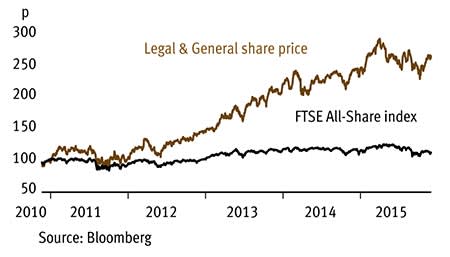

Legal & General's (LGEN) improving cash generation should result in impressive dividend growth from its already high-yielding shares in the coming years. A strong performance from Legal & General's asset management division helped lift its net cash generation to £943m in the nine months to the end of September, compared with the £827m generated in the same period a year ago. According to Bloomberg, consensus analysts dividend forecasts now stand at 13.4p for the current year, representing a 5 per cent yield, rising to 15.2p by 2017, equivalent to a 6 per cent yield. We see the current share price as a great opportunity to buy into this quality income stream from the diversified financial services giant.

- Net cash generation improving

- Asset management inflows

- High forecast dividend yield

- Corporate pensions strong

- Bulk annuities slower

- Solvency II impact

The star turn in Legal & General's third quarter came from Legal & General Investment Management (LGIM), which reported net inflows of £21.7bn for the first nine months of the year compared with the net £8.3bn in 2014. This includes mandates won in the US, China, Korea and Taiwan. It was the second quarter in a row of positive net flows across LGIM's major asset classes. At home, it has benefited particularly from demand from institutional investors for strategies that spread risk across asset classes, or hedge liabilities. What's more, these flow numbers did not include £13bn of pension funds won from the National Grid Pension Scheme, which are expected to transfer to the manager this month.

The defined-contribution pension business also offers strong prospects, and assets rose 13 per cent in the first nine months of the year to £43bn. Future growth should be helped by the manager gaining a place on the defined-contribution platform of one of the major pensions consultancies, Towers Watson, which should generate significant assets inflows.

Legal & General's bulk annuities business also offers potential, even if recent trading has not looked as impressive as the business's exceptional achievements in 2014. Bulk annuity deals offer companies the ability to offload their pension liabilities, and demand is increasing as these schemes shut and their demographics mature. Bulk sales represented £1.2bn in the first three quarters. True, this pales in comparison to the £3.4bn booked in the same period last year, but this business is lumpy and last year's £3bn deal with the ICI pension fund skews the comparison. Indeed, there's clearly potential here and it's of note that the company has written its first US transaction and will shortly enter the European market.

In its general insurance business, Legal & General is making similar moves to its competitors by keeping its pricing discipline and investing in digital media to try to protect its customer base. It is launching tablet and mobile-friendly platforms for its general insurance and life protection customers. But the market is fairly flat. In the first nine months of the year new protection sales reduced, only marginally, to £174m from £178m.

Legal & General is increasingly fashioning itself as a long-term investor in UK infrastructure, and as such has a growing exposure to property. Total group-wide direct investments increased to £6.6bn at the end of September from £4.6bn a year earlier.

A potential stumbling block is Solvency II regulation. Like other life insurers, L&G has submitted its internal model of how it will embed the requirements to the Prudential Regulation Authority, and expects to reveal its position at the time of the full-year results due for publication in March next year. Particularly unclear is what impact it will have on the bulk annuity market, if the cost of capital of this business increases. But Barclays analysts argue it should be able to pass that on to new business without affecting volume, but there is undeniably uncertainty here.

| LEGAL & GENERAL (LGEN) | ||||

|---|---|---|---|---|

| ORD PRICE: | 262p | MARKET VALUE: | £15.6bn | |

| TOUCH: | 261.4-261.6p | 12-MONTH HIGH: | 296p | LOW: 230p |

| FORWARD DIVIDEND YIELD: | 5.6% | FORWARD PE RATIO: | 13 | |

| NET ASSET VALUE: | 101p | EMBEDDED VALUE: | 184p | |

| Year to 31 Dec | Pre-tax profit (£bn) | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|

| 2012 | 1.03 | 13.6 | 7.7 |

| 2013 | 1.14 | 15.0 | 9.3 |

| 2014 | 1.24 | 16.5 | 11.3 |

| 2015* | 1.38 | 18.2 | 13.4 |

| 2016* | 1.59 | 20.9 | 14.7 |

| % change | +15 | +15 | +10 |

*Canaccord Genuity forecasts | |||