Watch out markets: BHP Billiton (BLT) is rebranding! At a reported cost of A$10m (£5.7m), the Australia-headquartered group is parting with its 'Billiton' suffix and - in another meaningless entry in the history of natural resource industry marketing - now presents itself as the diversified miner that will "think big".

- Renewed management focus

- Quality assets

- Potential oil spin-off

- Strong free cash flow

- Commodities volatility

- Samarco liability

Why should stockpickers indulge this waffle? Well, because it all points to something else, namely BHP's need to be seen as a credible investment in light of recent criticism from activist 4.1 per cent shareholder Elliott Management that it has sat idle on $46bn (£35bn) of untapped value.

Attached to the company's response are fresh commitments to grow BHP's value by "up to 50 per cent and almost double the return on capital" through further cost reductions, better investments and improved operating efficiency. Whether or not BHP delivers on these plans or falls victim to another softening of commodity prices is indeterminate at present. Either way, we think a renewed focus on shareholder value should help a share whose dividend yield looks supported by a fast-improving balance sheet.

BHP's business is based on four pillars: iron ore, coal, copper and petroleum. In the current financial year to June, analysts at HSBC expect the latter two divisions to deliver cash profit margins of 44 per cent and 65 per cent respectively, both rising in 2017-18 through a mixture of lower unit cash costs and higher oil, gas and copper prices. Conversely, the profitability of iron ore and coal production is likely to top out this year after the winter's huge spike in Chinese imports put the divisions on track for a whopping $9.3bn and $4.4bn, respectively, in full-year adjusted cash profits - again on HSBC's numbers.

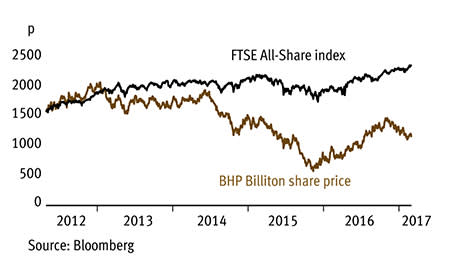

It is the fall of of metallurgical coal and iron ore prices in recent months that largely explains why shares in BHP are 22 per cent off their January high. Few market-watchers expect either commodity to recover in this calendar year. That said, BHP's astonishingly low-cost iron ore operations in Western Australia mean the division will continue to generate excellent free cash flows even as prices remain subdued, as was the case for much of the commodity cycle downturn from 2011 to 2016.

Any effect on prices of a parallel softening in copper demand should be less pronounced, given the metal's tighter supply conditions. If BHP can avoid a repeat of February's industrial action at its Escondida copper plant in Chile, the world's largest copper mine should be a big contributor to cash flows too. Indeed, cash costs at Escondida were falling to $1 per pound before the strike, which compares with a London Metal Exchange copper price floor over the past six months at about the $2.50 level. These margins underpin a dividend policy revised to redistribute 50 per cent of underlying profits, and could result in special returns when full-year results are published in August, particularly if BHP wants to placate income-seeking shareholders disappointed with its abandonment of a progressive dividend policy.

The assets drawing all the focus at the moment, however, are BHP's oil and gas operations, which span almost a million acres in four US shale basins, a number of fields in the Gulf of Mexico, and oil and gas production offshore and onshore Australia. In April, Elliott urged the commodities group to spin off the underperforming US petroleum assets in a $22bn New York listing, and has since argued that BHP should conduct a wholesale review of the division, citing "extremely broad and deep-rooted support" from other investors. Another of Elliott's contentions - that switching from a dual- into a single-listed company structure would result in a $5bn upward market revaluation - will be tricky to enact, but contains valid points and should hone BHP management's focus on shareholder value.

BHP BILLITON (BLT) | ||||

|---|---|---|---|---|

| ORD PRICE: | 1,171p | MARKET VALUE: | £68.6bn | |

| TOUCH: | 1,170.5-1,171p | 12-MONTH HIGH: | 1,519p | LOW: 786p |

| FORWARD DIVIDEND YIELD: | 7.6% | FORWARD PE RATIO: | 9 | |

| NET ASSET VALUE: | 1,064¢ | NET DEBT: | 32% | |

| Year to 30 Jun | Turnover ($bn) | Pre-tax profit ($bn) | Earnings per share (¢) | Dividend per share (¢) |

|---|---|---|---|---|

| 2014 | 67.2 | 20.9 | 259 | 121 |

| 2015 | 44.6 | 6.2 | 35.8 | 124 |

| 2016 | 30.9 | -5.3 | -120 | 30 |

| 2017* | 39.6 | 12.1 | 145 | 95 |

| 2018* | 42.6 | 13.7 | 164 | 116 |

| % change | +8 | +13 | +13 | +22 |

Normal market size:1,500 Matched bargain trading Beta: 1.58 £1=$1.30 *Investec forecasts | ||||