Anyone who has children will know about the clutter of toys. There's a good chance that a fair few of the things you trip over will come from the stable of Mattel, owner of enduring toy brands such as Barbie for girls and Hot Wheels for boys. Despite being the largest brands in their respective categories, both continue to grow rapidly – Barbie sales climbed 12 per cent in 2011, while Hot Wheels climbed 11 per cent over the Christmas quarter, completely selling out of its new Wall Tracks range.

- Owner of the world's biggest toy brands

- US economy recovering

- Strong presence in emerging markets

- Cutting costs and enhancing margins

- Worries over Europe

- Fisher Price sales under pressure

The giant toymaker – which controls over 10 per cent of the global market for toys worth $85bn (£53bn) a year – is also a dab hand at licensing hot properties and turning them into must-have toys. Two such licences, Disney Princess and Cars, were among the biggest selling toys of 2011. This year tie-ins are planned with films, including Brave and Batman, while Barbie is also to get a movie-inspired makeover, this time taking on a post-apocalyptic Hunger Games look to coincide with the release of the eponymous movie later this year.

That demand for edgier children's entertainment is also behind the launch of the internally developed Monster High franchise. This was the second most popular doll in the US last year, thanks partly to growing cult status among adult collectors. Its success drove a 19 per cent increase in sales of Mattel's non-Barbie dolls. The Monster High range has now been launched in 35 countries and should receive a boost this year from a feature film and new Nickelodeon TV shows. Mattel is also in touch with hi-tech trends with its new Apptivity range, which link toys with iPad applications, as well as turning digital properties such as Angry Birds into successful toys.

The group's recent $680m acquisition of HIT Entertainment (which was listed in London until 2005) should help redress weakness in its pre-school business and offset the loss of the Sesame Street licence last year. The deal brings such brands as Angelina Ballerina, Bob the Builder and the enduring Thomas and Friends, the fourth-biggest selling toy range in the US last year and the number one pre-school brand. It is also expected to add to earnings from 2013 and boost profit margins, thanks to its licensing model. Changes to marketing at Fisher Price, which produces more pre-school toys and accounts for a third of sales, also appear to have been well received by shoppers, halting the brand's recent underlying sales slide.

MATTEL (MAT) | ||||

|---|---|---|---|---|

| ORD PRICE: | $34.40 | MARKET VALUE: | $11.7bn | |

| TOUCH: | $34.39-34.40 | 12-MONTH HIGH: | $34.48 | LOW: $22.70 |

| DIVIDEND YIELD: | 3.9% | PE RATIO: | 12 | |

| NET ASSET VALUE: | $7.70 | NET DEBT: | 7% | |

| Year to 31 Dec | Turnover ($bn) | Pre-tax profit ($m) | Earnings per share ($) | Dividend per share ($) |

|---|---|---|---|---|

| 2009 | 5.43 | 660 | 1.45 | 0.83 |

| 2010 | 5.86 | 847 | 1.88 | 0.92 |

| 2011 | 6.27 | 971 | 2.20 | 1.24 |

| 2012* | 6.70 | 1,096 | 2.50 | 1.24 |

| 2013* | 7.07 | 1,243 | 2.90 | 1.35 |

| % change | +6 | +13 | +16 | +9 |

Beta: 0.8 £1=$1.594 *BMO Capital Markets forecasts (except DPS, consensus forecast) | ||||

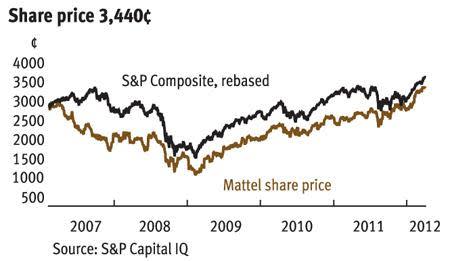

The strength of its portfolio has helped Mattel overcome a difficult trading environment. Toy sales have been hit by pressure on disposable incomes. According to market research group NPD, US toy sales slipped by 2 per cent last year to $21.2bn. Europe, which accounts for a quarter of Mattel's sales, is also subdued – the continent's biggest toymaker, Lego, said that its European sales would be flat at best in 2012.

However, Lego expects modest growth elsewhere, not least in the US where jobless rates are dropping and consumer confidence is rising. That's good news for Mattel because the US still accounts for half of sales. Yet Mattel is increasingly a global operation and is seeing especially strong growth in Latin America – which grew 14 per cent last year to approach $1bn in annual sales – and Asia. With annual spend per child significantly lower than in developed economies, developing economies should continue to grow fast as Mattel expands the toys range it offers in these regions.

Meanwhile, management continues to carve out cost-savings, recently identifying a further $25m in annual savings to bring the cumulative total to $175m, while price increases have enabled Mattel to claw back input cost increases of 30 per cent in the last three years. That means operating margins are well on course to hit Mattel's 20 per cent target, although there remains the risk that nervous retailers may again resort to heavy promotional activity. However, as Mattel's chief executive Bryan Stockton notes, toys have proved resilient to economic troubles, with the industry now 5 per cent larger than it was before the downturn.