The general consensus at Investors Chronicle's Emerging Markets Investment Trusts seminar last week was that the timing of the event was spot on. Emerging markets are down 10 per cent this year, leading most of the speakers to say that they thought emerging markets looked like good value.

Investors Chronicle editor John Hughman said: "Direct access to emerging markets isn't easy for the private investor to achieve, which is why collective vehicles like investment trusts have been so important in gaining exposure to this important and vast asset class."

He went on to outline how emerging markets have occupied a prominent role in the news agenda over the past few months, and not for the right reasons. They were hit disproportionately hard when the Federal Reseve announced its intention to start to taper its bond buying programmes, albeit at some unspecified point in the future. That news contributed to a near 19 per cent fall in a little under a month in May.

“The reasons for such a savage sell off have prompted some to suggest emerging markets assets could face further weakness in the months and years ahead when the Fed actually does begin to taper bond purchases, rather than just talk about doing so,” said Mr Hughman.

“Hopefully tonight’s seminar goes some way to helping us understand whether the rather pressing short-term problems of emerging markets are outweighed by the substantial long-term growth prospects.”

Annabel Brodie-Smith, communications director at the Association of Investment Companies, then gave an overview of the global emerging markets sectors. She explained that the Global Emerging Markets sector is the fifth largest AIC sector accounting for £4.9bn across nine companies. She also showed some slides showing the widest discounts and premiums on offer among emerging markets investment trusts.

Performance (end August 2013)

| Sector | Discount % | Perf - 1 YR % | Perf - 5 YR % | Perf - 10 YR % |

| Global Emerging Markets | -10 | -1 | 24 | 307 |

| Asia-Pacific Ex Japan | -6 | 7 | 78 | 222 |

| Country Specialist Asia-Pacific | -15 | 11 | 3 | 228 |

| Average Investment Company | -5 | 16 | 38 | 166 |

Source: Association of Investment Companies

Premiums vs Discounts - Global EM (20 September 2013)

| Company | Discount/premium % | Perf - 1 yr % | Perf - 5 yr % | Perf - 10 yr % |

| BlackRock Frontiers | 8 | 48 | na | na |

| Advance Frontier Markets | -8 | 29 | 11 | - |

| Templeton Emerging Markets | -9 | 5 | 72 | 373 |

| JP Morgan Emerging Markets | -11 | 8 | 52 | 369 |

| Ashmore Global Opportunities | -31 | 6 | -42 | na |

Premiums vs Discounts - Asia-Pacific Ex Japan (20 September 2013)

| Company | Discount/premium % | Perf - 1 yr % | Perf - 5 yr % | Perf - 10 yr % |

| Aberdeen Asian Smaller Cos | 3 | 23 | 336 | 617 |

| Scottish Oriental Smaller Cos | 1 | 25 | 266 | 504 |

| Fidelity Asian Values | -7 | 25 | 113 | 257 |

| Schroder Asia-Pac | -11 | 7 | 114 | 255 |

| Invesco Asia | -12 | 17 | 96 | 249 |

Source: Association of Investment Companies

Luke Richdale, client portfolio manager, emerging market equities at JP Morgan Asset Management then delivered a presentation on income opportunities in emerging markets. JP Morgan Global Emerging Markets Income Trust (JEMI) is a member of the Investors Chronicle’s Top 100 Funds. It targets a net yield of 4 per cent a year and its current underlying yield is 5.3 per cent.

Mr Richdale explained that price to book valuations in global emerging markets have now edged into the range from which returns have almost invariably ben positive.

He presented the case for income in emerging markets - the expansion of the investment universe in emerging markets makes a diversified income strategy possible. He produced evidence to show that the combination of income and growth in emerging markets has been powerful. Higher-yielding emerging markets stocks have outperformed the wider emerging markets index and the UK’s FTSE 100 Index consistently over the past 15 years. The annual returns from emerging markets' higher dividend yield stocks averaged 16.4 per cent a year compared with 10.8 per cent from the MSCI Emerging Markets Index and 4.1 per cent from the FTSE 100 Index.

But Mr Richdale emphasised that income in emerging markets is more than just Asia, with good dividends coming out of Latin America, Eastern Europe, the Middle East and Africa.

Companies that JEMI holds include Banco do Brasil, the largest Brazilian bank with the biggest retail branch network in Brazil, offering diversified financial service activities. Mr Richdale said the prospective yield on this stock is 7.8 per cent, with high single-digit growth projected.

The trust also holds Tupras Turkiye Petrol Rafinerileri, the only domestic oil refiner in Turkey, benefiting from a favourable industry structure resulting in high profitability. Mr Richdale said the prospective yield on this stock is 9.2 per cent, again with high single-digit growth projected.

However, he also discussed the risk profile of the trust, pointing out that investments in emerging markets may involve a higher element of risk due to political and economic instability and underdeveloped markets and systems. He also warned that exchange rate changes may cause the sterling value of underlying overseas investments to go down as well as up.

The second fund manager who presented was Slim Feriani, fund manager of Advance Developing Markets Fund (AFMF) which is also a member of the Investors Chronicle’s Top 100 Funds. He explained the investment strategy behind the fund, which invests in a portfolio of local funds, based in emerging markets countries around the world. He and his team conduct 300-400 manager meetings each year, with half of these conducted ‘on the ground’. They whittle down a universe of more than 4,000 funds to a portfolio of 30-50 funds.

Advance Developing Market Fund aims to achieve excess returns over the MSCI Emerging Markets Net Total Return Index and has achieved this in 10 out of 14 calendar years. By contrast, Mr Feriani showed that the iShares MSCI Emerging Markets ETF has lagged its benchmark by a significant margin, adding weight to his argument that you need an active fund manager to get outperformance in emerging markets.

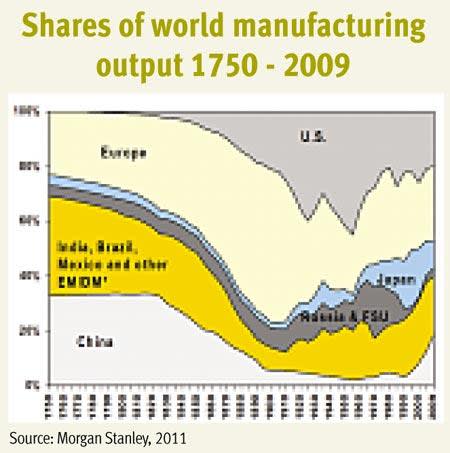

Mr Feriani explained that developing markets have relatively lower debt levels and higher reserves, giving them more flexibility to deal with current changes. He presented some interesting slides showing various performance ratio of emerging markets. The most fascinating of these was a slide showing world manufacturing output going back to 1750 when the US was not a player on the world stage.

The third (and fastest) transition in world manufacturing output since 1750

Emerging markets: past, present and future

COUNTRY | Current | 2022 Estimate | Compound Annual Growth Rate % |

| Share of world % | Share of world % | ||

| Brazil | 2.4 | 3.5 | 11.8 |

| Chile | 0.6 | 0.5 | 6.1 |

| China | 8.4 | 16.1 | 14.8 |

| Columbia | 0.6 | 0.6 | 7.3 |

| Czech Republic | 0.1 | 0.2 | 16.2 |

| Egypt | 0.1 | 0.3 | 16.7 |

| Hungary | 0.0 | 0.1 | 15.9 |

| India | 5.7 | 5.4 | 7.2 |

| Indonesia | 0.7 | 1.4 | 14.4 |

| Korea | 2.1 | 1.7 | 5.6 |

| Malaysia | 0.9 | 0.8 | 6.3 |

| Mexico | 1.1 | 1.6 | 12.3 |

| Morocco | 0.1 | 0.1 | 9.1 |

| Peru | 0.2 | 0.2 | 8.9 |

| Phillippines | 0.4 | 0.4 | 7.4 |

| Poland | 0.3 | 0.6 | 14.1 |

| Russia | 1.7 | 2.3 | 10.7 |

| South Africa | 1.1 | 0.9 | 5.3 |

| Taiwan | 2.1 | 1.5 | 4.0 |

| Thailand | 0.7 | 0.7 | 7.4 |

| Turkey | 0.6 | 1.0 | 13.7 |

| Global Emerging Markets | 25.9 | 39.9 | 10.8 |

| World | 6.1 |

*Note: Shading denotes a faster CAGR than the GEM aggregate

Source: Advance Developing Markets Fund, based on data from the World Federation of Exchanges, Datastream, CEIC, UBS Estimates

Investors Chronicle’s investment trust columnist John Baron discussed the strategy behind his two investment trust portfolios - growth and income - that he writes about every month in the magazine and website. However, he also pointed out that emerging markets ratings on 11x earnings have had quite a significant de-rating over the past year. Cyclically adjusted PE ratios for emerging markets in 2007 were 30x, compared with today at 13-14x. "I suggest that the fundamentals are brighter than valuations suggest. There are tentative signs that the focus on structural reform is moving up the political agenda in many emerging markets countries," he said.

"One can never predict short-term movements. Having accepted the de-rating now is as good a time as any to start building holdings if you haven't already done so.

"We often talk about the merits of emerging markets. But if you look at weightings, many portfolios are underweight. If investors avoid volatility they will always be fundamentally underweight good opportunities."

Moira O’Neill, personal finance editor at Investors Chronicle, discussed the role of emerging markets in your portfolio. She quoted a wide range of views from fund managers and financial advisers on how much emerging markets exposure investors should have in their portfolios - from 50 per cent to 14 per cent to none at all.

She also emphasised the need to establish what emerging markets exposure you already have in your portfolio before adding to it.

Add in exposure to commodities and you may have more emerging markets exposure than you realise. Many global trusts have emerging markets exposure, for example:

■ Foreign & Colonial: 5% Brazil, 2% South Korea

■ Scottish Mortgage: 16% China, 2% Brazil

■ Murray International: 10% Mexico, 8% Brazil.

She also explained why exchange traded funds (ETFs) may not be the best way to get access to emerging markets. Twenty-five per cent of the MSCI Emerging Market equity universe is accounted for by government-controlled or influenced companies. The MSCI Emerging Markets index is heavily weighted to resources, financials and telecoms. However, consumer goods and services, such as healthcare, are very under-represented.

MSCI Emerging Markets Index (USD)

| Year | Gross return % |

| 2012 | 15.15 |

| 2011 | -20.41 |

| 2010 | 16.36 |

| 2009 | 74.5 |

| 2008 | -54.47 |

| 2007 | 36.46 |

| 2006 | 29.18 |

| 2005 | 30.31 |

| 2004 | 22.45 |

| 2003 | 51.59 |

| 2002 | -7.97 |

| 2001 | -4.91 |

| 2000 | -31.8 |

| 1999 | 63.7 |

Souce: MSCI

Ms O’Neill then went on to make some investment recommendations. She singled out Utilico Emerging Markets (UEM) at 175p, trading at a discount of -7.98%.

This fund takes a conservative approach to investing in utility-type assets: water resources, airports and freight handling sectors. Its yield is 3.43 per cent so more comparable with the yield from the FTSE 100 than higher emerging markets yields.

However, the volatility of UEM’s net asset value is also much lower than emerging markets index and its investment trust peer group.

She also recommended Templeton Emerging Markets Trust (TEM) at 572.5p on a discount of -10.46% and BlackRock Emerging Europe (BEEP) at 292.5p on a discount of -10.15%.

At the Q&A panel debate there was much discussion of the importance of discounts in the decision whether to buy a trust.

Peter Walls fund manager of Unicorn Mastertrust said: "Discounts are very important. Discount volatility is crucial. For example, in the case of Fidelity China - they kept issuing shares. Lots of people paid a premium price of 116p - but today it's trading at 98p. Discount control mechanisms don't always work."

Stephen Peters, investment analyst at Charles Stanley said: "Don't buy past performance. Look ahead at value. Don't obsess about discounts. Buy long-term quality managers. You've got to let valuations be your guide."

Mr Baron said: "The discount is a good way in for the long term. I was happy to pay a premium for a good Frontier Markets trust." However, Ms Brodie-Smith said: "I personally wouldn't buy at a premium."