The high-profile spat between rail workers and management on the Govia franchise can distract from the investment potential of transport companies.

But estimates from broker Liberum suggest some bearishness towards most of the companies in the compact group of four UK-listed providers - FirstGroup (FGP), Go-Ahead (GOG), which part-owns the Govia franchise, National Express (NEX) and Stagecoach (SGC) - could be justified judging by valuations.

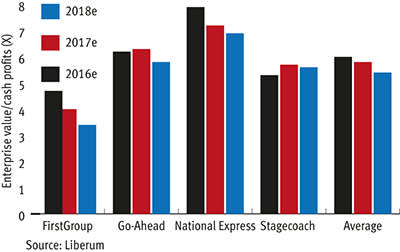

On an enterprise value to cash profits basis, only FirstGroup looks 'cheap' in Liberum's view, with Stagecoach about fair value but the other two expensive.

There are existing pressures to consider, such as declining high-street footfall, which has put pressures on bus volumes. These are only at 1990 levels compared to rail passenger volumes which are at their highest level in almost a century.

The Buses Bill could also put pressure on companies, as amendments made by the House of Lords have increased potential challenges and the government wants rail groups to collaborate more closely with Network Rail, the impact of which is unknown.