I first encountered Kondratieff in 'Industry and Empire', a wonderfully readable survey of British economic history by Eric Hobsbawm. Writing in the late 1960s, the Marxist historian reported that the "long waves" in prices identified by the economist pointed to an imminent spike in inflation. Because this premonition turned out to be accurate, the name stuck in my mind.

Kondratieff originally identified two complete price cycles - the first running from a deflationary trough in 1789 until 1849, the second from 1850 to 1896 - as well as the first half of a third. In each case, the inflationary peak coincided with war, and hence fiscal and monetary splurge.

With their implication that capitalism is self-renewing rather than doomed, these insights earned Kondratieff imprisonment and execution in his native land. But they have attracted something of a cult following elsewhere, not least among technical analysts. A research note from HSBC dropped into my inbox last month casually promising a "final icy blast of Kondratieff winter" for stocks ahead of a big trough in 2016.

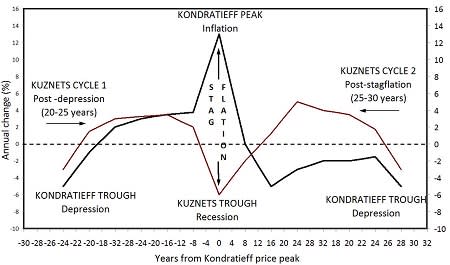

Perhaps the most respected proponent of Kondratieff's long-wave theory is the US-based human geographer Brian Berry. The illustration below is taken from his 1991 book 'Long-Wave Rhythms in Economic Development and Political Behaviour'. It shows Kondratieff's half-century wave combined with the shorter construction cycle identified by economist Simon Kuznets. According to Berry's highly schematic model, the economy collapses into stagflation at the peak.

Berry located the last peak in 1981, the high point for US inflation. He then argued that the end of the cycle would come around 2006-12, after which a new cycle would begin. This reading is seductively compatible with recent history, notably the 25-30-year era of falling bond yields that most investors have long expected to reverse.

But other interpretations are also plausible. Tony Plummer of Helmsman Economics, a British authority on Kondratieff waves, locates the last stagflationary top in 1974, when the UK stock market bottomed and UK inflation peaked. He consequently dates the last turning point earlier, in 2002, when many commodity prices bottomed.

These different readings have different ramifications for investment. Mr Plummer believes inflation will start to ramp up at some point after 2019, exploding to a peak in 2024-27. That suggests we should all be selling bonds and buying commodities in 2019, but that before then bonds may do better than most expect, as output stagnates. Meanwhile, Mr Berry's dating suggests the latest cycle has only just begun, which is more positive for equities. Either way, some years remain before the crunch point of stagflation.

The vagueness of the timing is the most obvious problem with trying to base investment decisions on Kondratieff waves. Another is the mystery of their origins. Mr Plummer sees them mainly as an "observable phenomenon", but he does speculate that the financial excesses associated with major wars may only arise once every couple of generations, as memories fade. He also notes that war may not be necessary to trigger an inflationary spike in the current cycle, since quantitative easing has already massively expanded the money supply.

Multi-decade cycles are under-researched, presumably because the theories of rational choice that underpin mainstream economics don't sit easily with such a deterministic framework. But that doesn't mean they don't exist. Mainstream economics have done such a dismal job of helping investors over the years that I will continue to keep Kondratieff at the back of my mind.