- High weighting to industrial and retail warehouse property.

- High dividend yield and pay-out fully covered.

- Diversified tenant mix, and high collection rates.

Geopolitical risk, supply chain shortages, surging commodity prices and inflation slashing the real value of money are some of the major headwinds investors are encountering right now. In the circumstances, it is prudent to increase exposure to higher yielding investments that are underpinned by strong fundamentals and structural growth drivers.

One internally managed Real estate investment trust (REIT) fits the bill. The company is not only a beneficiary of sectoral growth trends across the industrial/logistic and retail warehousing property sector, but its shares are priced on an unwarranted 25 per cent discount to net asset value (NAV) and offer a 5.7 per cent dividend yield.

Structural drivers

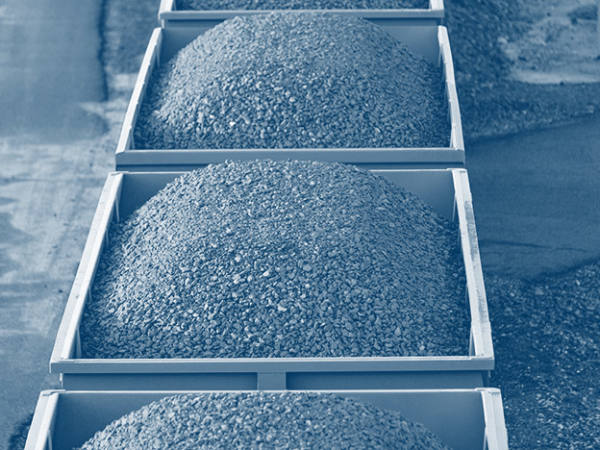

Activity in the UK industrial and logistics market went into overdrive last year with take-up surging to 78mn square feet (sq ft), surpassing the previous all-time high set in 2020 by 29 per cent.

The boom in online retail is a key driver. Occupational activity was led by the retail and wholesale sector as major players accelerated expansion plans, taking up 33mn sq ft of vacant space (source: Lambert Smith Hampton). Amazon was the most active single player, accounting for 12.5mn sq ft of space. Distribution and third-party logistic operators were active, too, reflecting structural change; the segment accounting for more than a fifth (16mn sq ft) of the total space taken up last year.

Top-end forecasts by Retail Economics predict that the proportion of non-food sales made online will increase from 37 per cent of the total in 2021 to almost 50 per cent by 2025. Ongoing growth on this scale underpins demand for space as retailers, parcel couriers and logistics operators try to keep up with rising end-user demand.

The increase in localised production is another factor driving demand for UK industrial warehouse and distribution property. Global supply chain disruption and spiralling shipping costs from Asian manufacturing facilities mean that offshoring is not the attractive proposition it once was for UK companies, the consequence of which is higher domestic demand for space.

It’s a favourable backdrop for industrial warehouse and logistics property players. However, one small-cap company has slipped well below the radar.

Download PDF