Markets in August were eerily calm, punctuated only by a UK rate cut, which sent riskier stocks and bonds even higher. Although the start of September brought a spike in volatility, markets might still be holding their breath in anticipation of the big correction.

Only days into September and equity markets are jittery in expectation of a US rate rise this month. It could be just the start of a panic many were expecting following a strangely quiet August, in which high-risk sectors thrived and gilts climbed even higher.

In August the Bank of England (BoE) chopped rates to a new record low of 0.25 per cent - never before seen in the UK - and unveiled its 'sledgehammer' package of measures to stimulate lending. The move sent UK stocks surging upwards and pushed gilts up even further. Amid persistent low volatility across markets, investors also flocked to riskier sectors and regions.

The Investment Association (IA) UK Index Linked Gilts fund sector was the top-performing sector over the month, with a return of 10.5 per cent between 31 July and 31 August 2016. Alastair Winter, chief economist at Daniel Stewart, says: "The FTSE 250 and the gilt market responded well to (the BoE's) new largesse and even the pound, somewhat perversely, picked up as August progressed."

Also responding well were emerging market equities, which have been enjoying a dramatic few months in the sun after rising from the doldrums to post stellar gains throughout June and July. "Funds are increasingly flowing out of European equities to hunt yield elsewhere," says Mr Winter. "Currently, emerging markets are hot, but the developed Asian economies are also in favour."

MSCI Emerging Markets Index gained 6.5 per cent between 1 and 15 August 2016, before losing some ground towards the end of the month. It has risen strongly since January 2016, and in the year to date the Lazard Emerging Markets (GB00B24F1G74) and JPM Emerging Markets Income (GB00B5M5KY18) funds are up 40 per cent and 39 per cent respectively. And among closed-end funds Templeton Emerging Markets Investment Trust (TEM) is up 41.5 per cent over the year to date and JPMorgan Global Emerging Markets Income Trust (JEMI) has returned 36.3 per cent.

Chinese equities also experienced a resurgence and the IA China/Greater China sector was the second best performing over the month, according to Ben Yearsley, investment director at Wealth Club.

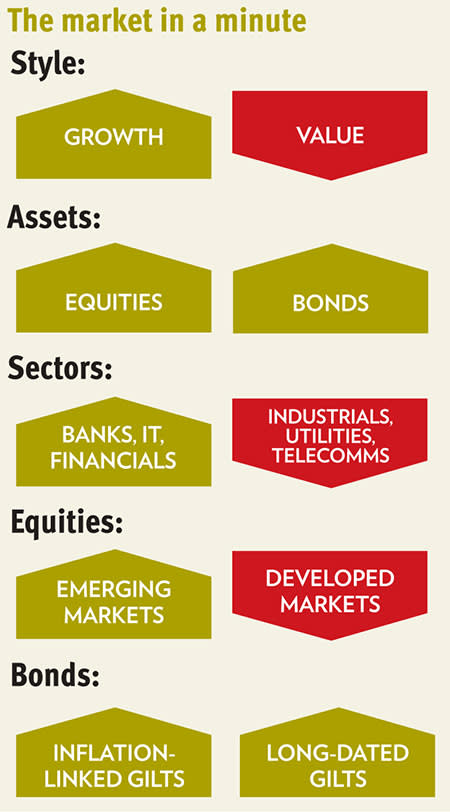

The yield hunt has also meant that sectors such as financials and technology were among the best performing areas over August. UK financial stocks had plunged to a stark low in the wake of the vote for Brexit, but are now trading at mid 2015 levels. Michelle McGrade, chief investment officer at TD Direct, says this is a "catch-up story".

On the flipside, defensive stocks fared poorly from the ramp-up in risk. "At the bottom of the pile in terms of sector performance were property, telecoms and utilities," she says. "It was a risk-on month with no volatility and nothing to really worry about, so those areas did not do well."

"The big defensive sectors - tobacco, pharmaceuticals, and utilities - all had a much worse month as risk seemed to be back on the table," adds Mr Yearsley.

Meanwhile US equities seemed to have nodded off in their sun loungers. The S&P 500 had not, until September, moved 1 per cent in either direction in two months, and that made markets nervous. Calm might seem like a good thing, but the last similar bout of inertia in August 2015 precipitated a major crash.

"History tells us that the longer spot and futures prices are static, the greater is the probability of a correction," says Mr Winter.

That correction appeared to arrive on Friday 9 September, when US stocks posted their worst performance since 24 June. However, many are fearful that things could get much worse.

August's winners and losers

The best-performing open-ended funds in August were bond funds. Baillie Gifford Active Index Linked Gilt Plus (GB00B0BSLC14) and Fidelity UK Index Linked Bond (GB0033144527) both returned more than 12 per cent over the month.

The worst-performing open-ended funds in August were focused on gold. However, this was a dent in an otherwise stellar run for funds invested in precious metals since the start of the year. Investec Global Gold (GB00B1XFGM25) was down 13.5 per cent, Junior Gold (GB00BH57BR88) was down 13.3 per cent, Way Charteris Gold & Precious Metals (GB00B3ND2W21) was down 9.5 per cent and CF Ruffer Gold (GB00B03VWY73) was down 9.9 per cent.

"Gold underperformed over the month only by a tiny amount," says Ms McGrade. "Funds invested in gold shares have, until now, had a superb year. So BlackRock Gold and General (GB00B99BDY18) is up 100 per cent, and other funds focused on gold and silver have gone even higher. But I would now be looking to take profits in some of these funds that are up 100 per cent in the year."

Adrian Lowcock, investment director at Architas, says expensive bonds should make investors nervous. "We have been expecting some sort of sell-off in markets after the rebound following the Brexit vote," he says. "At present, markets haven't moved significantly and there could be much further to fall before this becomes a genuine correction. September has a reputation for being a poor month for shares, particularly equities, but is a better month for gold. Now is perhaps the time to protect yourself; the time to buy may come later.

He points to Newton Real Return (GB0001642635), which aims to deliver returns of 4 per cent above cash and focuses on capital preservation as a good cautious holding, and suggests buying gold.