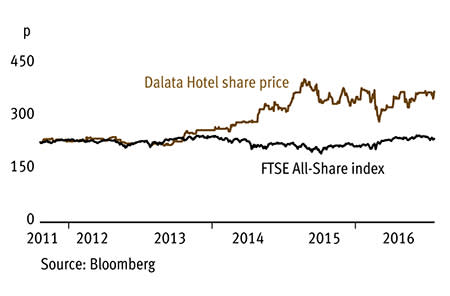

Hotel businesses are hypersensitive to the economic health of the regions in which they operate. This means the resurgent Irish economy is proving a boon for dual-listed Ireland-based Dalata Hotel Group (DAL). Since raising €265m (£230m) from its 2014 float, the company, set up in 2007 by a team of ex-Jurys Doyle management that are still at the helm, has been on a major buying and building spree in its fragmented and undersupplied home market.

- Analyst upgrades

- Strong Irish hotel market

- Industry consolidator

- Strong margin expansion

- Wide spread on shares

- Brexit concerns

Of its 6,610 rooms, almost three-quarters are in Ireland, with about half in the thriving Dublin market. Prospects of growth in revenue per available room (RevPAR) - a key metric for hotel businesses - look extremely attractive in the region. Hotel data monitor STR Global said RevPAR in Dublin rose more than 23 per cent in 2015. Even following the Brexit vote RevPAR of 16 per cent is expected this year and 5 per cent the year after. Analysts estimate Dalata can match 2016 industry-wide growth and beat it in 2017.

The predictions of RevPAR growth for Dalata are supported by some important trends. Ireland's GDP growth is extremely strong as the economy stages a marked recovery with growth of 7.8 per cent last year greatly outpacing the rest of Europe. Furthermore, travellers from the UK only contribute 25 per cent of nights stayed in the Dublin's hotels by international visitors, so there shouldn't be a major 'Brexit effect' if the pound remains weak and discourages Brits' overseas travel plans. The average room rate increased from €85.48 to €94.78 in the 12 months to the end of June thanks to increases in each of its geographic divisions, including the less-pacy UK business, which accounts for a quarter of revenue.

Importantly, the relatively high proportion of fixed costs involved in running a hotel means a large proportion of RevPAR growth should fall through to profits. This means broker Berenberg forecasts that an already healthy 27.8 per cent cash profit margin in 2015 could rise by 170 basis points this year and about 200 basis points in each of the following two years.

Another important factor supporting potential RevPAR growth through rate rises is the severe shortage of rooms available and minimum new supply expected, especially in Dublin. Dalata has also been quick to strike some important deals, and with relatively low net debt at 2.6 times cash profits has room to gear up further to continue working as a consolidator its fragmented markets.

The group's most recent acquisition was the Burlington Hotel leasehold, which it takes over from Hilton. This led to broker Davy upgrading the group's expected 2017 earnings for the second time in two weeks. It reckons the transaction will add €7m to cash profits in 2017, equating to a 7.5 per cent upgrade. The hotel, like others it has bought recently, also boasts sizeable meeting and conference spaces, meaning Dalata is not a pure tourism play, but taps into important business demand too. The company is also developing four new city centre hotels, which are expected to add about 675 rooms when they all open in 2018.

| DALATA HOTEL GROUP (DAL) | ||||

|---|---|---|---|---|

| ORD PRICE: | 360p | MARKET VALUE: | £659m | |

| TOUCH: | 354-375p | 12M HIGH / LOW: | 405p | 280p |

| FORWARD DIVIDEND YIELD: | NIL | FORWARD PE RATIO: | 12 | |

| NET ASSET VALUE: | 316¢ | NET DEBT: | 33% | |

| Year to 31 Dec | Turnover (€m) | Pre-tax profit (€m)* | Earnings per share (¢)* | Dividend per share (¢) |

|---|---|---|---|---|

| 2014 | 79 | 4.2 | 3.6 | nil |

| 2015 | 226 | 28.5 | 14.5 | nil |

| 2016* | 289 | 49.8 | 23.2 | nil |

| 2017* | 339 | 72.8 | 34.2 | nil |

| % change | +17 | +46 | +47 | - |

Normal market size: 1,000 Matched bargain trading Beta: 0.11 £1=€1.15 *Davy forecasts, adjusted PTP and EPS figures | ||||