Baghdad bounce

The attack on Iraq in 2003 and that on Libya in 2011 were each associated with good buying opportunities in equities. A massive 29 per cent, 14-week-long rally in US and UK stocks began in early March 2003, just days before the Allied invasion began. The onset of the Libyan campaign in March 2011 triggered a 10 per cent surge in the S&P over the following seven weeks.

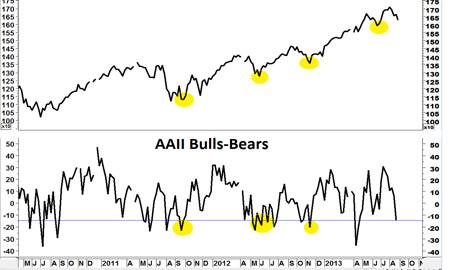

It should surely hearten us, therefore, that there is quite so much bearishness is in the air right now. According to last week’s AAII survey of retail investors in the US, 29 per cent of those polled were bullish, against 42.9 per cent bearish. The negative spread of 13.9 per cent is slightly wider than that which we saw at the outbreak of the Libyan adventure. Preferably, it'll widen further, to around -20 per cent or so, a level that has marked many very tradeable lows on Wall Street.

Bears in the majority

Scepticism has spread well beyond the US indices, too. Spread betting positioning data also shows retail punters are in pretty sombre mood right now. As of the afternoon of 28 August, only just over half of one spread betting firm's clients were long of the FTSE 100, with a similar showing for Germany's DAX.

NYSE breadth dives

Another indicator of market health has already reached levels that have figured around important bottoms. The McClellan Summation index for the New York Stock Exchange, which is related to how many individual stocks are rising or falling, hit -339 on Tuesday, 27 August. That's comparable with the readings achieved in November 2012 and June 2013, just as big rallies were about to begin. Once again, a deeper correction - and therefore a bigger buying opportunity - could see this drop to below -550.

I mooted last week the possibility of a decline to around the 55-week exponential moving average. This line has been a good place from which to buy rallies in the past. At present, it cuts in at around 1548 in the case of the S&P 500, or about 5 per cent below where we are now. I should stress that this is an idealised set-up and no more. I am more than ready to buy the turn if it happens earlier. Price action should always be the main consideration.

Take-offs: true and false

I've often used a rule of thumb of 'two really decent up-days' in order to determine when exactly to turn bullish again. By 'really decent' I mean low-to-high daily gains of at least 1.5 per cent. The gains that we saw in the Dow on Thursday 22 and Friday 23 August, by contrast, always looked like a counter-trend affair to me, and indeed gave way to sharp selling as this week began. On the intraday chart, a crossover of the 21- and 55-four-hourly EMAs would do the trick for me also.