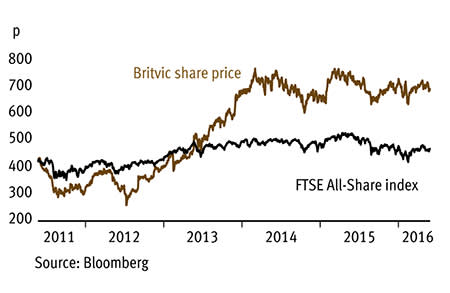

With hints of deflation in the UK soft drinks market, access to international consumers is becoming increasingly important for the nation's beverage manufacturers. And this is why we believe now is a compelling time to buy Britvic (BVIC) shares as two key moves into overseas territories are being underestimated by the market. What's more, the soft drinks giant looks ahead of the curve in advance of the introduction of a sugar tax in the UK and, despite tough conditions in the home market, efficiency improvements should continue to drive margins upwards.

- US launch of multipack Fruit Shoot

- Brazilian acquisition

- Ahead of curve with sugar levy

- Investment in supply chain

- Tough conditions in France

- Competition in the UK

Britvic's sales outside the UK account for roughly a third of turnover and some potentially pivotal changes have occurred recently which could help further propel the group's global footprint. The business is well established in France and Ireland but it is the huge US and Brazilian markets where things are becoming particularly interesting.

In the US, management recently announced it had secured agreements through a distributor to stock Fruit Shoot multipacks with major US supermarkets including Walmart, Kroger and Texas-based HEB. This is potentially very exciting as Fruit Shoots sold individually are already extremely popular across the pond, having gained a 17 per cent share of the children's single-serving market. The Fruit Shoot brand is popular elsewhere, too, accounting for about 6-7 per cent of Britvic's global revenue and boasting the number-one spot in the French children's soft drink market. There's potential for the product in other more far-flung markets too, including Brazil and India.

Prospects for Britvic in Brazil look particularly exciting following its acquisition six months ago of Ebba, a leader in concentrates that also boasts a strong position in nectars. In its recent results, Britvic said the integration was largely complete and there is a plan to double cash profits by 2020 by accelerating growth of its existing products and introducing Britvic brands.

Back at home, the market is tough. However, management is facing up to the challenge by reining in costs and investing £70m-£80m to improve the UK supply chain. A new production line is now operational in Leeds and work is under way to improve sites in Rugby and London. Importantly, the company expects to generate cash returns on capital invested of at least 15 per cent from the sites when fully operational. Broker Berenberg forecasts that this programme will help Britvic build on its record of growing cash profit margins from 9.2 per cent to 13.2 per cent between 2012 and 2015, and take the margin to over 15 per cent in the medium term. And strong cash generation means the broker thinks net debt will remain below two times cash profits despite this capital expenditure.

A forthcoming challenge for Britvic and its peers in the UK is the sugar levy, which is due to be implemented in 2018 on drinks with more than 5g of sugar per 100ml, while a higher tariff will be put on those with 8g of sugar per 100ml. We believe Britvic has been ahead of the curve in reducing sugar content, having cut an annualised 19bn calories from its portfolio since 2012, which has helped it get 66 per cent of its drinks below the sugar-tax threshold. While this has won Britvic plaudits (Chancellor George Osborne singled out the elimination of added sugar from Britvic's market-leading Robinson's brand for praise when announcing the sugar levy), it has come at a cost. Indeed, removing added sugar hit Robinson's sales volumes last year, which was combined with tough competition from own-label products, particularly Aldi's. However, we think the move will soon look farsighted.

In the UK, management has also signed a seven-year deal with Subway to stock Britvic brands as well as Pepsi (Britvic has an exclusive agreement to produce and sell the US giant's products in the UK). The company also faces challenges in France, although its Irish business is performing well.

| BRITVIC (BVIC) | ||||

|---|---|---|---|---|

| ORD PRICE: | 701p | MARKET VALUE: | £1.84bn | |

| TOUCH: | 700-701p | 12-MONTH HIGH: | 775p | LOW: 632p |

| FORWARD DIVIDEND YIELD: | 3.6% | FORWARD PE RATIO: | 14 | |

| NET ASSET VALUE: | 84p* | NET DEBT: | £549m | |

| Year to 27 Sep | Turnover (£bn) | Pre-tax profit (£m)** | Earnings per share (p)** | Dividend per share (p) |

|---|---|---|---|---|

| 2013 | 1.32 | 108 | 35.2 | 18.4 |

| 2014 | 1.34 | 133 | 41.8 | 20.9 |

| 2015 | 1.30 | 147 | 46.3 | 23.0 |

| 2016** | 1.39 | 160 | 48.1 | 23.9 |

| 2017** | 1.43 | 170 | 50.7 | 25.2 |

| % change | +3 | +6 | +5 | +5 |

Normal market size: 3,000 Matched bargain trading Beta:0.74 *Includes intangible assets of £387m, or 147p a share **Berenberg adjusted forecasts, adjusted PTP and EPS figures | ||||