The biotech sector probably ranks alongside the dot-com boom as one of the worst stock market bubbles to inflate in the past 20 years. From the disaster of British Biotech in the late 1990s to the dispiriting run of business failures since 2007, you could be forgiven for steering well clear. However, something is stirring below the surface as the market starts to reassess the prospects for the survivors and take a renewed interest in what is now a more mature and realistic industry. Furthermore, it is a trend that hasn't escaped the professionals. The International Biotechnology Trust (IBT), as good a barometer as any, recently hit a 10-year share price high of 200p due to surging valuations of quoted companies in the US, which make up the majority of its holdings. The problem is that unless investors are particularly savvy about how the biotech industry works, it is easy to get caught up in short-term trading patterns that cost both time and money, as well as the 'rush for the new' that can characterise the investment approach to biotech.

So, in response, and in order to help avoid the pitfalls, we are starting what will be a regular 'Drug Watch' feature - a nod to our small-cap oil and gas correspondent's excellent online 'Drill Watch' series - where we will be watching the development process for biotech drugs, analysing the year's upcoming clinical trials and assessing the impact of a successful outcome for the companies promoting the trials.

Why has the sector woken up?

Part of the reason why smaller biotech companies are doing better is that big pharma companies are closing down and outsourcing more of their research and development (R&D) and concentrating on marketing the eventual product instead. Biotech companies have been the main beneficiaries and the average number of collaborative R&D deals has stayed relatively stable despite the economic problems of the past five years; Pharma Deals Review reckons that the industry deals are averaging about 3,500 a year, with other analysts estimating the total number of products that could be potentially partnered off at more than 5,000. That said, some of the sector's chronic problems, such as spiralling costs, have not gone away, but there are signs that these have peaked.

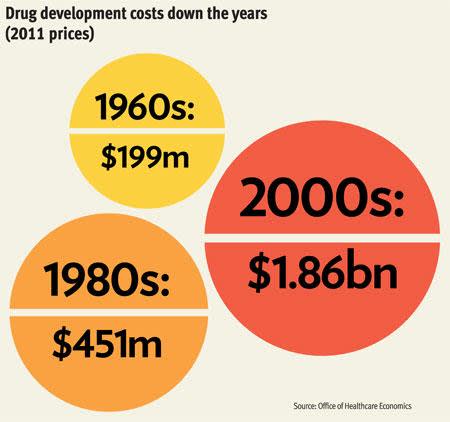

Part of the reason for higher costs of research is that drugs have become both more complex to manufacture - a production run for biological medicines can last several months - while the illnesses they are designed to cure, such as cancer, are no less easier to treat. In the meantime, a combination of tougher regulatory hurdles and lower R&D efficiency means that the average cost of drug development has tripled in less than 50 years (see graphic below).

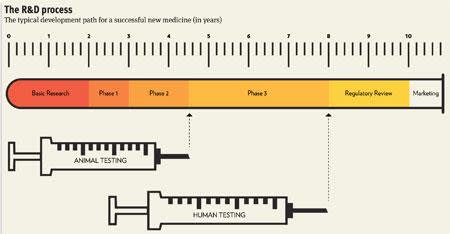

A successful drug takes about a decade to reach the market, with a failure rate along the way of over 90 per cent. It tends to be high-profile failures in Phase III trials that catch the headlines – the disaster that befell Antisoma's (ASM) failed lung cancer trials in 2011 is a case in point, although it was less well reported that Novartis had to write off $120m, as well. But it is still surprising that, according to recent research by the Office of Healthcare Economics, the most likely reason for a drug to fail to make it to market is economic - ie, the patient population is not big enough to justify further costs.

There may be light at the end of the tunnel as the bill for developing new drugs has peaked as companies have started to find ways of keeping costs down. These include taking research out of the internal organisation and relying much more on smaller biotech companies to undertake more of the scientific heavy lifting. In practice, this means smaller companies taking on more trials funded by the pharma majors, which means that it could pay for investors to give serious attention to the outcome of earlier-stage drug trials for the first time since the ill-fated biotech boom of the 1990s.

Relative value

The actual value of trial results is relative to the size of the organisation running the trial. Mega-caps such as AstraZeneca (AZN) or GlaxoSmithKline (GSK) are running dozens of trials simultaneously in order to build up a bank of data to show to regulators. If the data is then deemed good enough by the US Food and Drug Administration (FDA) or the European Medicines agency the medicine is approved for prescription to patients. One trial failure in the early phases of development may not be fatal for a product if it can ultimately demonstrate superiority over an existing therapy, which is what pharma companies are looking to achieve.

In contrast with big pharma, smaller companies develop early-stage products and look to license the products out after a certain amount of development, with more advanced data generating higher levels of royalties. This category of companies can still capture value from their products without needing to fund vast clinical trials. For example, for a microcap such as university spin-out Valirx (VAL), the addition of a number of different indications to its main prostate cancer drug, VAL201, is a way of attracting potential development partners. Valirx is still in its early development stage, whereas GW Pharma (GWP), by contrast, has reached the point where it can farm out its development programme for cannabis-based medicines to Japanese company Otsuka (OPC) and charge regular fees to undertake specialist research. As long as smaller companies do not have to pay for big clinical trials, they can operate for a considerable amount of time without burning through too much cash.

What's coming up?

It is not possible to underestimate how many trials are taking place at a given time. A pared down list from pharma information company EP Vantage puts the current number of Phase II or Phase III clinical trials at more than 1,800 taking place around the world during the next six months. The trials in the table below look the most interesting to us in terms of the products they are testing and because they are in late-stage Phase III trials. The clinical trials are fully recruited and have a good chance of reporting within the next three quarters.

The complexity of the condition which is being treated in each trial is a good guide to the possibility of higher returns in the long term if the drug is ultimately approved. Cancer drugs are particularly prized for the willingness of health authorities to pay for treatment, as well as the difficulties generics companies have in copying them.

How pharma majors' key products in development compare

| Company | Product | Condition | Current share price |

|---|---|---|---|

| Bristol-Myers Squibb | Ablify | Schizophrenia | $32.27 |

| Keryx Biopharmaceuticals | Kerenex | Kidney Failure | $2.86 |

| Roche | Xolair | Chronic Idiopathic Urticaria | CHF200 |

| Biogen | KNS-760704 | Amyotrophic Lateral Sclerosis | $143.7 |

| Sanofi-Aventis | Avapro | Hyper-tension | 72.5 |

| AstraZeneca | Iressa | Non-small cell lung cancer | 3,109p |

| Johnson & Johnson | Velcade | Multiple myeloma | $72.9 |

| Celgene | Abraxane | Metastatic pancreatic cancer | $98.19 |

| Bayer | BAY 81-8973 | Haemophilia A | 72.62 |

| Pfizer | Enbrel | Spondylitis | $26.83 |

| Vertex Pharmaceuticals | Incivek | Hepatitis C | $46.79 |

| Lundbeck | Vortioxcetine | Depression | DKK87.4 |

| Baxter Healthcare | Gammagard | Alzheimer’s disease | $67.19 |

| Oncolytics | Reolysin | Head and neck cancer | $3.75 |

| Takeda | Ortenorel | Prostate cancer | ¥4450 |

| Novo Nordisk | Victoza | Obesity | DKK993 |

*Source EP Vantage | |||

Investing in biotech

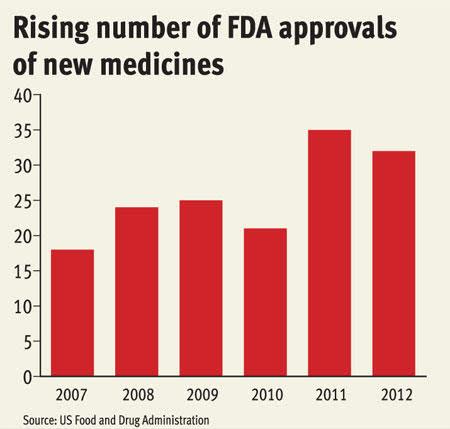

In many ways the bull run in biotech shares is puzzling as further down the chain the funding for early-stage research companies is drying up, particularly in the US where available venture capital fell by an estimated 19 per cent throughout 2012, according to PricewaterhouseCoopers. Yet shares have risen sharply over the same period, which ultimately reflects the ability of well-established companies to partner the drugs they have in development, or in some cases to simply go it alone. Regulators have also played their part. The FDA is proving to be far more willing to approve drugs that treat rare diseases and, in consequence, the number of drug approvals has been rising after several years of stagnation. The forecast this year is for another 30-plus medicines to be approved, which could help support share prices.

Some biotech companies such as Nasdaq-quoted Gilead (GILD), Amgen (AMGN) and Celgene (CELG) have the resources to fund their own development programmes and it is no surprise that these shares performed the best in 2012. Celgene in particular seems to have a promising looking pipeline over the next three years, which may keep the sector's outperformance going for a while longer. Access to foreign shares is now easier through online brokers, but watch for double taxation issues on dividends.

The easiest way to gain exposure is of course to buy shares in the remaining UK biotech companies. The sector here has been battered by a poor funding environment, but this has started to change. Companies such as e-Therapeutics (ETX), which raised nearly £18m in 2011, BTG (BTG), Phytopharm (PYM), Vectura (VEC) and Vernalis (VER) all continue to fly the flag for the sector. BTG has finally moved up into the upper reaches of the stock market with a business model that has moved away from drug discovery, while Phytopharm has made some progress with its Cogane treatment for Parkinson's disease.

UK companies have returned significant value in the past, as the example of Cambridge Antibody Technologies proves, so it would be foolish to write the sector off. Nevertheless, until the cohort of companies that survived the credit crunch starts to successfully partner drugs for late-stage clinical trials, the investment picture is likely to remain mixed. The UK government has made money available for early-stage research – biotech gets a significant chunk of the latest £1bn funding round for early-stage research - the problem has always been getting promising ideas out of the lab and into the boardroom.

Funds and trusts

A simpler route into international biotech investment that doesn't involve buying individual shares might include the London Stock Exchange-quoted International Biotechnology Trust. The trust's share price has risen greatly this year but the discount to net asset value is still over 18 per cent and there may be further value to be captured before the price reaches a natural peak.

Tracker funds also feature heavily, with vehicles like iShares' Nasdaq Biotechnology ETF (IBB). The fund holds most of the growth US biotech, including Gilead and Amgen. Another option is the broader iShares Dow Jones US Healthcare Sector Index ETF (IHE), which includes larger pharma companies balanced off with healthcare equipment and services companies. These funds are specifically Nasdaq-listed, but they should be available via most online brokers.

China's rise

Another way of playing the trend is to assess where the greatest amount of biotech investment will be over the next few years. In this case, it is China that sweeps the board as the government is committed to spending over $300bn on bioscience research in its latest five-year plan. That isn't just for medical research - food science and healthcare equipment are included in the calculations - but it is easily the single largest biotech investment programme anywhere in the world at the moment. In addition, Chinese companies also benefit from significant tax credits when it comes to R&D, such as being able to write down the carrying value of equipment far quicker than is allowed in the west.

The easiest way to access this market is via London-listed companies such as Hutchison China Meditech (HCM), although we'd expect to see more liquidity in Chinese shares as the market there is slowly reformed. HCM is notable because it is one of few pharma companies to form a joint-venture company with a larger manufacture to research a range of medicines from within its library - ie, Hutchison's deal with Nestlé (NESN) to develop botanically-based gastrointestinal medicines.