Upping the ante

Bookie merger

UK-based bookie William Hill (WMH) and rival SkyBet have backed Canadian gaming supplier NYX's £270m takeover of OpenBet, the gaming technology company. The move comes as many of William Hill's rivals have been engaging in mergers in a bid to scale up to better deal with increased taxes introduced in the UK at the end of 2014. The deal will hopefully provide WMH with a dose of optimism after its shares fell 13 per cent in one day last month on the back of a profit warning.

Mucking in

Lead by example

New Marks and Spencer boss Steve Rowe will remain in charge of the high street retailer's general merchandise division in spite of his promotion to the top of the group. Mr Rowe is credited with turning the food business around and had only been in charge of the clothing and homeware division since July before the January announcement of his appointment to chief executive. Just days into his new role, however, he announced he would keep leading the general merchandise division - no doubt keen to reverse the 5.8 per cent fall in sales over the Christmas period.

Petroceltic pressure

Activist progress

The board of Petroceltic has caved in to a takeover bid from Worldview and recommended shareholders accept the Russian activist hedge fund's 3p a share offer. The Irish oil producer posted a positive update on its acreage in Algeria on Tuesday, now believes a rival takeover from a third party is "unlikely". Instead, it believes, and has been advised, that it is more likely proposals put forward under its current examinership process - a precursor to insolvency in the Irish legal system - would wipe out the equity. Shareholders have been advised to accept the offer by 14 April.

Big rise in pension alternatives

One year on

A year after chancellor George Osborne's pension freedom reforms were enacted the landscape looks rather different. The changes removed the compulsion to buy an annuity and have prompted a large rise in alternative pension products, particularly income drawdown which involves leaving money invested. FCA data shows a 9 per cent drop in annuity purchases between October and December to 21,289 compared with the previous quarter, while 37,150 new drawdown policies were entered into. Nearly two-thirds (63 per cent) of guaranteed annuity rates were not taken up.

Oil and gas companies struggle

UK oil profits

It was fairly obvious the plunging oil price would hit the profitability of commodity stocks but the extent to which it has done so has now been made clearer. The Office for National Statistics has said UK companies extracting oil and gas from the North Sea were operating at their lowest level of profitability in the final quarter of 2015 since it began compiling such data in 1997. The body measures profitability using the net rate of return, calculated by expressing profit as a percentage of the capital used to produce it.

Glencore shift

Agri sale

Commodities major Glencore has sold a 40 per cent stake in its agricultural business for $2.5bn (£1.8bn) to the Canada Pension Plan Investment Board. The move is part of its aim to strengthen its balance sheet in the wake of tumbling commodity prices. Ratings agency Moody's said the deal was credit positive and should help Glencore reach its goal of $4bn-$5bn in divestment proceeds, which is one plank of its plan to improve its financial standing.

Nikkei continues to slide down

Abenomics losing

The Nikkei index in Japan closed down for a seventh straight session this week, marking the longest losing streak in more than three years. Wednesday's fall meant the index notched up its greatest number of consecutive daily drops since November 2012, which was the month before prime minister Shinzo Abe was elected on a platform of economic reform. Part of the issue has been the recent strengthening of the yen, which has hit the export side of the Asian economy.

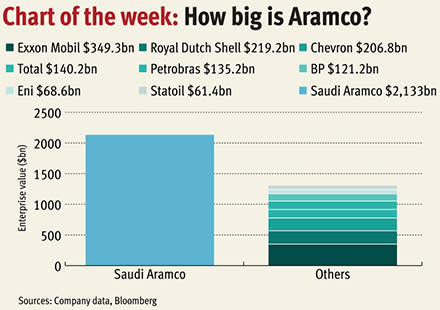

In the next two years, we may well see the largest initial public offering (IPO) in history. Saudi Arabia is considering floating up to 5 per cent of Aramco – the state oil and gas company – by the end of 2018. It’s a pretty tiddly portion of the equity but the sheer enormity of Aramco means very big sums will be involved.

The company has previously been valued at up to $10 trillion (£7 trillion), but based on its reserves of around 260bn barrels, and assuming a very low valuation of $10 profit per barrel, Bloomberg assigned the group a valuation of $2.5 trillion in January.

As the chart here shows, that value could be slightly less now, but that’s more than enough to swallow all the listed oil companies which averaged at least 1m barrels of production a day in 2015.