PLUS, the stock exchange for smaller and mid-sized companies, has been relaunched after its purchase by ICAP (IAP), the world's largest interdealer broker, last June.

Now named ICAP Securities & Derivatives Exchange or ISDX, key improvements designed to attract and assist companies include the provision of increased liquidity, which will come from the addition of two leading market makers, Peel Hunt and Shore Capital. Both will make markets in the exchange's largest stocks, while the quality of companies quoted will be enhanced through the introduction of a new admissions framework.

ISDX will also allow companies to raise capital on the primary market and investors will be able to trade the shares in an active secondary market. The plans form part of a strategy to sidestep the previous chicken and egg stalemate where investor appetite was curbed by the lack of liquidity, while market makers were reluctant to provide sufficient liquidity due to lack of investor demand.

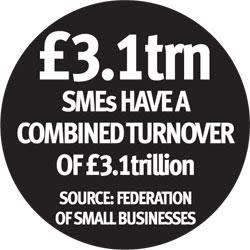

And there is evidence to support the claim that many smaller companies have slipped under the radar of most investors, including the Alternative Investment Market (Aim), which has underperformed since 1996. Much of this reflects a drive by fund managers to chase beta performance, but as small to medium-sized enterprises (SMEs) make up 85 per cent of all the companies quoted in the UK, there is a clear opportunity to provide the means to sponsor greater investment and expansion.

ISDX has also produced a report in collaboration with analysis provided by Edison Investment Research, highlighting some of the companies currently trading on the exchange. Many of these companies are joined by one prevailing thread, and that is the need for significant external capital to support expansion. Here, we pick out some of the companies highlighted by Edison and look at what's on offer.

Bioventix

Bioventix develops and manufactures antibodies, and generates royalties on the sales, for companies such as Roche. One of the main attractions is the stable cost base. So while sales have grown by 34 per cent in the past five years on a compound annual growth rate, operating costs over the same period have risen just 6.8 per cent, resulting in operating profit margins this year of 63 per cent.

The group has a cash balance, makes a profit and even pays a dividend giving a yield of 5 per cent. The main competition comes from diagnostic companies' own in-house research teams, and there have been several acquisitions of independent diagnostic companies within the sector, usually at a significant premium. Shares in Bioventix are tightly held, but Malaysian venture capitalist SpringHill Bioventures has indicated that it is looking to sell its 70 per cent stake within the next 12 months.

Chapel Down

Three cheers for Chapel Down, an English wine-maker with around 40 per cent of the market and a reputation for high-quality wines borne out by the fact that demand for its still and sparkling wines exceeds supply. And the group is also reporting encouraging results from its majority-owned Curious Brew beers.

Much of the company's success stems from gaining listings in high-profile restaurants and hotels, which is not easy unless the wines are good. This, together with a supply shortage, helps to sustain a premium price structure - and with 70 per cent of grapes sourced from third-party growers in several different locations within the UK, there is a reduced risk of production losses from unseasonal frosts. And the company's established position is likely to serve it well, with several speculative entrants in the market this year badly affected by the poor weather.

First-half sales to June rose by 34 per cent, helped by a shift in the product mix towards more expensive sparkling wines. Overall profits are naturally weighed towards the second half. Looking ahead, the brand could be developed further to include cider and perry drinks.

Daniel Thwaites

The sustained destruction over the past 40 years of the UK brewing industry, where traditional beers were driven out by fizzy, foul tasting alternatives, has provided an ideal opportunity for the smaller regional brewer, helped along the way by active campaigning from real ale groups and a growing demand from drinkers for beer that tastes nice.

Still, trading for brewer and pub owner Daniel Thwaites has been far from easy, with turnover affected by the smoking ban and the economic downturn, which has hit the company's northern base. The brewer recently announced job losses at its Blackburn base. However, the company is still growing its small managed estate and operating profits in the year to June were broadly unchanged from a year earlier. Gearing is a modest 22 per cent and the 101p share price is a whopping discount to net asset value of 328p.

Central Asian Minerals & Resources

Camar is focused on gold exploration and production in northern Tajikistan where it owns 49 per cent of the Aprelevka mining company, and is licensed to operate six mining concessions. These have been worked to various stages of development by the former Soviet Union, but working on relatively high cut-off grades means that there is a lot of potentially economic grades still in the ground. Significant development costs are likely, but Camar expects to release an initial inferred resource target of 1-2m ounces of gold within the next six months from its Aprelevka mining licence alone. Predictably, the company is loss-making, although cash outflows were more than offset by proceeds from a convertible loan note, leaving an end-June cash balance of $3.2m (£2m).

Ascot Mining

Ascot Mining operates the Chassoul gold mine in Costa Rica and, given the company's one commodity/one country business, management has been planning to diversify its exploration portfolio, fast-tracking production growth to fund acquisitions. Current production is tiny at just 300 oz per month, but the plan is to boost this 10-fold to help fund ongoing exploration. And the group recently secured $10m of finance through the issue of convertible preference shares that will enable it to clear the debt of its current major lender, re-commence and greatly expand production, as well as complete further exploratory work.

In July last year, it also sold its stake in Canada-based mineral exploration and development company Mineral Hill Industries, eliminating $500,000 of debt and 2m associated warrants. Like most junior explorers and developers, Ascot Mining makes a loss, and the risks are high, especially since production at its sole mine was affected by a recent earthquake. However, Ascot is looking to expand production at some point to 12,000 oz this year.

The sale of apartments at the old Highbury Stadium has helped reduce net borrowings for Arsenal.

Arsenal Holdings

The Premier League football club may not be outperforming on the pitch, with some blaming the sub-par performance on the selling of key players. However, profits from player trading has more than made up for increased wage costs, allowing underlying pre-tax profits to treble, albeit against some pretty weak comparatives. However, net debt is long-term and at a fixed rate and comprises barely a third of shareholder funds.

Apartment sales at the old Highbury stadium have helped to bring net borrowings down from nearly £300m in 2009 to just £99m. On the revenue side, Arsenal is now tackling the ever-increasing wages bill by promising significant growth in its commercial activities. And brand deals and partnerships helped to boost retail revenue by 13 per cent in the year to May.

However, the biggest boost will come from the sale of TV rights for the next three seasons at a 70 per cent premium to the previous deal. Perhaps something of an acquired taste at £17,000 a share, and not exactly easy to come by, given that US entrepreneur Stan Kroenke owns two-thirds of the shares, while Red & White Securities, which is co-owned by Russian billionaire Alisher Usmanov and London-based financier Farhad Moshiri, has a 29.9 per cent stake. But in the past year, the shares have risen by 25 per cent.

Newbury Racecourse

The trouble with racecourses is that most revenue comes from horse racing, and expansion potential here is limited. So although Newbury Racecourse runs up to 30 meetings a year, which generate 92 per cent of turnover, the return on net assets (including 291 acres of land) is pretty low. However, this will soon change because the company has secured a deal with housebuilder Barratt Developments whereby a joint venture between them will see 1,500 homes being built on some of the land owned by the racecourse.

Most of the return will come at the later stages, but Barratt will pay as much as £48m over the course of the 10-year development, a significant source of income given that the race course has racked up annual pre-tax losses of around £500,000 over the past two years. But the new revenue stream has prompted management to introduce plans to resume dividend payments.

Horseracing currently generates 92 per cent of Newbury Racecourse's turnover, but that is all set to change following a deal with Barratt Developments to build homes on land owned by the racecourse.

Shepherd Neame

Nestled away in the beer drinker's paradise town of Faversham in Kent, Shepherd Neame has shown that astute management can deliver results despite all the economic, social and financial headwinds. In fact, results for the year to last June delivered record profits and an increased dividend payout. Within its portfolio of properties, tenanted and managed pubs recorded growth, as did the hotels it owns. And while total UK beer sales fell 1.2 per cent, Shepherd Neame racked up 5.6 per cent growth.

Active management of the pub portfolio has also delivered results, notably a reduction in the number of 'wet-only' pubs (typically those that rely on drink sales, not food) falling from 42 per cent of the portfolio to 31 per cent in the four-and-a-half years since the smoking ban. Despite all this, the share price at 810p is well below net asset value of at least 1,463p per share.

Sprue Aegis

Operating in the intensely competitive world of consumer safety products, Sprue Aegis has done well not to be squeezed by bigger players. Part of this has been achieved by securing over 50 patents in its name as well as achieving the stringent certification standards demanded in each market. What's more, a careful control on costs has helped to generate decent cash flow, sufficient in fact to fund ongoing product development as well as building up a £5.3m cash pile.

And by outsourcing production to a select number of suppliers in China, the group is achieving gross margins in excess of 40 per cent. As well as through the trade, its smoke and carbon monoxide detectors are also distributed through leading chains including B&Q, Tesco Boots and Robert Dyas. And trading for 2012 is expected to be slightly ahead of previous forecasts, helped by another contract win with B&Q and a deal with British Gas, although margins have been affected by a combination of adverse currency movements, a higher proportion of lower-margin sales and increased manufacturing costs in China. Still, with the new contracts starting and a collaboration agreement signed with boiler maker Baxi, chairman and chief executive Graham Whitworth expects to see further growth in the coming year.