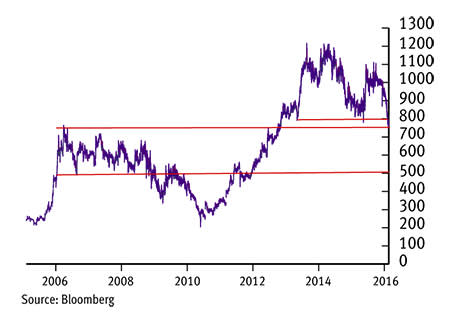

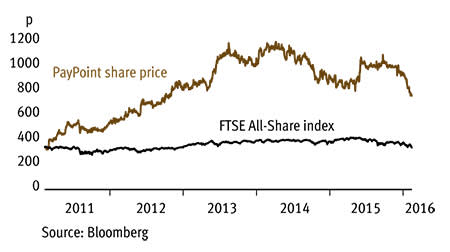

We think the recent declines in PayPoint's (PAY) share price are set to continue as investors are forced to re-evaluate the company's growth prospects. What's more, the shares are approaching a critical support level at about 750p which, if broken, could prompt a 33 per cent decline from current levels based on technical analysis.

- Technical breach

- Margin erosion at Collect+

- Increasingly crowded marketplace

- Low barriers to entry

- Good dividend prospects

- Underperforming asset sales

PayPoint's core business involves operating terminals in convenience stores which allow people to make payments on to keys for domestic energy meters, as well as top up mobile phones and collect and return parcels. While the group's Romanian business, which accounted for 14 per cent of last year's revenue, is thriving, its operations in the UK and Ireland face a number of challenges. The problems were reflected in the group's third-quarter trading update late last month.

The group's largest division, bills and general, which accounts for almost half of revenues, saw a 2.4 per cent drop in sales after the warm winter led to an 8.1 per cent decline in the UK. And, while the Romanian business continues to impress, there are fears that the UK division could face bigger problems in coming years than just warmer winters. The government's push towards digital utility meters is likely to mean consumers will increasingly be able to pre-pay for energy online rather than traipsing to a local convenience store with a PayPoint terminal. Such changes could substantially increase competition.

The threat of changing customer habits is already very clear in PayPoint's top-up business, which accounts for 17 per cent of sales. Net revenues in the third quarter fell 13.7 per cent, despite a 6.2 per cent increase in Romania. What's more, PayPoint even faces problems at its fast-growing retail parcel division, which accounts for 27 per cent of turnover. The group's Collect+ joint venture grew by 23 per cent in the third quarter, but ongoing negotiations with joint-venture partner Yodel over costs means a loss is expected. PayPoint hopes to have come to an agreement with Yodel when it reports full-year results in May.

The group's attempts to diversify through its online and mobile divisions have also been disappointing. Following a large writedown to the value of its online business last year, the operation was finally sold to Capita for £14.4m at the end of January. Efforts to offload the lossmaking mobile business, PayByPhone, are ongoing. The catalogue of problems have seen EPS forecasts for the current year scaled back by 11 per cent in the past three months, according to Bloomberg.

| PAYPOINT (PAY) | ||||

|---|---|---|---|---|

| ORD PRICE: | 781p | MARKET VALUE: | £532m | |

| TOUCH: | 781-784p | 12-MONTHHIGH: | 1,111p | LOW: 751p |

| DIVIDEND YIELD: | 5.8% | PE RATIO: | 13 | |

| NET ASSET VALUE: | 141p | NET CASH: | £46.1m* | |

| Year to 31 Mar | Turnover (£m) | Pre-tax profit (£m)** | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|---|

| 2013 | 106 | 41.3 | 45.3 | 30.4 |

| 2014 | 114 | 46.2 | 51.7 | 35.3 |

| 2015 | 123 | 49.6 | 57.5 | 38.5 |

| 2016** | 130 | 49.6 | 57.5 | 43.1 |

| 2017** | 137 | 52.0 | 60.2 | 45.3 |

| % change | +5 | +5 | +5 | +5 |

Normal market size: 300 Matched bargain trading Beta: 0.38 *Includes short-term client obligations of £28.3m **JPMorgan Cazenove forecasts, adjusted PTP figures | ||||