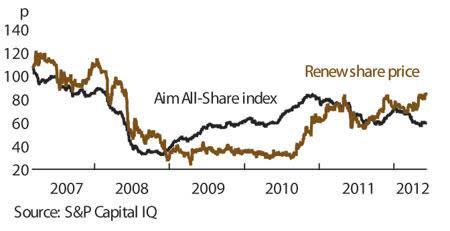

Renew has transformed itself into a specialist engineering support group following last year's acquisition of Amco, but investors haven't noticed and the share price doesn't reflect the bulging pipeline of work or the revitalised profit margins. But later this year the shares will be shifted into the London market's 'support services' sector and, helped by a strong first half that saw record results, that could be the catalyst for a re-rating.

- Record first-half results

- Engineering services orders growing

- Dividend on the rise

- Assured revenues

- Exposure to construction sector

- Debt levels following Amco deal

The £15m deal for Amco in February 2011 looks a smart move. It brought national coverage and, perhaps more importantly, highly profitable engineering support work, with clients such as Network Rail, British Energy and National Grid. Engineering services work is also stable as it comes through framework agreements whereby Renew is effectively on its clients' payroll, doing small-ticket items, such as clearing sewage blockages or re-laying cables on projects for Network Rail and London Underground. These contracts give Renew predictable revenues and the company now has 75 framework deals, up a fifth in the first half of the current year, with 62 in the engineering services sector. Also, as flooding hits the UK, this increases the chances of more spending on flood defences from the Environment Agency, another client of Renew.

The Amco deal increased some risks by raising net debt to £10.3m by March 2011, but strong cash flow saw this fall to £6.9m by the end of this March; broker WH Ireland reckons the figure will fall to £3.3m by the end of September, so the deal has almost paid for itself.

RENEW (RNWH) | ||||

|---|---|---|---|---|

| ORD PRICE: | 85p | MARKET VALUE: | £51m | |

| TOUCH: | 83-85p | 12-MONTH HIGH: | 85p | LOW: 49p |

| DIVIDEND YIELD: | 3.9% | PE RATIO: | 7 | |

| NET ASSET VALUE: | 18p | NET DEBT: | 66% | |

| Year to 30 Sep | Turnover (£m) | Pre-tax profit (£m) | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|---|

| 2009 | 317 | 1.17 | 0.6 | 3.0 |

| 2010 | 290 | 3.99 | 4.6 | 3.0 |

| 2011 | 357 | 2.46 | 2.2 | 3.0 |

| 2012* | 354 | 9.00 | 11.2 | 3.2 |

| 2013* | 352 | 9.40 | 12.0 | 3.3 |

| % change | -1 | +4 | +7 | +3 |

Normal market size: 4,000 Market makers 12 Beta: 0.8 *N+1 Brewin estimates (earnings are not comparable with historic figures) | ||||

Previously, Renew had been more exposed to the vagaries of the construction market, and further downturn there could still hurt as construction was responsible for 42 per cent of group revenue and 18 per cent of operating profits in the half year to 31 March.

But it is the growth of the engineering services division that makes Renew an exciting prospect. True, the order book is down from £334m in March 2011 to £304m in March 2012 as construction demand eases, but underneath the headline figure much has changed - 75 per cent of orders are for higher-margin engineering services, up from 49 per cent a year ago.

Renew's performance should also become less volatile, with 83 per cent of engineering work coming from regulated sectors, such as water, railways and nuclear power. Operating profits in the first half more than doubled from £2.2m to £4.7m, and the operating margin improved from 1.4 to 2.5 per cent. Chief executive Brian May thinks the company is well on the way to delivering a profit margin of over 3 per cent. The dividend is moving in the right direction, too. After being stuck for three years at 3p, a 5 per cent rise in this year's half-year payout indicates management's confidence.