The world is at war – the United States and China are battling for supremacy and the fallout affects the UK, eurozone and emerging markets. When the weapons of tariffs, currency manipulation and restrictions around strategic industries are employed, there is collateral damage to workers, companies, consumers and investors. Yet, when the very concept of national interest can no longer be agreed upon in the west, the skulduggery of politicians and partisan news organisations adds complications and makes the business of managing money more difficult.

For nearly five decades, since the World Economic Forum began meeting annually at the Swiss Alpine resort of Davos, the consensus of global financiers has been that integration of economies and supply chains is infinitely desirable. Undoubtedly, breaking down barriers to trade has enormous benefits, but it is impossible to separate international commerce and the global financial system from geopolitics.

Liberalisation of trade rules and the rise of supranational bodies such as the World Trade Organization (WTO) and the European Union (EU) are co-dependent factors, plus there is the emergence of China as challenger to American hegemony. Shifts in the balance of power, from national parliaments to commissioners, from west to east; and exacerbation of imbalances between labour and capital, have led to unrest and questioning of the Davos worldview.

The reappraisal of globalism that is sweeping Europe and the US is of enormous consequence for private and corporate citizens alike, which by extension makes it integral to portfolio management. Inevitably, the political debate is clouded by emotive forces of nationalism and identity and, rather than being upheld as a vital goal of international relations, trade has been used as carrot, stick and negotiating chip by those with ideological motives.

Divergence between globalists and patriots

Undoubtedly, breaking down barriers to trade has enormous benefits. Countries can focus their productive capacity on industries where they have a comparative advantage (ie, they can produce relatively more cheaply). Even if a country can make lots of things for less than anyone else, trading enables them to concentrate their assets on the goods they can make most efficiently. In other words, trade is a virtuous cycle that raises productivity, suppresses prices and benefits consumers. Furthermore, open international markets offer opportunities for good businesses to expand and make more profits for their shareholders.

After the end of the Cold War, encouraging world trade became a pillar of establishing a new world system. Yet, in the case of emerging nations such as China, nationalism has still been at play and they have taken advantage of policies in the West to not just partake in a new system, but challenge the international order. When it joined the WTO in 2001, China’s annual trade surplus with the rest of the world was $178bn (£144bn), but this had risen to $873bn by 2017. Reinvesting the proceeds enabled China to build up massive reserves of foreign assets – notably US Treasury bonds – and has helped it become a much more assertive power financially and militarily.

In the 2000s the west didn’t look beyond its short-term interests. Importing cheaply from China helped suppress inflation as economies such as the US and Britain gorged on a debt-fuelled boom. Germany even benefited from rising Chinese demand for its exports of capital goods and Australia enjoyed a bonanza in commodities prices.

Following the global financial crisis, however, far greater scrutiny has been placed on how equitable trade relationships are with China. The country has advantages that should give a natural trade surplus with nations like the US, but there are reasonable grounds to question whether the chasm in goods traded between the two was entirely due to efficiencies or other factors, such as the rate at which China pegged its currency, the renminbi (RNB), to the US dollar.

When added to allegations of industrial espionage and intellectual property theft – all against the backdrop of rising strategic tensions over global influence – and it’s apparent the interests of American consumers and financiers might not totally align with Uncle Sam’s. Given this context, the brinkmanship between US President Donald Trump and Chinese premier Xi Jinping is understandable and the trade conflict has been escalating over the past two years. In total, the US has applied exclusive tariffs of $550bn on Chinese goods and China has responded with $185bn exclusive tariffs on US products.

Table: 2017 Trade between the world's four biggest economies and the UK ($bn)

| USA | China (mainland) | Japan | Germany | UK | |

| USA | -344 | -58.1 | -50.4 | 1.4 | |

| China (mainland) | 344 | 22 | 14 | 37 | |

| Japan | 58.1 | -22 | 2 | 7.4 | |

| Germany | 50.4 | -14 | -2 | 51.7 | |

| UK | -1.4 | -37 | -7.4 | -51.7 |

Source: Simoes, Landry, Hidalgo, Observatory of Economic Complexity (Massachusetts Institute of Technology Business School)

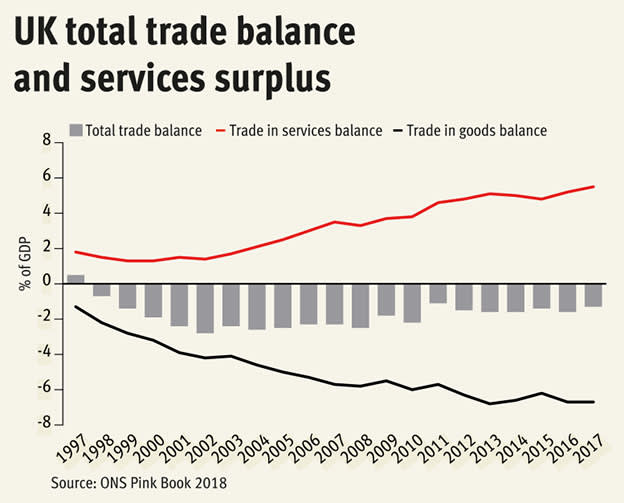

Britain’s situation with the EU differs in that, although it has an immense deficit in goods traded with its European partners, the controversial issue that led to a vote to leave was not the terms of trade but the amount of sovereignty given up to access them. It cannot be claimed with certainty that the country could or could not achieve a healthier balance of payments overall, trading more equitably with the rest of the world and on slightly worse terms with the EU. What cannot be denied, however, is that Britain is heavily reliant on its services sector, which trades considerably with Europe and on its proximity to the continent with other partners.

FTSE All-Share composition and the UK financial services surplus

Financials account for roughly 18 per cent of the FTSE All-Share index (excluding investment trusts). That makes it the largest single sector and in terms of the UK economy, the industry contributed a $44.4bn trade surplus to the overall services surplus of $111.6bn in 2017. Therefore, it comprises 40 per cent of the figure that goes some way to counterbalance the UK’s enormous deficit (-$222bn) in physical goods traded with the rest of the world.

It’s easy to see why financial lobbyists have so much influence on politicians at Westminster. Given Europe was the largest contributor ($25.6bn) to the UK’s 2017 financial services surplus, the willingness of Conservative Party MPs to defy the party whip, against leaving the EU without a bespoke trade deal, acquires further context.

Yet, for stock market investors the picture is nuanced. Of the financial companies included in the FTSE All-Share (ex-IT) index, commercial banks make up over half the market value of the sector. The biggest, HSBC (HSBA), makes significant revenues in Asia and all have far greater exposure to the UK domestically than Europe. Life, health and multi-line insurers have relatively inelastic demand for their services and they make up 17 per cent of the finance sector; domestically focused property and casualty insurance accounts for 6 per cent; the London Stock Exchange (LSE) itself is nearly 6 per cent of the financials total; and even some of the largest companies in the asset management and custody banks category are UK-centric, such as Hargreaves Lansdown (HL.).

The balance of payments

Strategic concerns for the UK relate more to how the country funds its overall current account deficit. This is the difference between the value of all goods and services the country exports and what it imports, plus the net effect of income flows in and out of the country from financial assets (such as bonds and shares); and residents/non-residents (corporate or individual) making income transfers (ie repatriating profits or salaries).

The Office for National Statistics (ONS) releases its Pink and Blue Books on the balance of payments at the end of October (interestingly the date is later than usual and coincides with the current Brexit departure date), but there are fears that sterling’s lower value against major currencies since the 2016 referendum has exacerbated the current account deficit. London School of Economics trade expert Dr Swati Dhingra notes many UK sectors with highly integrated global supply chains have seen import costs rise thanks to sterling depreciation. Furthermore, she observes “lower wage growth and lower worker training in these sectors”. Longer term, this sounds like a recipe for lower productivity, which would be bad for Britain’s economic output, exports and the balance of payments.

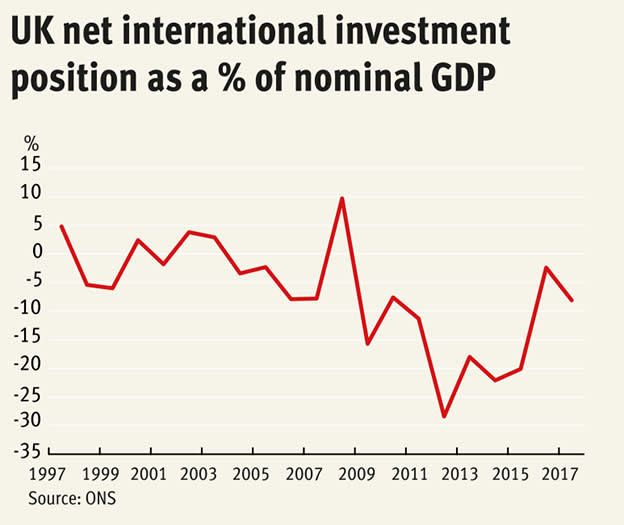

Ultimately, the UK must fund its trade deficit from its capital account. This measures the net position in a country’s capital assets and liabilities. The International Monetary Fund (IMF) splits the higher-level definition of capital account into a capital account of non-produced, non-financial assets and liabilities; and a financial account that measures net acquisition of financial assets or net incurrence of financial liabilities.

In 2017, the ONS calculated the value of UK overseas investments to be worth roughly £11 trillion. The value of foreign investments in the UK was rated at a similar amount, but what is key in understanding how the country finances its borrowing is how the relative value of assets the country holds and the liabilities it incurs fluctuates. Britain’s international investment position (IIP) is like a stock take of financial investments, with the net IIP showing the difference in assets and liabilities.

While foreign investment is a good thing when it is used to build more productive assets, if Britain is just selling the family silver, the nation becomes poorer in the long term. Jewels of the UK stock market are especially being eyed by foreign suitors thanks to the weaker pound since the referendum to leave the EU. The Hong Kong Stock Exchange’s £32bn bid for the LSE has raised questions about foreign ownership of UK assets.

The LSE is a public company, so is fair game in a well-functioning capitalist system, but some of the other foreign investment projects given the green light in recent years raise eyebrows, with justification. Former Chancellor of the Exchequer George Osborne’s approval of Chinese capital investment in Britain’s power infrastructure is questionable for a host of reasons. At a time when safer, renewable electricity is coming down in price and battery storage technology is improving rapidly, Mr Osborne committing UK consumers to paying £92.50 per Megawatt/hr for nuclear energy doesn’t seem the best deal.

China understands the long game

Nationalism has become taboo in the west (especially Europe), but China’s patterns of investment – including buying strategic western assets – and economic expansion have been meticulously planned to advance its national interest. The world’s oldest civilisation is used to playing the long game and western policymakers have been naïve over the past 20 years in appraising its motives. China has never forgotten its century of humiliation at the hands of western powers, Russia and Japan. Commerce at bayonet point and hunger for resources motivated China’s tormenters between the First Opium War (1839-42) – when Britain savagely enforced trading cheap tea for hard drugs – and Japan’s brutal occupation of mineral-rich Manchuria (1935-45).

Since the 1990s China has been expanding its reach, acquiring access to overseas resources and securing trade routes. The One Belt, One Road (OBOR) initiative – China’s plan to make investments and establish capital footholds with its Eurasian and Australasian trading partners – has been characterised as an expanded Silk Road for the 21st century. Critics worry that this could reduce independent democracies to vassal status, although when compared with 19th century western imperialism, China’s counter charge of hypocrisy is not without validity. The OBOR strategy is the brainchild of President Xi, and China’s commitment is unwavering. Sat Duhra, co-manager of investment trust Henderson Far East Income (HFEL), says that: “OBOR will ultimately support China’s plans to internationalise the RMB (China’s currency, the renminbi) and expand markets for industries that are facing overcapacity, with easier transport links between trading partners.”

The same is true in Africa, where Chinese investment is still less than that of historic colonial powers such as Britain and France. And it has been noted by Forbes China correspondent Alicia Garcia Herrero that Chinese investment has been concentrated in acquiring access to raw materials and has generated less wealth per head for recipient countries. It is also noteworthy that whereas Britain ($6bn deficit) and France (slight surplus) had quite equitable trading relationships with Africa in 2017, China had a trade surplus of over $20bn with the continent.

Overall, China’s overseas investment policy isn’t yet a factor in the investment case for shares in the country’s companies. “The beneficiaries [of One Belt One Road] are likely to be the mega SOEs [state owned enterprises],” says Mr Duhra, “but history has shown that SOEs do not necessarily make the best investments in China.” At this stage in China’s development, Mr Duhra is more focused on its domestic businesses: “The real gems in the China market remain the domestic-focused consumption stories, which are generating abundant FCF [free cash flow], retain strong balance sheets and aim to increase dividends over time. This is our favoured theme in China and exposure to OBOR is not an investable theme at this early point.”

US securities markets will have greater direct impact

The US is a much larger part of the global securities opportunity set, so investors are more likely to have big direct exposure in their portfolios. At the end of August, American stocks made up over 60 per cent of the MSCI World index by market capitalisation and UK investors are very likely to hold companies such as Apple (US:AAPL), Alphabet (US:GOOGL), Amazon (US:AMZN), Exxon Mobil (US:XOM), Disney (US:DIS) and MasterCard (US:MA) through tracker or managed funds, and they may well hold these businesses directly. It’s also likely strategic bond funds will have big US exposure.

As the reserve currency of the world, and the lubricant of the global banking system, the value of the dollar has a huge impact on UK investors. Artur Baluszynski, head of research at Henderson Rowe, says any “short- to medium-term shocks or recessions will drive strong demand for the US dollar”. Normally, this potential currency appreciation would be good news for UK investors in US securities such as US Treasury bonds or S&P 500 shares, but the pound is at such depressed levels there is still a risk it could appreciate against even a strengthening dollar if Brexit is shelved.

That said, the building up of dollar reserves ahead of potential recession should continue. Mr Baluszynski says that dollar availability might be helped by Federal Reserve chair Jerome Powell’s talk of organic balance sheet growth and President Trump’s attacks on the Fed to loosen policy, but that “unless we see a significant QE [quantitative easing] or a large fiscal stimulus, the dollar hoarding should continue”.

Withstanding any sudden jumps in the pound on a Brexit deal/cancellation, this pressure will have a positive translation effect for UK investors in dollar assets, but will have an impact on UK-listed companies with operations that require dollar financing. “For offshore dollar sovereign and corporate buyers, especially the ones with an asset-liability mismatch, the stronger the dollar, the more incentive to stockpile ahead of any potential refinancing”, says Mr. Baluszynski.

Indirectly, US Treasuries are a cornerstone for the capital asset pricing model and therefore the relative valuation of all listed securities. The yield (rate of return) on the world’s safest government bonds is used as the risk-free rate against which all assets are judged. The higher the yield on US debt, the higher the returns investors require from riskier assets such as emerging market debt or shares. Furthermore, the dollar as the global reserve currency, has a bearing on the activities of resource economies; and most international companies (including many listed on the London Stock Exchange) will be affected by the price and supply of the dollar in their treasury management.

Other knock-on effects of the trade wars

One of the strategies China used to build its trade surplus with the US was suppressing the value of its currency and, as trade negotiations become more hostile, it is once again resorting to devaluation. This has a knock-on effect for other countries, summarised by Mr Baluszynski: “China’s ongoing devaluation of its currency and injections of liquidity will continue to drive devaluations of peer currencies against the US dollar.” Other local or competing economies experiencing fallout from the slowdown in China will attempt to boost their economies via currency depreciation. To put it simply, we are talking about good old fashioned currency wars.” Citing Michael Pettis, professor at Peking University, a 1 to 1.5 per cent appreciation of the renminbi is roughly equivalent to the impact of a 10 per cent tariff on the Chinese economy. This, Mr Baluszynski says, “should give us some idea about potential devaluation if China-US trade wars escalate further”.

When dollars are earned from a trade surplus they need to be recycled into US assets or investment in the US economy. Japan has done much the same and in fact holds even more US Treasuries than China does. Japan also invests in building US factories and other developments that add to wealth creation in the US economy. Of course, the difference is that ever since it was totally defeated in the Second World War, Japan has been a firm American ally.

There is far less sensitivity around Japanese companies working closely with US companies and universities, so Japan is excluded from fewer strategic industries. Technology is another huge issue in the US-China rivalry. The laxity of previous US presidential administrations has come home to roost as China has stolen a march on 5G mobile technology. America’s punitive actions against the chief financial officer (CFO) of Huawei, China’s biggest mobile operator, lay down a tough marker against a company that represents a strategic threat. The fact that the request for Meng Wanzhou’s extradition from Canada was linked to trying to circumvent US-led sanctions against Iran perfectly illustrates that the rivalry transcends corporate espionage.

From an investment perspective, tensions with China raise supply chain issues for big US businesses and alter the case for semi-conductor businesses such as Tencent (HK:0700) that have been some of the best performing Asian stocks over the past decade. In US equities, the investment case for businesses such as Apple is probably more sensitive to demand side issues, such as the lengthening replacement cycle for the iPhone. Other companies such as Amazon are diverse enough to adapt to any supply-side problems, without major issues for earnings. Problems are more likely on the demand side if the trade wars cause a fall in consumer confidence and precipitate a recession.

Greater risk could be to corporations in other parts of the world. Germany, for example, is caught between a rock and a hard place. China and the US are its two of its biggest three export markets. If there is a recession in the US, then exports of cars and vehicle parts take a hit. Its export of capital goods to China has already slowed and will be ground further by a contraction of Chinese exports to the US.

Portfolio building in an era of economic nationalism

Protecting and growing your wealth at a time of severe tension between the world’s largest economies and uncertainty about the UK’s future relationship with the EU isn’t just a matter of picking winners and losers on the stock market. Portfolios need to be positioned to take account of secular trends and counter-balance risks as geopolitical rivalries play out. There is an interplay between currencies, bonds, equities and alternative assets that investors need to consider in choosing and managing their asset allocation.

At a time when the world’s appetite for risk is tapering off amid fears of recession, investors need to ask questions about their bond allocations. The performance of UK government bonds (gilts) in 2019, which are up nearly 10 per cent in the year to date, is due to price increases. The price of these supposedly safe assets is arguably in a bubble, which makes decision-making harder.

Hard Brexit looks dead in the water following Prime Minister Boris Johnson’s series of chastening reverses in parliament and the law courts, so some of the idiosyncratic risks for UK bond investors have subsided. The fear of a short-term spike in inflation, thanks to the pound tanking on a no deal, is dissipated, so the case for expensive index-linked gilts looks even weaker now. Stephen Baines, who manages the Artemis Short Dated Global High Yield Bond Fund (LU198889314), says: “Inflation needs to average more than 3.37 per cent over the next 10 years for investors to break even on an investment in index-linked gilts versus simply holding conventional gilts, substantially higher than the current inflation rate.”

Some portfolio allocation to ordinary gilts is worthwhile, however. Lower outlooks for gross domestic product (GDP) will suppress yields and, with the threat of secular deflation hanging over the world economy, there may be further price gains for government debt if rates head into negative territory – price gains that would offset any potential weakness in shares. Other core bond holdings, such as US Treasuries, which are a safe haven asset, benefit from trade tensions in the short term. The opposite is true of emerging market bonds, which investors tend to buy when they are more positive on global growth prospects. That said, a small allocation to emerging market debt could be a value way to profit from countries in Southeast Asia.

Reasons for optimism

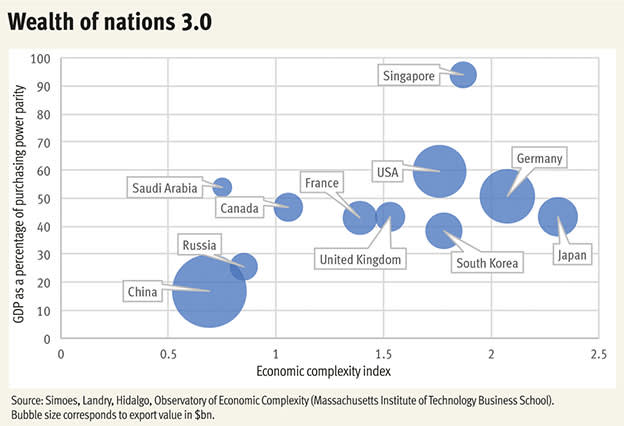

Perversely, one of the benefits the UK has from being a post-industrial economy is that the manufacturing companies it does have are highly complex. The country now produces mainly highly specialised products or components, which have a low level of demand elasticity and tend not to be produced too many places elsewhere. Falls in global demand will hurt some UK companies, but a good many are also in areas of structural growth that are prime to benefit from government fiscal stimulus.

This notion is explained further in the Atlas of Economic Complexity (Hausmann, Hidalgo et al) which defines the complexity of an economy as “the multiplicity of useful knowledge embedded in it” and says that it “reflects the structures that emerge to hold and combine knowledge” in an advanced economy.

Complexity is quantified using two metrics: diversity and ubiquity. Diversity is the number of products a country’s economy is connected to and ubiquity is the number of countries a product is connected to. Countries with more diversity, and less ubiquity, in what they make are deemed to be more complex economies. The UK is the 10th largest export economy in the world and the 11th most complex. Exporting 363 products with which it has a revealed comparative advantage, The Observatory of Economic Complexity (OEC) points out that Britain’s “share of global exports is larger than would be expected from the size of its export economy and from the size of a product’s global market”.

So, it’s not all doom and gloom for investors amid a testing time for the world economy. However much of a mess politicians try to make of things, there are still good businesses innovating and making quality products. The trick, as ever, is to buy into them at the right price.