This month has brought no fewer than three major blows to the UK steel industry. First, the UK arm of Thai group Sahaviriya Steel Industries entered bankruptcy proceedings, having mothballed the Teesside Steelworks in Redcar in September. A fortnight later Caparo Industries, a privately owned producer of steel products, followed suit, blaming intense competition from cheap imports. And then last week Tata Steel - the Indian group that now owns most of the assets once operated by British Steel, which was privatised in 1988 - announced a major redundancy programme at its plants in Scunthorpe and Glasgow. Overall, at least 3,400 jobs are being cut out of an industry total of roughly 30,000.

The news flow will not have surprised anyone who has followed China's transition away from infrastructure construction and the resulting overcapacity in global steel markets. But it nonetheless offers a stark illustration of Britain's failure to protect its manufacturing sector - even after industrial policy has made something of a political comeback. George Osborne's 2011 Budget speech painted a picture of Britannia "carried aloft by the march of the makers". "We want the words: 'Made in Britain, Created in Britain, Designed in Britain, Invented in Britain' to drive our nation forward," declared the UK Chancellor.

The policies associated with this heady rhetoric - enterprise zones, tax support for research and development, nine "university centres for innovation" - have so far made no discernible impact on the national accounts put together by the Office for National Statistics. Strip out inflation and the manufacturing sector is 6 per cent smaller than it was in the first quarter of 2008, while the services sector - which includes retail, hospitality, healthcare, professional services and the like - is 10 per cent larger.

The UK has found a path back to economic growth. But - just like the boom that ended in 2008 - it has been paved with household consumption, funded by declining savings, rather than exports and industrial technology.

This feature sets out to explain why the UK has been so bad at manufacturing and exports, and - more importantly - whether it matters. Is political rhetoric about manufacturing just a way of tapping into nostalgia about the country's 'workshop of the world' days? Or is the economy's renewed reliance on consumption and services setting Britain up for another crisis? Above all, what are stock investors supposed to make of Britain's unbalanced recovery?

Stumble of the makers

The weakness of British manufacturing in recent years can be attributed both to problems of luck and skill. Let's start with the luck - the factor emphasised by optimists who think the sector can bounce back.

A few months after Mr Osborne heralded the "march of the makers" in the House of Commons, the eurozone crisis took a nasty turn. Since the eurozone is Britain's most important trading partner, and goods account for over half of total exports, it was hardly surprising that the manufacturing sector failed to take off in the way the Chancellor hoped. Now the eurozone is showing signs of economic recovery, but emerging markets are faltering, most notably China. Recent business surveys from Markit and the British Chambers of Commerce suggest confidence in the manufacturing sector has weakened substantially. The BCC found that the balance of firms reporting improvements in exports is now at its lowest level since the third quarter of 2009, when the UK was in recession.

The rump of the once-expansive British steel industry is the highest-profile victim of the latest weakness. But higher-tech manufacturing has not been immune to the problems brewing in China. Valve-control specialist Rotork (ROR), for example, was buoyed for years by the oil and gas boom - pipelines need a lot of valves - and the construction of infrastructure in emerging markets. Now chief executive Peter France complains of "so many headwinds all at once", including project delays in China, sanctions in Russia and the strong pound.

Still, these factors - currency, recessions abroad - are essentially cyclical; Rotork's position in the global actuator market remains strong. Some economists are therefore optimistic that the balance of Britain's economy will improve as the cycle moves on. A recent report by consultancy Capital Economics drew succour from the trend towards 'reshoring' - the reversal of offshoring as manufacturers try to make their supply chains more responsive and reliable - and the strength of the UK aerospace industry. "It has been hard for manufacturers to make progress in the past few years, but further ahead we see hope of some rebalancing," says Vicky Redwood, chief UK economist.

Triumph of the pessimists

But others take a more downbeat view, worrying that Britain's manufacturing capacity has for years been gradually but irrevocably atrophying. John Longforth, director-general of the BCC, says his visits to local chambers of commerce suggest that "the rump of manufacturing in the UK is not that innovative or technologically advanced". In other words, global leaders like Rotork and - in the even higher-tech aerospace industry - Rolls-Royce are the exception, not the rule. He identifies four structural reasons why the sector has struggled, even without the vagaries of the business cycle.

1. Access to finance. Credit crunch or credit glut, Mr Longforth worries that "Britain has an obsession with equity" over debt. "If you need finance, you have to sell out to a venture capitalist. It doesn't lend itself to building long-term businesses." Inevitably, the comparison is with Germany, where state-backed business banks made loans of €29bn last year. These are in effect subsidies for small and medium-sized businesses, but because they pre-date the Treaty of Rome they are exempt from European Union rules limiting state support for industry.

2. Infrastructure. Britain's infrastructure - both old-fashioned transport and newfangled digital services - compares unfavourably with that in other countries. The UK has spent less than its rich-world peers on infrastructure over the past three decades, according to the OECD. The World Economic Forum ranks the country 10th in the world for infrastructure, behind Germany, the Netherlands France and even Spain, though ahead of the US in 12th place.

3. Skills. Hand-wringing about the skills shortage has become a standard feature of business coverage in the mainstream media. This year's CBI / Pearson education and skills survey found that "over half of all businesses fear that there will not be enough people available with the skills needed to fill their high-skilled jobs - particularly in the key sectors which underpin growth, such as manufacturing and construction."

4. Export support. Mr Longworth thinks businesses need more practical help and advice on how to enter new markets. The BCC is trying to address this problem by setting up platforms.

It seems reasonable to assume that both cyclical and structural factors have played a part in Britain's poor manufacturing performance since the recession. This suggests that even if global growth picks up, the pound drops and banks get more interested in lending to exporters, the manufacturing recovery will be lacklustre. But this begs another question: should we care? If the much larger and more sophisticated services sector is happy to take the slack, why should we mourn the decline of manufacturing?

Liberal economic orthodoxy

A widely held view among economists is that the transition to a consumer-led economy dominated by services is an inevitable feature of economic development. After all, most Western economies have seen their manufacturing sectors decline relative to their services sectors over the past two decades. As if to prove the point, China is now trying to move away from a growth model based on infrastructure investment and low-cost manufacturing. Germany - one of the few economies in Europe to have seen manufacturing outgrow total output since 1997 - is sometimes criticised (including in a recent feature by Investors Chronicle associate editor Philip Ryland) for being dangerously skewed in the opposite direction to Britain.

Moreover, the distinction between manufacturing and services is much more blurred than it was in the post-war era that gave birth to national accounting. Infamously, iPhones advertise that they are "designed by Apple in California, assembled in China". Gianluca Moretti, fixed income economist at UBS Global Asset Management, says this model applies equally to European manufacturing, with many white goods and cars engineered in Germany but made across the border in Poland or other lower-cost countries. A related point is that Rolls-Royce - Britain's flagship manufacturing group - makes about half of its revenues from long-term service agreements with clients as opposed to selling goods. Quite how such arrangements are counted by national statisticians is unclear, but given the problems of definition getting hung up on macroeconomic distinctions seems to miss the point.

That point is that modern economies should focus on those activities they excel in, no matter how the national accountants define them. This follows the classical economics of 'comparative advantage' to their logical conclusion. The economist David Ricardo famously argued in the early 19th century that Britain and Portugal were better off specialising in the production of cloth and wine, respectively, and then trading freely with each other, than each trying to produce both goods for their domestic markets.

Two centuries later, Mr Moretti thinks the country's best chance at productive growth now is in the technology sector - providing those services that come with the internet. London's 'tech belt' around Shoreditch, just east of the City, is already earning a reputation for innovation in this field as the city's hipsters strive to come up with the next big smartphone app. But these innovations - which are being funded by venture capital to a degree that might not be possible in other European countries - will count as services, according to national accounting standards.

"Of course, Britain could try to imitate Germany and invest in high-end manufacturing, but it has to develop the skills and infrastructure, and that would take a long time - whereas all the infrastructure is already in place to develop services," explains Mr Moretti.

The problem with this line of thinking is that it leaves an economy prone to imbalance as it overspecialises. Following the consumer boom and bust of the 2000s, and given the enduring socio-economic problems in those parts of the midlands and north of England that were historically hubs for manufacturing, even Conservative politicians have in recent years been reluctant to follow Margaret Thatcher's lead in leaving the invisible hand of free trade completely to its own devices. The previous Tory-led coalition government was happy to launch an "industrial strategy", even if the rallying cry was led by the Liberal Democrat business minister Vince Cable. The current government has preferred to focus on devolution as a way to stimulate the "Northern Powerhouse" - a shift in policy that risks being undermined by the crisis in steelmaking.

Maxing out the current account

The most obvious manifestation of Britain's unbalanced economy is the current account deficit - the amount the country has to borrow from abroad to finance its consumption. In the first quarter of 2015 the deficit amounted to £24bn or 5.3 per cent of national output - the widest since at least 1955. This was driven less by the trade balance (exports minus imports) than the income balance (UK earnings abroad minus foreign earnings in the UK). Perhaps because Britain was one of the fastest growing economies in the developed world last year, our vast stock of investments abroad have stopped paying the dividends they used to, relative to the equally vast stock of foreign investments at home.

Still, a healthier domestically owned manufacturing sector would improve the situation. Britain has been successful at exporting services, notably financial services; in the three months to August it had a trade surplus in services of £23.3bn, of which trade with the USA represented almost £7bn. But it is much easier to export tangible goods than often intangible services, particularly within the European Union. "There is no single market in services," points out Mr Longforth of the BCC. So the surplus on services was more than offset by a deficit on goods amounting to £31.4bn for the quarter to end-August. If Britain could foster a larger high-end manufacturing sector, it would almost certainly improve its trade balance. It is telling that Germany, with its massive manufacturing sector, runs a persistent current-account surplus.

The weakness of Britain's current account also offers an uncomfortable echo of the past. The deficit peaked in 1990 - the height of the Lawson boom - and 2007 - the apex of the most recent credit boom. The stories of Ireland, Iceland and Spain offer similar cautionary tales. A widening current account deficit can, therefore, signal that growth is being fuelled by unsustainable borrowing.

This time around, the chief borrower is the government, rather than consumers or companies. The austerity programme outlined out in the July budget to reduce government borrowings therefore poses a "major risk" to the UK economy, says Mr Moretti of UBS. That's particularly true because a major part of the programme - amounting to some £12bn - consists of benefit cuts for low-income families, which tend to spend most of their income. (If middle-class savers saw their incomes fall, the economic effect would be less immediate.)

Government spending has the benefit of being much less subject to swings in sentiment than consumer or corporate spending - swings that go a long way towards explaining the cycle of boom and bust. Borrowing in the consumer sector, which is the backbone of the UK economy, is not obviously out-of-control. Consumers started saving more in the wake of the financial crisis, and this saving has dwindled, sparking a consumer recovery, but on aggregate households have not yet turned to borrowing.

But there are still two worries. First, consumer debt is likely to pick up if the current trend continues. "The problem isn't really that large now, but if growth continues to depend on the household sector it will get back to the problem we saw in the years before the crisis," says Martin Beck, senior economic adviser to the EY Item Club.

The second worry - one that has occupied the Bank of England's Financial Policy Committee - is that the outstanding level of household debt, though stable, is still high relative to incomes, compared to other countries, mainly because house prices are high. Moreover, unlike in the US, with its subsidised mortgages and interest-rate swaps, mortgage rates in the UK can be fixed for a maximum of five years.

This combination leaves Britain more exposed to interest-rate increases than its peers. "The risk in the UK is that people have to start paying a lot more on their loans," says Joshua McCallum, head of fixed income economics at UBS Global Asset Management.

Maintaining a diverse portfolio of industries

The current-account deficit is one way of looking at Britain's unbalanced recovery - the way most common in economic discourse. But another way of looking at it is in the mix of industries that make up the UK economy. The idea that Britain should focus on what it does best - rather than trying to foster what it does less well - raises the risk that the economy becomes ever more dominated by one successful sector in one successful area. When the sector hits a rut in the road, the country can then face a protracted period of underperformance.

This is as true for Britain and its financial and professional services industry, for example, as it is for Saudi Arabia and oil - or Germany and its now-stuttering Baden-Württemberg export sector for that matter. Just as an investor needs a diversified portfolio, an economy needs a diversified industrial mix.

That's why it is worrying that manufacturing has declined much faster in Britain than in other developed economies. The ONS estimates that the sector accounted for 18 per cent of gross value added by the UK economy in 1997. By 2015, that share had dwindled to just 10 per cent. That decline was far sharper than in comparable rich countries such as France, Italy, the US and Canada, according to an OECD analysis.

Britain has been left with a smaller share of its economy in manufacturing than any of the other top 20 manufacturing nations globally. If households cut back their spending because of higher interest rates, slowing wage growth, a correction in house prices or some other unanticipated shock, the UK economy would therefore struggle to fall back on alternative sources of demand, such as exports or corporate investment, to which the manufacturing sector caters.

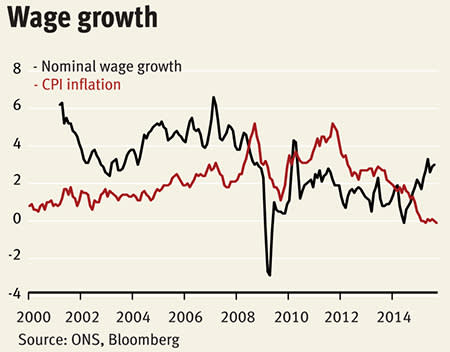

Parenthetically, the growth of low-value consumer services rather than high-value manufacturing may also explain Britain's poor productivity record. High-end manufacturing is highly automated and thus creates substantial wealth per unit of labour. Britain's poor productivity performance since the financial crisis - which is the most logical explanation for the weakness of wage growth - may therefore reflect the expansion of labour-intensive services in retail and hospitality relative to manufacturing and other productive sectors.

How I learnt to stop worrying and love the boom

For all these concerns, it has not been profitable for stock investors to worry too much about the unbalanced nature of Britain's economic recovery over the past three years. The top performers in the FTSE 350 over that timeframe are a diverse bunch - Thomas Cook, JD Sports, Ocado, Betfair and Marshalls are currently the top five - but most are in or related to sectors such as clothing retail, credit, leisure and property that thrive on growth in disposable consumer spending.

This performance bias looks set to continue for the next few months at least - possibly even years. Crucially, real disposable incomes are growing, paving the way for consumption growth without growth in debt. As long as productivity continues to rise and inflation remains low, the consumer recovery should be maintained. Retail sales enjoyed a particularly strong September, with volumes up 6.5 per cent year on year, perhaps helped by the Rugby World Cup.

Some of the stocks we like that are exposed to this theme are listed below. Most are far from being contrarian calls, but it does not always pay to be contrarian. The conditions in the domestic economy certainly seem much more propitious than those facing exporters such as Rotork or multinationals such as consumer goods giant Unilever (ULVR), let alone resource companies such as Rio Tinto (RIO) or Shell (RDSA) (though these unambiguously offer value, which is another matter).

That said, it is essential to watch for danger signals that the cycle is turning. Rising interest rates is the most obvious one, but slowing income growth - caused either by weak wage settlements or rising inflation - could also knock the sector off its roll. The impact of benefit cuts may also be severe for some companies.

In any case, the case for diversification remains as strong as ever. Britain may struggle to wean itself off its economic dependence on consumer services, but investors need not make the same mistake. Even if their prospects don't look appealing just now, it's worth keeping some core holdings in the export or multinational sector. When conditions in emerging markets improve or the pound drops - and that enormous current-account deficit suggests sterling is skating on thin ice - they will be poised to make a comeback.

Rotork: a case study of modern British manufacturing

Rotork is not a household name, but the Bath-based engineer nonetheless embodies a certain ideal of modern British manufacturing. It makes actuators - devices that control the opening and shutting of industrial valves - and, together with US giant Emerson and privately owned German group Auma, dominates this small but safety-critical market niche globally. At the same time, it focuses on design and assembly rather than component production. At the factory that adjoins the company's Bath headquarters, components arrive on one side of the site and leave fully assembled from the other for shipment across the world. A full 96 per cent of the actuators it assembles in the UK are exported.

This combination of niche-market dominance and lean manufacturing make Rotork highly profitable; last year its pre-tax margin was 24 per cent. This is one reason why the stock has proved rewarding for long-term holders: including dividends, Rotork's shares have returned 15 per cent a year over the past decade, placing them in the top quintile of the FTSE 350 for performance and cementing the company's reputation as a blue-chip engineer.

But the actuator trade has not been immune to the capital-spending cuts announced in the oil and gas industry this year - nor to other problems. Chief executive Peter France says projects in China are being delayed by the crackdown on corrupt local officials as a vast cadre of senior managers has been replaced. At the same time Russia has responded to the European Union sanctions that followed its aggressive foreign policy towards the Ukraine by refusing to import the bloc's goods - including Rotork actuators. "They've been trying to replace foreign products with local ones. They're not good quality but companies are being forced to use them," he says.

The strong pound - up almost 17 per cent since its low point in early 2013, when there was lingering talk of a triple-dip recession - has not helped, either. Mr France issued a profits warning last month, guiding the market to expect adjusted operating earnings of £120-130m, down from £157m last year. This will mark the first fall in the company's profits since the turn of the millennium (see chart below).