First the US Fed started raising interest rates because the economy was doing so well (in their view despite a wickedly low participation in employment rate), and bond traders sold short-dated and bought long-dated Treasuries. Yesterday, at 82 basis points between 5 and 30-year paper, it’s at its flattest since 2007. Yesterday the Bank of England raised rates by 25 basis points and guess what bond traders did. Bought long-dated Gilts.

The Venezuelan government of Nicolas Maduro plans to make a final payment on state oil firm PDVSA bonds this week and then renegotiate/restructure all its global debt, Bloomberg reports. They are blaming US sanctions for their inability to raise new financing.

DAX 30

Suddenly stopped at the top with a tiny dragonfly doji candle yesterday. Still too overbought for words.

SHORT TERM TRADER: Square.

POSITION TAKER: Square.

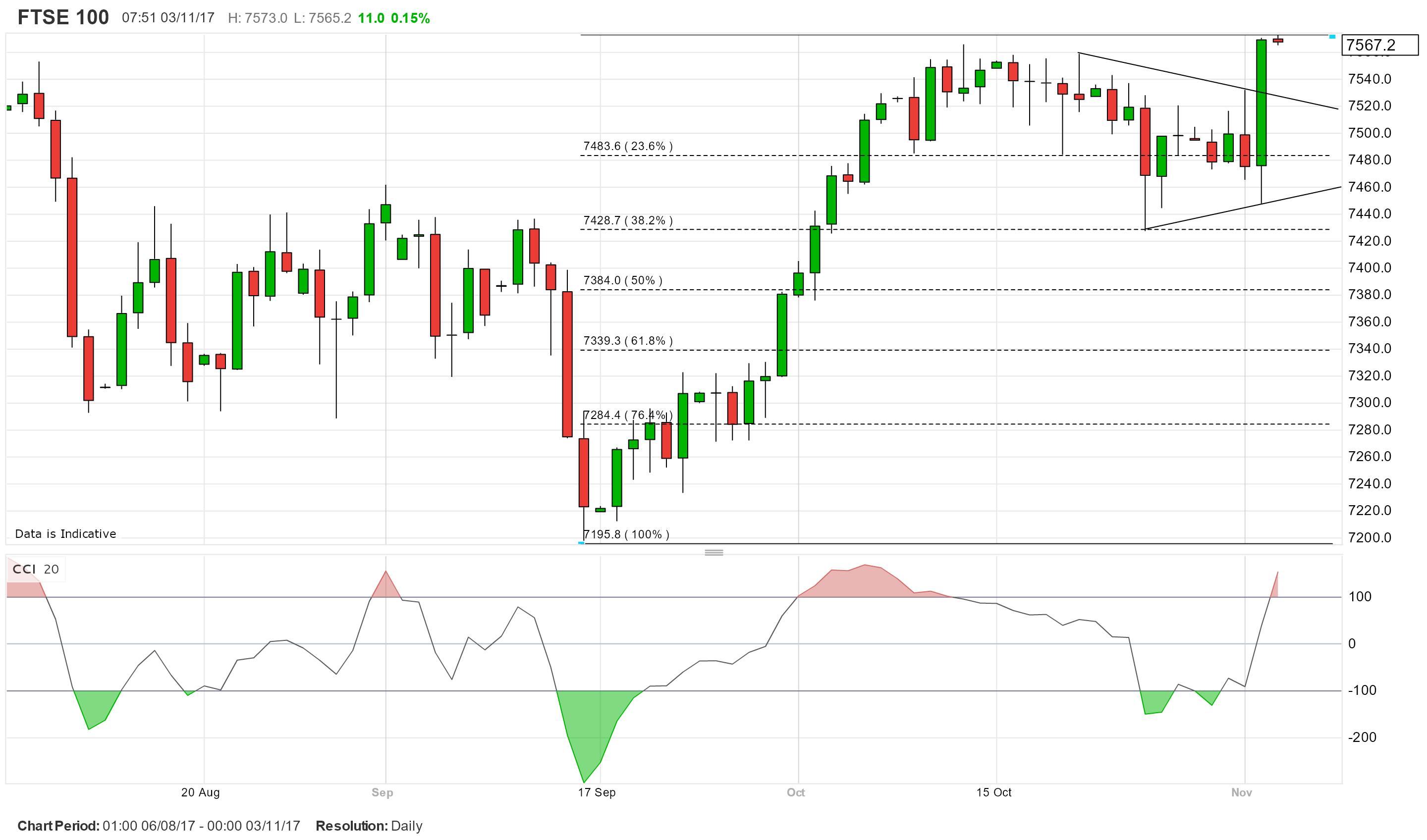

FTSE 100

Just as we had thought, support on the downside was stronger than resistance to the upside, and a wimpy move by the Bank of England saw dealers assume rate rises were nothing to worry about. They claim savers will benefit – we’ll see about that. They say so many have fixed rate mortgages that most will see a £15 monthly increase. More to the point, let’s see what rates on unsecured lending will do. You have one guess.

SHORT TERM TRADER: Short at 7554; stop above 7570. Target 7320.

POSITION TAKER: Square.

S&P 500

Sort of clinging on to trend line support but, at roughly 45 degrees, this will become increasingly difficult.

SHORT TERM TRADER: Square.

POSITION TAKER: Square.

BRITISH POUND/US DOLLAR

Seven of the nine MPC members at the Bank of England decided that they needed to fight inflation by raising interest rates. Look what they did to the pound. So once again the cost of importing all of the stuff that we need just got a little more expensive again. Great.

SHORT TERM TRADER: Stopped out of my long position at a 1 cent loss.

POSITION TAKER: Square.

EURO/US DOLLAR

Very odd as it’s stopped dead in its tracks. Momentum still bearish though.

SHORT TERM TRADER: Square.

POSITION TAKER: Square.

GOLD

Again testing immediate trend line resistance as we remain trapped in the middle of the range since July.

SHORT TERM TRADER: Small short at 1275; stop above 1285. Target 1220.

POSITION TAKER: Square.

Nicole Elliott is a long-standing Member of the Society of Technical Analysts and has taken over the IC’s trading coverage. She is regularly interviewed and quoted by the financial media, is a conference speaker, and author of several books on charting.