Increased risk to capital should be rewarded with a higher rate of return. Some short-term money market instruments (for example, three-month Treasury bills) are characterised as ‘risk-free’ due to the presumed safety of the principle sum invested. Share prices, on the other hand, are volatile and there is a greater likelihood of suffering nominal losses. The chance of higher returns is compensation for this risk and, over time, equities have beaten many other asset classes. The margin by which the average annual performance of stocks outshines that of risk-free assets is the equity risk premium (ERP).

London Business School academics Dimson, Marsh and Staunton have done extensive research into long-run equity risk premiums. Building on this work as part of their Global Investment Yearbook 2016 (produced in conjunction with Credit Suisse), the relationship between ERP and interest rates is analysed. The team’s ERP studies go back to 1900 but the Yearbook concentrates on periods in the US (1913-2015) and the UK (1930-2015), when data on rate cycles is also available.

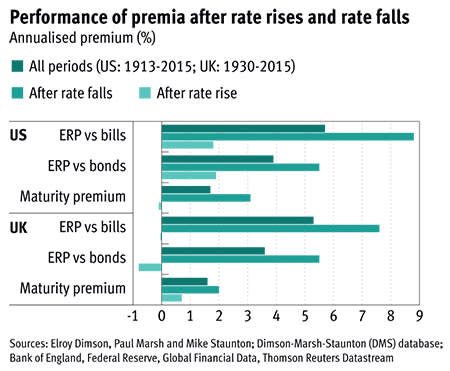

Over these time frames, in real terms, equities delivered an average annual premium (over respective national T-bills) of 5.7 per cent in the US and 5.3 per cent in the UK. Therefore, investors in UK shares have required real annual returns of 6.2 per cent (versus 0.9 per cent from bills); for American investors the required rate is also 6.2 per cent but, with only a 0.5 per cent real return from T-bills, the US equity premium is greater.

Equity risk premium and interest rates

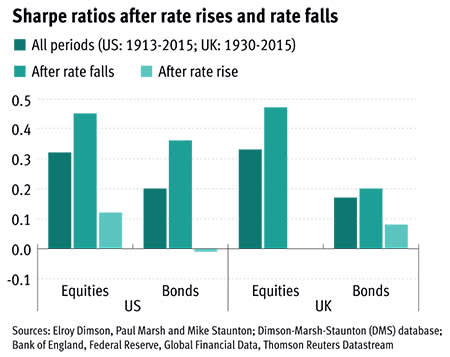

Most of the US premium has been earned during rate easing cycles, with annualised excess returns (over T-bills) of 8.8 per cent in these periods as opposed to 1.8 per cent, on average, when rates have risen. This is highly significant as the Federal Reserve tentatively embarks on its programme of hikes. Corporate earnings forecasts have been consistently downgraded over the past year and it is well documented that a lot of activity supporting the S&P 500 has been debt-funded buybacks. With accommodative monetary policy being pared down, the medium-term outlook for US equities might be subdued.

For the UK, the relationship between interest rates and ERP is even stronger. The entire equity premium has been earned in easing cycles, with shares actually underperforming T-bills following rate hikes. The Bank of England appears, for now, to have kicked rate cuts into the long grass as growth fears prompted by the disinflationary environment in Europe and China’s slowdown persist. Even though rates are at historic lows, the extent to which positive equity returns have occurred in easing cycles, alongside the pattern of weaker company earnings, means the present neutral policy does not support a bullish case for UK shares.

Investors drawn to risk but asset allocation remains crucial

All of which leaves investors in something of a bind. Anaemic real returns from cash and the minimal premium on offer from short duration government bonds has helped maintain the relative attractiveness of equities, despite weakening fundamentals. For UK and eurozone stocks, the determination of many companies to preserve their dividend ensures a significant yield spread above government bonds. According to conventional theory, shares yielding more than bonds is a bad sign for growth. While it would be fair to say that with the current, unprecedented, rate policy situation old rules may not hold true, the prospects for capital gains seem limited. Furthermore, shares are riskier than assets that gave equivalent yields (ie, to the current level of FTSE 100 dividend yield) in the past.

Against a challenging backdrop, considered portfolio management is essential to balance capital protection with long-term growth and/or income objectives. The heightened volatility at the start of 2016 serves as a reminder that it is prudent to maintain some holdings in cash. Low-risk money-market instruments fit the defensive part of the management brief and, in spite of offering minuscule growth, keep pace with current inflation.

Moving further along the risk curve, government bonds also have a role in balancing asset allocation. Over the past two decades, benchmark 10-year government bonds outperformed equities as horrendous bear markets in 2000-03 and 2007-09 caused prior stock market gains to unravel. Low interest rates mean absolute returns of new bond issues held to maturity will be less than in the past but fixed income exchange traded funds (ETFs) increasingly offer an easy way to invest in bond portfolios that focus on a variety of durations.

When it comes to riskier assets, there are tactical alternatives to equities. Gold has positive momentum once again and enjoys the advantage of being very weakly correlated with other asset class returns. Another speculative play is the prospect of an oil price recovery. Betting a large proportion of total funds on oil would be a punt, but relatively modest exposure might be a smart move. Some investors have already been burned trying to pick smaller oil stocks with recovery potential, but larger companies (that also pay an attractive dividend) may be good value now. Another tactic is to buy an oil exchange trade commodity (ETC) and await the rebound. This could take time, and further falls are far from improbable, but price volatility is a more appreciable risk than the myriad of issues smaller exploration companies face relating to their own operational, geopolitical and debt situations.

Factoring equity returns

All of this is not to say investors should retreat from the stock market. The long-run premium of US and UK equities is outstanding and, even if returns have a more global distribution going forward, internationally ERP has tended to revert to around 4.5 per cent in a remarkable number of markets.

An advantage of diversifying across numerous asset classes is that it frees up the portfolio’s ‘risk budget’ to take a more nuanced approach to equities. Market capitalisation-weighted indices, such as the FTSE 100 or the S&P 500, represent broad plays on country opportunity sets but investors can choose to tilt their exposure towards specific risk factors. This may sound counterintuitive, but higher potential returns offered by indices comprising stocks with value, quality, minimum volatility, size, dividend yield or momentum characteristics can improve the overall reward-to-risk profile of a balanced multi-asset portfolio.

A tactic that has done relatively well in 2016 so far is to focus on the apparent anomaly of less volatile stocks outperforming market capitalisation-weighted benchmarks. One popular explanation for this phenomenon is the ‘lottery’ principle; where investors have paid a premium for risky stocks that in many cases have underperformed on the chance of a big winner. A second theory is that analysts overly focus their attention on darlings of the day with the effect that less glamorous stocks benefit when the market realises they have been overlooked and are undervalued.

On a cautionary note, it is possible that as minimum volatility strategies gain in popularity, the return factor will be arbitraged away. Other factors that depend on behavioural phenomena, such as momentum, may also have periods where the effect appears to dry up. Furthermore, spells of serious underperformance have been suffered by some factors (size, momentum and value especially) so tilts should not replace market cap-weighted investing entirely.

Interest rates lower for longer

The great conundrum facing policy-makers in the 2010s is how to reintroduce some inflation into the economy and boost growth. Despite unprecedented central bank support, quantitative easing (QE) and near-to-below zero rates in major regions, global growth is stubbornly below its average before the 2007-09 crisis.

One possibility explored by the research team at Barclays in its annual equity gilt study is that the equilibrium level for interest rates has fundamentally shifted lower. This implies that monetary policy needs to remain loose but there are systemic risks if negative rates, as seen in Sweden and Japan, were to become more widespread. Pension funds and life assurers would face serious difficulties if unable to match nominal liabilities with fixed income. This danger ought to discourage a proliferation of the negative rate experiment but central banks are running out of ammunition to stimulate the global economy.

What does this mean for equity risk premiums? Without profit growth, it will become harder to fund expansive dividend policies. There is, however, enough demand in economies around the world to suggest shares in companies can still offer excess returns over cash and Treasury bills. Volatility has always been a feature of equity investing but applying sensible principles of broad portfolio construction and diversifying with some cash, bonds and alternative risk assets such as gold, can improve the chances of building wealth over the longer term.

n The charts here are reproduced courtesy of Elroy Dimson, Paul Marsh and Mike Staunton, of the London Business School. © 2016 Elroy Dimson, Paul Marsh and Mike Staunton. The research is a continuation of work first published in their book: Triumph of the Optimists: 101 Years of Global Investment Returns, Princeton University Press, 2002.

■ Reviews of exchange traded funds (ETFs) and exchange traded commodities (ETCs) that give exposure to a variety of asset classes can be read in 2015 Top 50 ETFs feature and recent updates on gold, oil and minimum volatility equity strategies are available in the ETFs section on the Investors Chronicle website.