As far as brand awareness goes, Dunelm (DNLM) is unlikely to rank highly on the list of the nation’s best-known retailers. So it might come as a surprise to know that the purveyor of home goods and furnishings actually overtook the mighty John Lewis last year to become the market leader in the UK homewares sector, with a tasty 6.9 per cent slice of the pie, according to Verdict Research. In fact, Dunelm has been a great growth story in recent years, and we believe there’s plenty more upside to come, given the potential for further store rollouts, increased brand awareness and a significant opportunity to grow online sales. What’s more, analysts are forecasting double-digit earnings growth over the next few years, and with a history of returning excess cash to shareholders - and everything pointing towards a continuation of this strategy - there’s a generous yield on offer too.

- Store rollout

- Low brand awareness

- Double-digit forecast earnings growth

- Online expansion

- Net cash in bank

- Direct Sourcing

- Shares have already had good run

- High valuation

In the last financial year Dunelm opened 14 superstores bringing the total to 126. Management believes the ideal store estate is roughly 200, so there’s still plenty of scope for expansion. And with brand awareness still very poor, there’s also huge potential to reach tens of thousands of new customers. To help spread the word, the company has launched its first significant TV advertising campaign. Crucially, this investment in new stores is generating fanastic returns for shareholders. Based on S&P Capital IQ data, the company boasts a sector-leading return on capital of 33 per cent and has generated an average 22 per cent return on assets in the past five years, as well as an equally impressive 40 per cent return on shareholder equity.

And the great thing about Dunelm is that it’s self-funding this growth while retaining a net cash position. In fact cash generation is so good that Dunelm has been returning surplus capital to shareholders: in the last financial year it paid a special dividend of £50.7m (25p per share), in addition to a full year dividend of 16p. Over the past two years it has paid out a total £116m in special dividends. Analyst at Citi believe this can continue at a rate of £50m-£60m a year with a broadly stable cash balance. If as expected, special payments are maintained at 25p a share, that would imply a dividend yield of 4.9 per cent for 2014, based on Citi's forecast 18p payment, rather than the significantly less impressive headline figure.

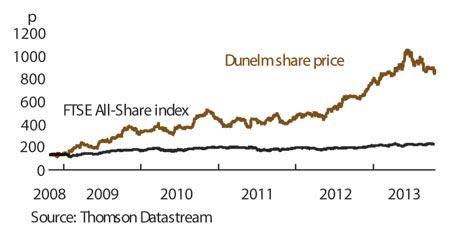

Admittedly, the shares have been on a roll over the past year. But, it’s worth noting that since peaking in the summer, they’ve taken a bit of a battering and fallen by 14 per cent from highs reached in July. The reason behind the share price weakness was worse-than expected like-for-like sales declines in the first quarter. However, given that quarterly sales improved from declines in the high teens in July to 1 to 2 per cent growth in August and September, this suggests that the weakness was entirely due to the hot weather, rather than anything inherently wrong. And despite the first quarter miss, full-year earnings estimates have been trimmed by just 1 per cent, with both sales and earnings growth forecast to remain robust. Therefore, we see this temporary weakness as a clear buying opportunity.

| DUNELM (DNLM) | ||||

|---|---|---|---|---|

| ORD PRICE: | 882p | MARKET VALUE: | £1.7bn | |

| TOUCH: | 882-888p | 12-MONTH HIGH: | 1,027p | LOW: 590p |

| FWD DIV YIELD: | 2.2% | FORWARD PE RATIO: | 18 | |

| NET ASSET VALUE: | 98p | NET CASH: | £44.7m | |

| Year to 29 Jun | Turnover (£m) | Pre-tax profit (£m) | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|---|

| 2011 | 538 | 83.7 | 29.3 | 11.5 |

| 2012 | 604 | 96.2 | 35.1 | 14.0 |

| 2013 | 677 | 108 | 40.0 | 16.0 |

| 2014** | 724 | 117 | 44.1 | 17.5 |

| 2015** | 785 | 131 | 50.0 | 19.5 |

| % change | +8 | +12 | +13 | +11 |

Normal market size: 1,000, Matched bargain trading, Beta:0.58, **Numis Securities forecasts | ||||

Dunelm is also a tightly run ship, thanks to a strong management team. Increased direct sourcing is resulting in an ever widening gross margin - in the last financial year the gross margin improved by 40 basis points to 48.7 per cent, and the first quarter saw a 70 basis point improvement. It’s also noteworthy that online sales account for just 4.5 per cent of the total, so there’s a great opportunity to exploit this potentially lucrative channel.

The shares trade on a forward PE ratio of 19, a premium to the general retail sector of about 16, but growth and yield expectations justify a premium. Based on Citi's forecasts, if you take the cash-adjusted PEG ratio adjusted for the expected yield (special and regular dividends), as favoured by investment greats such as Peter Lynch and John Neff, the valuation of 1.3 times looks a bargain given the strong growth prospects and sector-leading returns.