exodus. These generally don’t ask you to provide personal information in order to sign up, thus preserving the privacy that bitcoin followers value. The responsibility for remembering your passcode lies with you: an upside for those who support the decentralised ideals of bitcoin, but a downside for those who have lost the code. Earlier this month, one programmer in the US hit the headlines after misplacing the password that he needs to access his 7,002 bitcoin, then worth $220m.

So you’ve chosen your exchange and your wallet, how much bitcoin do you buy? Only as much as you’re prepared to lose, according to Laith Khalaf, financial analyst at AJ Bell. While much was made of Ruffer’s entry into bitcoin, it’s important to remember the firm only invested about 2.5 per cent of its portfolio, Mr Khalaf added. Financial advisors have recommended a similarly minimal weighting for retail investors looking to buy. While investors also technically risk losing all the money they invest in shares, no ordinary stock rises and falls as precipitously as bitcoin.

Indirect access

For those who seek to access crypto but don’t want to step too far from traditional investments, there are options. Regulated crypto funds, for example, whose providers say they remove investor concerns about how to access and store bitcoin, rule out the possibility of a wallet being hacked and serve as a regulated custodian to the asset.

From 6 January 2021, the sale of exchange traded notes (ETNs) and derivatives that reference cryptocurrencies to UK retail investors has been banned, owing to their extreme volatility, lack of reliable basis for valuation and prevalence of financial abuse in the secondary market, according to the regulator.

To get around this, Charlie Morris of ByteTree Asset Management says some UK investors have been setting up accounts with online brokers in the European Union and Switzerland where the sale of crypto ETNs is permitted, with a popular product including Sweden-listed XBT Provider Bitcoin Tracker (SE:XBT), the first bitcoin-based security to be listed on a regulated exchange in Europe, in 2015.

The UK’s ban comes after rapid growth in crypto currency investment products last year. According to Morningstar data, European mutual funds and exchange traded products investing in cryptocurrencies saw assets under management increase fivefold in 2020, to €2.3bn.

In the US, the Securities and Exchange Commission (SEC) has batted off numerous applications for crypto ETFs, but there are some large crypto funds that sophisticated investors can access. Grayscale Bitcoin Trust (US:GBTC) was the first publicly-quoted Bitcoin investment vehicle, and is the largest with a market cap of $23bn at the time of writing. The trust was established in 2013, but ceased to be sold on UK platforms after it failed to comply with MiFID II regulations introduced in January 2018.

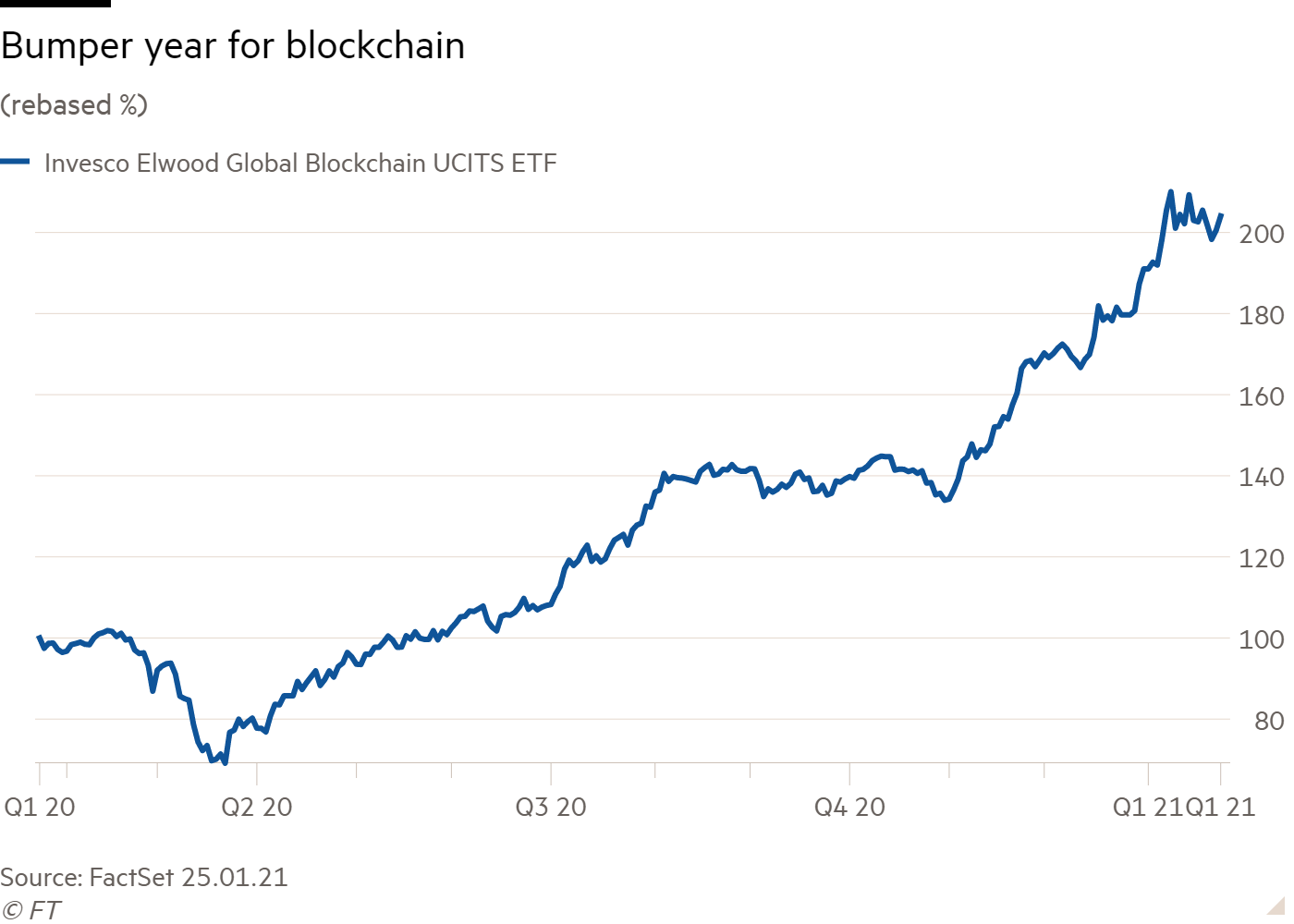

If you don’t want to venture into a foreign jurisdiction, there are other ways to play the crypto theme. While not investing in cryptocurrencies, Invesco Elwood Global Blockchain UCITS ETF (BCHS) offers exposure to companies that use or are developing blockchains, the technology that underpins Bitcoin. The ETF grew by over 90 per cent in the year to 22 January and has more than $400m of assets.

Investing in London-listed crypto mining companies is another way of mirroring the currencies’ trajectories. Argo Blockchain (ARB), which recently issued a share placing to boost its crypto mining capacity, topped Hargreaves Lansdown’s ‘net buy’ list for the first three weeks of this year, across both UK and international shares. The stock is up over 1000 per cent in the past 12 months, making it now look extremely expensive.

Online Blockchain (OBC) is another option, which describes itself as a “an ecosystem of cryptocurrency projects and solutions”. The company provides funding and support for the development of new cryptocurrencies across the world and has been extremely volatile, with its share price halving following bitcoin’s price peak on 8 January.

In the US, business intelligence firm MicroStrategy (US:MSTR) holds thousands of bitcoin tokens on its balance sheet, and has been widely seen as a bitcoin play. The US also has established crypto mining companies such as Marathon Patent Group (US:MARA) and Riot Blockchain (US:RIOT) listed on the Nasdaq, each with a market cap of over $1bn and accessible on the major UK platforms. US crypto exchange Coinbase filed for an initial public offering with the SEC last month, which if successful will make it the first crypto exchange to go public.

Payments companies might also benefit from increased bitcoin adoption. Last October Twitter-founder Jack Dorsey’s payments firm Square (US:SQ) announced it had bought 4,709 bitcoins, worth approximately $50 million at the time. PayPal (US:PYPL) has also entered the crypto market by letting its customers buy and sell Bitcoin and other virtual currencies using their PayPal accounts.

Investors should heed the advice of the UK watchdog, and remember that crypto assets are a highly complex, high risk and relatively new area of investments. While the rise of bitcoin has been hard to ignore, we saw this in 2017 before it came crashing back down again. As the price has been falling since the second week of January, those who want to invest might benefit from waiting. And any crypto allocation should only account for a very small proportion of an investment portfolio, if any at all.

Foreign ETNs and derivatives | |

XBT Provider Bitcoin Tracker (SE:XBT) | Sweden-listed. The first bitcoin-based security to be listed on a regulated exchange in Europe |

Grayscale Bitcoin Trust (US:GBTC) | The first publicly-quoted Bitcoin investment vehicle, and is the largest with a market cap of $23bn at the time of writing |

UK-listed bitcoin exposure | |

Invesco Elwood Global Blockchain UCITS ETF (BCHS) | Exposure to companies that use or are developing blockchains |

Argo Blockchain (ARB) | Cryptocurrency mining company which topped Hargreaves Lansdown’s ‘net buy’ list for the first three months of this year |

Online Blockchain (OBC) | Provides funding and support for the development of new cryptocurrencies |

US-listed bitcoin exposure |

|

MicroStrategy (US:MSTR) | Business intelligence firm which holds thousands of bitcoin tokens on its balance sheet |

Marathon Patent Group (US:MARA) | Cryptocurrency mining company |

Riot Blockchain (US:RIOT) | Cryptocurrency mining company |

Square (US:SQ) | Payments company run by Twitter-founder Jack Dorsey which bought 4,709 bitcoins, worth approximately $50m last October |

PayPal (US:PYPL) | Lets its customers buy and sell Bitcoin and other virtual currencies using their PayPal accounts |