The quarterly reshuffle date for my momentum screen this time around (15 June) happened to fall very close to the date of our recent general election (8 June). Interested to see what impact the election would have on the results of the screen, I checked the momentum performance figures and stock selections the day before the UK went to the ballot box. At 10pm on election night, once voting was finished and the exit polls were out, it looked as though this could prove an extremely interesting experiment given the 'shock' nature of the unfolding result. However, the most interesting thing about the performance of the screen and the stock selection is that both remained largely unchanged. Perhaps this suggests the market had quietly been as underwhelmed by the prospect of a bigger majority for Theresa May's government as the electorate proved to be? More saliently, it's a reminder of how hard it is to second-guess markets.

For the momentum screen, the past three months have really not stood out. The longs picked by the screen in mid-March have modestly outperformed the market, while the shorts have performed more or less in line.

| LONGS | SHORTS | ||

|---|---|---|---|

| Name | Total Return (15 Mar 2017 - 12 Jun 2017) | Name | Total Return (15 Mar 2017 - 12 Jun 2017) |

| Hikma Pharmaceuticals | -29% | Next | 9.6% |

| Fresnillo | 16% | Pearson | 9.3% |

| Unilever | 6.3% | Dixons Carphone | 3.8% |

| Randgold Resources | 8.5% | Royal Mail | 7.0% |

| International Consolidated Airlines | 4.6% | BT Group | -10% |

| Burberry | -2.1% | Tesco | -3.7% |

| Taylor Wimpey | -6.3% | Marks and Spencer | 9.5% |

| Mondi | 6.9% | WPP | -1.7% |

| Smurfit Kappa | 2.4% | Centrica | -8.9% |

| Persimmon | 15% | BP | 3.5% |

| LONGS | 2.3% | SHORTS | 1.8% |

| FTSE 100 | 1.8% | FTSE 100 | 1.8% |

Source: S&P CapitalIQ

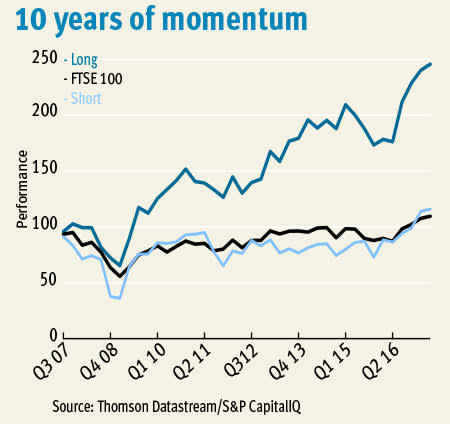

This latest outing for the screen marks an interesting point in its life: its 10th anniversary tracking a basic blue-chip momentum strategy from the height of the previous bull market. The table below shows the screen's capital performance (share price movements but not dividends paid) over 10-year, five-year, three-year and one-year periods.

| LONG | SHORT | FTSE All Share | |

|---|---|---|---|

| 1 Yr | 39% | 34% | 26% |

| 3 Yr | 30% | 38% | 11% |

| 5 Yr | 89% | 52% | 35% |

| 10 Yr | 146% | 16% | 10% |

Source: Thomson Datastream/S&P CapitalIQ

While the performance of the 'longs' (there's an explanation of how these are selected below) is what one would expect over all the periods, the shorts have misbehaved by outperforming the market in every period, whereas momentum theory suggests they should underperform. Part of this was due to the recent very strong outperformance caused by the resurgence of resources stocks in 2016. However, as I've commented a number of times over the years I've monitored this screen, the shorts can be a particularly treacherous basket of stocks that, based on the experience of this screening experiment, often do the opposite of what they should.

The 10 momentum longs are based on the 10 best-performing FTSE 100 shares of the previous three months, while the shorts are based on the worst-performing 10. The shares picked for the coming quarter can be found in the table below, along with write-ups of all the longs. Due to print production, this screen has been conducted a few days ahead of the official end to the quarterly selection period. Future assessments of the screen performance will be based on stocks selected based on the full performance period and may therefore differ slightly from those listed below.

Longs

| Name | TIDM | Price | Market Cap | 3mth Mom | NTM PE | DY* |

|---|---|---|---|---|---|---|

| easyJet | EZJ | 1,329p | £5.3bn | 34% | 15 | 4.0% |

| 3i | III | 931p | £8.9bn | 27% | 10 | 2.8% |

| ConvaTec | CTEC | 324p | £6bn | 24% | 22 | - |

| Coca-Cola HBC | CCH | 2,329p | £8.5bn | 17% | 24 | 1.7% |

| Fresnillo | FRES | 1,725p | £12.7bn | 16% | 37 | 1.4% |

| Rolls-Royce | RR. | 909p | £16.7bn | 16% | 27 | 1.3% |

| Persimmon | PSN | 2,379p | £7.3bn | 15% | 11 | 5.7% |

| Scottish Mortgage | SMT | 418p | £5.8bn | 14% | - | 0.7% |

| Rentokil Initial | RTO | 281p | £5.1bn | 13% | 24 | 1.2% |

| Micro Focus | MCRO | 2,499p | £5.7bn | 12% | 18 | 2.1% |

Shorts

| Name | TIDM | Price | Market Cap | 3mth Mom | NTM PE | DY* |

|---|---|---|---|---|---|---|

| Hikma Pharma | HIK | 1,631p | £3.9bn | -29% | 19 | 1.6% |

| Old Mutual | OML | 197p | £9.1bn | -13% | 9 | 3.1% |

| Shire | SHP | 4,346p | £39.2bn | -11% | 11 | 0.5% |

| ITV | ITV | 184p | £7.4bn | -10% | 12 | 6.6% |

| BT | BT.A | 295p | £29.2bn | -10% | 10 | 5.2% |

| Glencore | GLEN | 295p | £42.0bn | -9.8% | 11 | 1.9% |

| Anglo American | AAL | 1,081p | £15.2bn | -9.8% | 6 | - |

| Barclays | BARC | 207p | £35.2bn | -9.6% | 10 | 1.9% |

| Centrica | CNA | 199p | £10.9bn | -8.9% | 12 | 6.0% |

| Kingfisher | KGF | 310p | £6.8bn | -8.5% | 12 | 3.4% |

*Includes special dividends

Source: S&P CapitalIQ

LONGS

Following easyJet's (EZJ) shares' dramatic fall from grace in 2016, the past three months has seen the budget airline take flight once more. While the group reported a perturbing fall in first-half revenue per seat, investors seem to be interested in encouraging signs of solid passenger number growth in Europe and the retreat of competitors. Indeed, the torrid second quarter of its current financial year could mark a low point, and EasyJet may now start to benefit from its strategy of growing capacity in the hope that it can outcompete its rivals, some of which, such as Alitalia, are already in trouble. easyJet's attempts to win market share as peers pull in their horns should be helped by its strong position in key, capacity-constrained European airports. Investors have also responded well to the company's plans to delay some of its investment in planes, which should result in better cash generation in coming years.

Performance may also be boosted by the highly publicised computer glitch that led to a weekend of flight cancellations by BA and the carrier's botched attempts to deal with the fallout. However, external factors have not all been positive, with the London terror attacks expected to reduce overseas visits to the capital.

Private equity giant 3i (III) released a storming set of full-year results during the three-month period that the momentum screen is based on. The group reported a 36 per cent increase in net asset value (NAV) during the period on a total return basis. Having spent a number of years prior to these results pruning its portfolio of investments, realisations made minimal contribution to the NAV gain. Instead, it was earnings growth from the companies it holds stakes in along with valuation gains that were the key reasons for the strong result.

Of particular note was another excellent performance by the group's largest holding (29 per cent of NAV), a European non-food discount retailer called Action. The group has close to 900 stores and between 2012 and 2016 has boasted a compound average growth rate in sales of 32 per cent and cash profits of 33 per cent. The group's second-largest holding, ferry company Scandlines, also made a strong contribution.

Medical equipment company ConvaTec (CTEC) floated last year with a market cap large enough to make it straight into the blue-chip index. The shares have attracted a lot of attention as a play on the major demographic theme of the growing elderly population, especially in the West. Indeed, there can be few other situations where such mass excitement exists about colostomy bags, catheters and incontinence management products!

The group actually produced some rather disappointing first-quarter numbers during the three months the screen results are based on, however this did little to slow the share price ascent over the period as a whole. Indeed, some of the slower-than-expected growth was put down to product rationalisation, which should help ConvaTec boost margins in the longer term. What's more, the company had previously told investors to expect a relatively weak first half and has stuck by expectations of organic sales growth of more than 4 per cent for the year as a whole.

While the first-quarter results from bottler Coca-Cola HBC (CCH) provides little information beyond sales and volume numbers, and covered what is the group's least important three months seasonally, the trading news was encouraging enough to sustain the impressive share price movement that has developed since February's full-year results. Strong growth in emerging markets, led by price rises in Nigeria, along with signs of a recovery in Russia, were key causes for encouragement.

However, what has really driven the re-rating of the shares this year is the prospect that these solid trading conditions will underpin further impressive operating margin improvements. The company's official target is to take margins, which hit 8.3 per cent in 2016, to 11 per cent by 2020. Recent progress means some analysts think profitability could hit that target level sooner. What's more, the company's finance costs are coming down, which has the potential to exaggerate the impact of rising operating profits on the bottom line.

In many ways, shares in Mexican precious metals miner Fresnillo (FRES) can be regarded as a turbo-charged play on gold and silver prices, and this certainly seems to be reflected in the performance of the stock over the past three months. Gold has risen from about $1,200 per ounce at the start of the period to peak close to $1,300 in early June, since when it has lost a little ground. Some of this benefit will have been offset by the strengthening of the Mexican peso against the dollar and its impact on the miner's costs.

While market volatility is low, the type of uncertainties that cause investors to seek sanctuary in the yellow metal are unlikely to stay that far from investors' minds over the summer, which may support prices. Meanwhile, the miner itself should continue to benefit from recent efforts to bring down costs and rein in capital expenditure.

Is a recovery finally under way at beaten-up engineering giant Rolls-Royce (RR.)? After multiple profit warnings, a dividend cut and a £671m bribery fine, investors seem to have been betting that the worst is over during the past three months.

There are some decent grounds for this view based on the hope that the heavy investment in new products that has decimated cash flow over several years will now begin to pay off. What's more, sterling's weakness should benefit reported numbers for this big dollar earner. There could also be a pick-up in some key end markets, thanks to increased US defence spending and healthier conditions for the marine business thanks to the higher oil price.

The surprise general election result and prospect of a protracted period of political uncertainty has left estate agents worried that a recent spell of low transaction levels will continue. That's not played well for housebuilders in recent days, but Persimmon's (PSN) shares have enjoyed a strong enough three months overall to still make them a 'long' momentum pick. Much of the rise experienced by the shares over the past three months continues to reflect the shares making up ground lost after Britain's last shock election result a little less than a year ago: Brexit.

While politics has been a big influence on the shares, actual underlying trading has continued to be impressive, with strong demand for the group's houses helped by buyer incentives and limited supply. The company also continues to throw off cash, which is being returned to shareholders with gusto.

The publication schedule of this magazine means it is impossible to align the date this screen is run with the date it is published and the official quarterly cut-off date used for the momentum picks (the 15th of December, March, June and September). This can mean that a few of the stocks published in my write-ups don't actually make it into the official selection of stocks from which performance is calculated. Scottish Mortgage's (SMT) position among the 'longs' may fall victim to this timing issue as on the day of writing (12 June) the shares are down by more than 3 per cent.

The problem of recent days for the blue-chip investment trust is that the tech shares that have propelled its performance over several years have hit a bump. Whether this turns into something more protracted is anyone's guess, but the trust itself can be expected to keep its colours firmly pinned to the mast of - for want of a better phrase - the information revolution. Indeed, the trust's manager recently got approval to increase the proportion of the portfolio that can be invested in unquoted companies from 15 per cent to 25 per cent, in order to get exposure to some of the most exciting opportunities that technological change presents.

The reinvigorated fortunes of pest control and hygiene giant Rentokil (RTO) has helped push the shares higher over the past three months, helped by an encouraging trading update in April. The company continues to focus on expanding its pest control business, where its margins are higher and growth is being propelled by rising demand in emerging markets as a growing middle class wages war on pests.

Recent deals mean about 60 per cent of the business is now focused on pest control. Acquisitions are a major part of this expansion strategy and, having spent £107m on 41 businesses last year, management has earmarked £150m for deals in 2017. Importantly, while 'buy-and-build' is an important focus for the business, organic growth has been decent too.

Over the years, the key attraction of software company Micro Focus (MCRO) has its ability to juice high returns from businesses focused on old technology. After initial scepticism, there are growing hopes that its acquisition of HPE Software will provide it with an opportunity to repeat the trick. True, the 9 per cent second-quarter sales slump from HPE that was reported in May wasn't pretty. However, this was in part caused by restructuring and a decision to wind down parts of the business. What got investors' attention for the right reasons, though, was a leap in HPE's operating margin from 16 per cent to 26 per cent. This has helped improve some investors' feelings about the deal, which is taking a long time to complete. As with Scottish Mortgage, the recent tech sell-off could mean Micro Focus struggles to make the final cut for this quarter's momentum picks on 15 June.