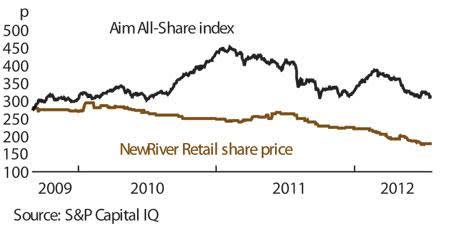

This is one for the contrarians. Shares in NewRiver Retail have dropped continually since they were floated in 2009, and the company's field of investment - high-street mini-malls in the UK - could hardly be less fashionable. Yet the plan makes sense and, so far, it has been executed with consistency. We don't know when the share price erosion will stop - but we are confident the shares are already a bargain.

- Fat dividend yield

- Growth potential through asset management

- Management's track record

- Shares trade far below net asset value

- Retail space deeply unfashionable

- Taking on complex projects

NewRiver was set up by property old-timer David Lockhart, whom seasoned investors may remember as the founder of Aim-quoted Halladale. He bailed out at the right time, selling Halladale in early 2007. He then launched NewRiver just as the real estate market was recovering in mid-2009. The idea was to buy down-market shopping arcades, ideally from distressed sellers, turn them around and sell them.

That's easier said than done, particularly in a recession that is hitting consumer spending the hardest. But there is evidence that the plan is working. NewRiver's first disposal was of a retail unit in Canterbury, which it acquired in 2010. The company conducted a rent review with a discount department store, Wilkinson, then sold the unit to an institutional investor for a geared profit on cost of 16 per cent. Last October, it sold a unit in Great Yarmouth for £3.38m, having bought it for £2.5m and re-let it almost immediately to Poundland.

NEWRIVER RETAIL (NRR) | ||||

|---|---|---|---|---|

| ORD PRICE: | 182p | MARKET VALUE: | £57.7m | |

| TOUCH: | 175-182p | 12-MONTH HIGH: | 260p | LOW: 177p |

| DIVIDEND YIELD: | 8.9% | INVESTMENT PROP'S | £209m | |

| DISCOUNT TO NAV: | 30% | NET DEBT: | 126% | |

| Year to 31 Mar | Net asset value (p) | Pre-tax profit (£m) | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|---|

| 2010 | 261 | 2.2 | 21.0 | n.a. |

| 2011 | 273 | 4.9 | 23.1 | 5.5 |

| 2012 | 254 | 4.0 | 15.3 | 15.0 |

| 2013* | 261 | 7.1 | 22.3 | 16.0 |

| % change | +3 | +79 | +46 | +7 |

Normal market size: 1,000 Market makers: 5 Beta: 0.4 *Investec estimates (profits and earnings not comparable with historic figures) | ||||

Of course, such isolated deals are the low-hanging fruit. Most of NewRiver's investments are whole malls, which take longer to turn around, often involving costly refurbishments. For example, the company bought an ugly shopping precinct in Witham, Essex, last November, which it hopes to spruce up and reconfigure to accommodate a supermarket. It has similar plans for four larger centres it bought last August in a transformational £68m deal from Zurich Insurance.

Such projects are more complex and riskier. Moreover, left to themselves, valuations for such assets are falling. Bank finance is thin, and equity-rich institutions won't touch assets that need hard management work. NewRiver will have to run just to stand still.

Yet the company has a commonsense approach. It only buys centres where rents are already low – that, Mr Lockhart thinks, is the secret to keeping old tenants and attracting new ones. He also sticks as closely as he can to four sectors in which consumer demand is reasonably robust: supermarkets, cheap fashion, health and beauty, and discounters. Three-fifths of income in the Zurich portfolio comes from these sectors.

Meanwhile, NewRiver generates lots of cash. Its acquisitions last year had an average rental yield of 8.5 per cent - far higher than the cost of debt. That funds the dividends that currently generate a fat yield (see table). NewRiver is a real-estate investment trust, so it is obliged to distribute 90 per cent of its rental profits.