The attraction of stamps as an investment medium is their high value relative to their weight. And prices have been documented over many years, so historic returns can be calculated with some accuracy.

Those looking to use stamps as an investment medium need to bear in mind the usual drawbacks of any tangible asset. These include lack of immediate liquidity, high transaction costs, and the long timescale needed for the best returns are achieved.

What sort of returns can be expected? Indices of stamp prices compiled by Stanley Gibbons suggest that, over the last decade, annual returns have been in the region of 6-7 per cent, with rarer items appreciating at approaching double that rate.

However, there are caveats. One is that the wide spread between bid and offer prices typically charged by dealers cuts these annual rates of return by anything up to three percentage points. So rare British stamps that have appreciated at around 12 per cent a year over the past decade might show a return of less than 10 per cent when the spread is factored out.

The second is that there have been periods when prices have spiked. The late 1970s was a case in point. Many investors at this time learnt the salutary lesson that buying at the wrong time can make a big dent in returns.

A further point relates to the dominance that Stanley Gibbons has in the publication of the price catalogues on which these calculations are based, since the firm is also one of the principal dealers and owners of stock. Some dealers complain that prices in the SG catalogue are set at unrealistically high levels relative to the prices of stock that is typically available in the market.

SG's argument is that, since it is only one of several dealers in the auction market for stamps, there is no reason for them to set catalogue prices at an unrealistically high level, and that their catalogues are simply a guide to what stamps in the best possible condition might fetch.

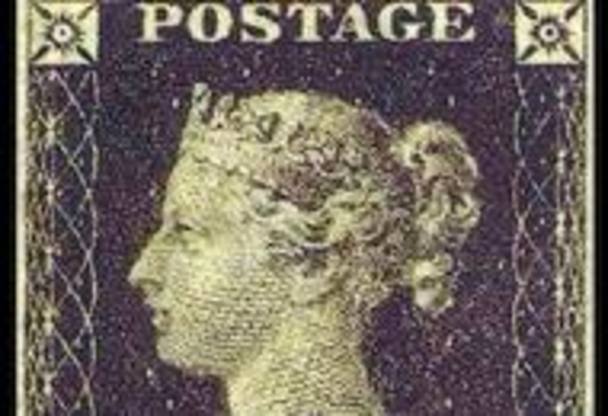

Settling on a theme for a portfolio is best done with advice. A limited number of classic stamps in top condition arguably make the best choice. Dealers can advise on the most suitable stamps to use. There are top quality rarities in most categories. One area for investors to avoid, however, is recent stamp issues. The post war era saw postal authorities in most countries issue large numbers of stamps annually to take advantage of philatelic interest. While of interest to collectors, these are not sufficiently rare to make good investments.

Another important consideration is preserving the stamps in good condition. Investment grade stamps are extremely susceptible to damage from moisture, sunlight and careless handling. Few individuals are likely to be able to replicate the correct conditions at home, so investment grade stamps are usually best kept in the temperature and humidity controlled vaults of the dealers through which they have been bought. Some dealers will store and value portfolios free of charge.

Dealers like Stanley Gibbons also offer alternative routes into stamp investment. Gibbons has, for example, pioneered the use of so-called guaranteed return contracts. These offer investors a fixed rate of interest over a pre-set period and what amounts to a free call option over a portfolio of stamps. These can be rolled over, kept, or sold at a fixed percentage of the catalogue price at the end of the term. There has also been talk of the firm launching a stamp investment fund.

Gibbons also offers short term financing of stamp investment portfolios and a discretionary rare stamp trading facility, where it splits any profits with the investor.