And while the sterling-denominated gold price remains nearly 15 per cent up on its pre-Brexit level, the fact that gold carries no yield means its value tends to move up or down, rather than sideways. For gold bugs, the volatility has been moving in the right direction this year, with the dollar price up 23 per cent since the start of January. But during that period, purchases of gold exchange-traded funds (ETFs) have hit an all-time high and the world has stepped further into the unchartered waters of negative interest rates and negatively-yielding debt.

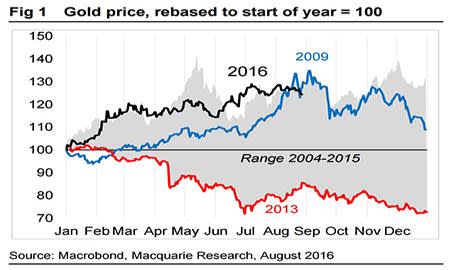

And yet gold is still 30 per cent short of 2011’s record price of $1,895. Researchers at investment bank Macquarie put this down to several factors, including the low-starting price for the metal at the beginning of this year – demonstrated by the fact that this year’s price is still near the top of the appreciation seen in any given year between 2004 and 2015 (see chart below).

“We attribute this to a stronger US economy – both shown in a higher dollar and yields – and signs of a jaded physical market,” added the bank’s commodity analysts. “Our expectations for these suggest slow appreciation for the gold price is more likely than a spike higher.”