This being said, the US remains far and away the most lucrative market for biotech and pharmaceutical research and development (R&D). A NASDAQ listing is highly sought after by biotech companies as it is widely accepted that US investors demonstrate a greater interest in the sector than their English counterparts. Companies operating in the biotech ‘hubs’ of San Francisco, New England and San Diego raised a total of roughly $20bn in 2015. Along with Singapore these three areas are acknowledged as the best in the world for biotech and pharma R&D, which is perhaps why London-listed companies Shire (SHP) and Hikma Pharmaceuticals (HIK) have chosen to centre their R&D departments in the US. For the UK it could be perceived as something of a concern that the countries two fastest growing pharmaceutical companies have chosen to do the majority of their R&D stateside.

Building better biotech in Britain

In an attempt to better compete with our large neighbours across the pond, the government has launched initiatives which aim to help biotech start-ups.

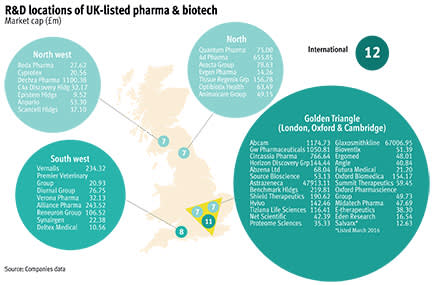

The south east region has benefitted most from this investment, particularly the area which has become known as the “golden triangle” linking university towns Oxford and Cambridge and financial centre London. Almost half of the 183,000 lifesciences jobs in the UK are centred in this region. In 2014 outgoing London mayor Boris Johnson launched an initiative known as MedCity – brother of the successful technology start-up scheme TechCity – to develop the country’s capital as a biotech centre of excellence. This includes the building of a major new research centre in St Pancras which is due to open later this year.

Larger companies have also gravitated towards this golden triangle for their R&D. GSK has invested heavily in its research centre in Stevenage – strategically located between Cambridge and London. AstraZeneca recently (controversially) moved out of its R&D site at Alderley Park in Cheshire to open its main science centre in Cambridge, where it joined Aim’s two largest biotech’s GW Pharma (GWP) and Abcam (ABC).

A northern powerhouse fuelled by lifesciences

Astra’s move to the golden triangle has left behind a world-class research facility, which has churned out many blockbuster drugs over the years. Alderley Park is now owned by Manchester Science Partnerships (MSP), the UK’s largest science park operator which owns 4 other ‘hubs’ in the north west.

Chris Doherty, the site director at Alderley, worked for Astra when it was at the park and has described the huge potential it offers. “When Astra left they left behind a world class facility with biology, chemistry and in vitro labs, animal facilities, as well as big imaging kit, which can’t be moved to Cambridge”. Alderley was also the home of around 4000 research scientists, many of whom chose to stay in the north west when Astra made the move south. As such, there is a pool of top scientists in the area.

The site has already garnered some government attention, perhaps partly due to the fortuitous circumstance that it is located in Tatton, the local constituency of chancellor George Osbourne. “We see George occasionally” says Dr Doherty, who is confident that the site will start to attract more government funding as Mr Osbourne attempts to implement his northern powerhouse project that aims to reduce the economic dominance of the south east of England. It already benefits from some funding from the Medicines Discovery Catapult scheme and has recently been identified as a pilot centre for antibiotic development.

Alderley is not the only site in the UK attempting to reinvent itself as a science park after being vacated by a large pharmaceutical company. Others include Pfizer’s former R&D centre in Sandwich, Kent, and a former Merck facility near Glasgow. But Dr Doherty believes that Alderley is the only one that will be a pure play life sciences site, “even most sites around Oxford or Cambridge are mixed”.

MSP will invest £160m in the park in the next 10 years, which will include the development of an all purpose village, including hotel, pub and sports centre. It is going to develop its own cluster of companies and is also working with BioCity, a business incubator group whose BioHub unit supports start-up companies at Alderley. RedX Pharma (REDX) is the first listed company to move into Alderley. The cancer, infection and immunology company has operated two of its divisions at the site for a few years, but has recently integrated its entire business there. The group’s chief executive Neil Murray is hoping that more mid-sized pharma groups will also make the move to the site, as he believes this will attract further funding. At present the “level of government backed research in the golden triangle is understandable, as that is where biotech companies sit”. With more companies will come more interest in Alderley. He may be in luck as according to Dr Doherty at least one other Aim listed company will make the move to Alderley imminently.