- High industrial property weighting.

- Asset sales materially above book value.

- Capital being recycled into high yielding retail warehouse assets at trough valuations.

The investment risk looks skewed to the upside for investors taking a 12-month view on the high yielding shares of one well managed real estate investment trust (Reit).

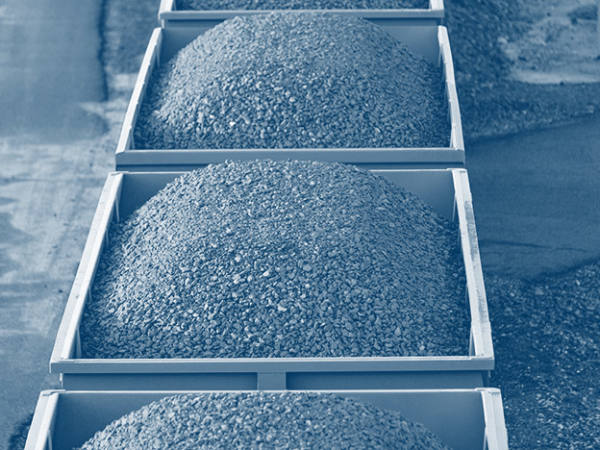

That’s because 50 per cent of the fund’s investment portfolio of high yielding commercial property is in the industrial sector, a hot segment of the market that has been attracting significant demand from both tenants and investors. In 2020, over 50m sq ft of warehouse space was let, or 12.7m sq ft ahead of the previous record set in 2016.

Furthermore, the portfolio is well managed. Recent disposals have realised more than 30 per cent above book value of the assets with the funds being recycled into high yielding investment opportunities that offer significant growth potential. The fund looks set to deliver yet another year of strong NAV growth, a factor not reflected in the shares' current rating.

Download PDF