“While changes in tax policy will likely provide some lift to economic activity in coming years, the magnitude and timing of the macroeconomic effects of any tax package remain uncertain,’’ noted Janet Yellen at yesterday’s FOMC rate-setting meeting. As widely expected the Fed Funds target was increased by 25 basis points to 1.5 percent, economic growth expectations were raised slightly to 2.5 per cent but rather than the huge surge touted by the President the Fed suggested it would only provide ‘some modest lift’.

Reacting to this the Peoples Bank of China raised its reverse repo rate on 7 and 28 day repurchases by 5 basis points, something markets had not expected, also on its medium-term lending (MTL) facility. Such a small move is symbolic rather than material.

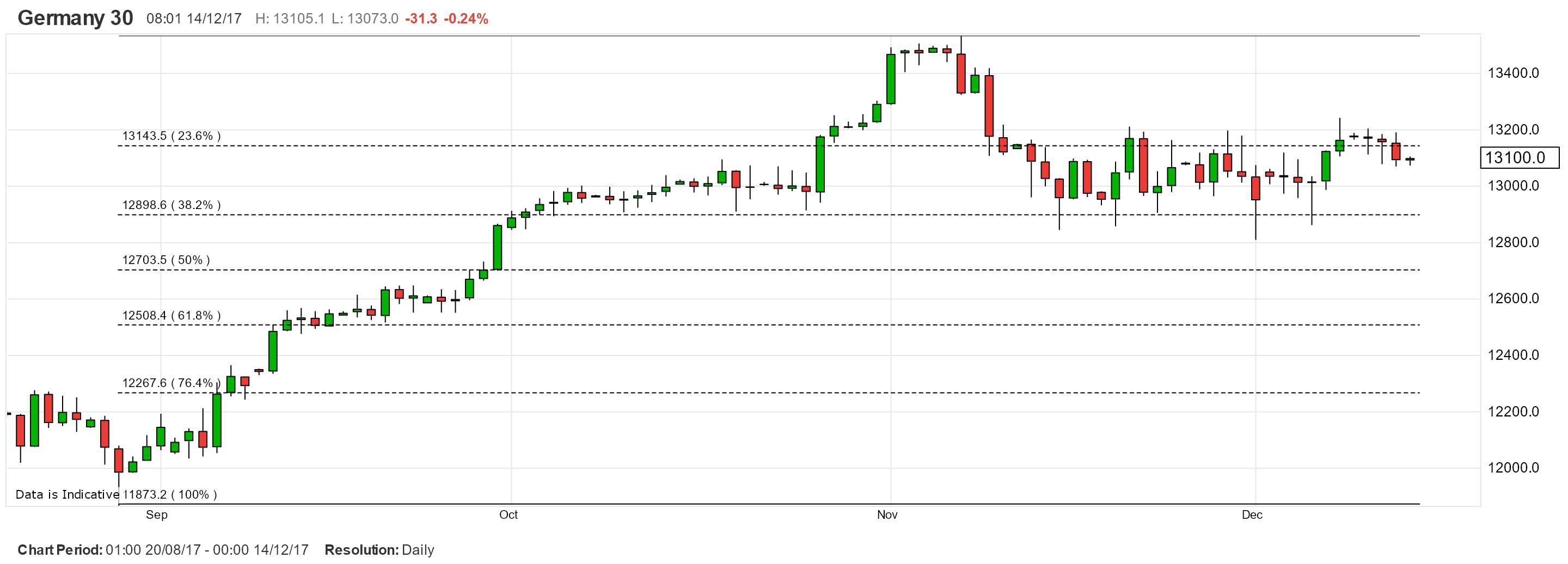

DAX 30

Too boring for words.

SHORT TERM TRADER: Square.

POSITION TAKER: Square.

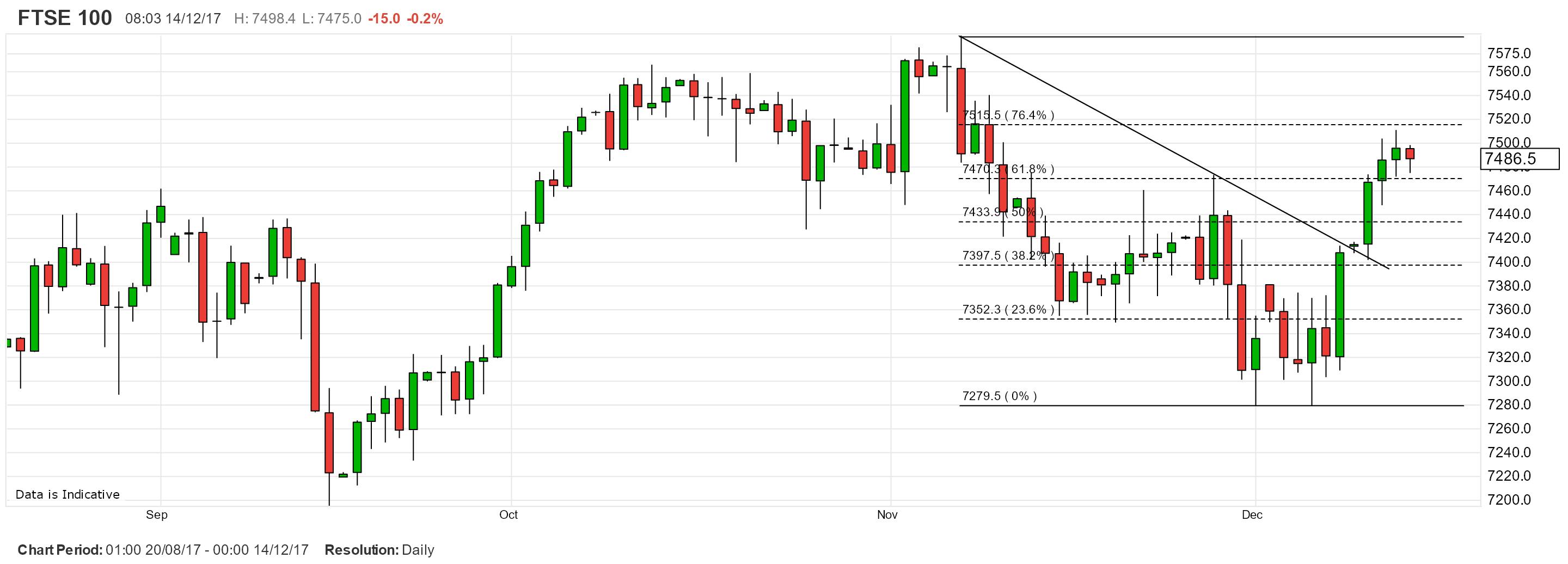

FTSE 100

Suddenly stopped in a sort of no-man’s land.

SHORT TERM TRADER: Square.

POSITION TAKER: Square.

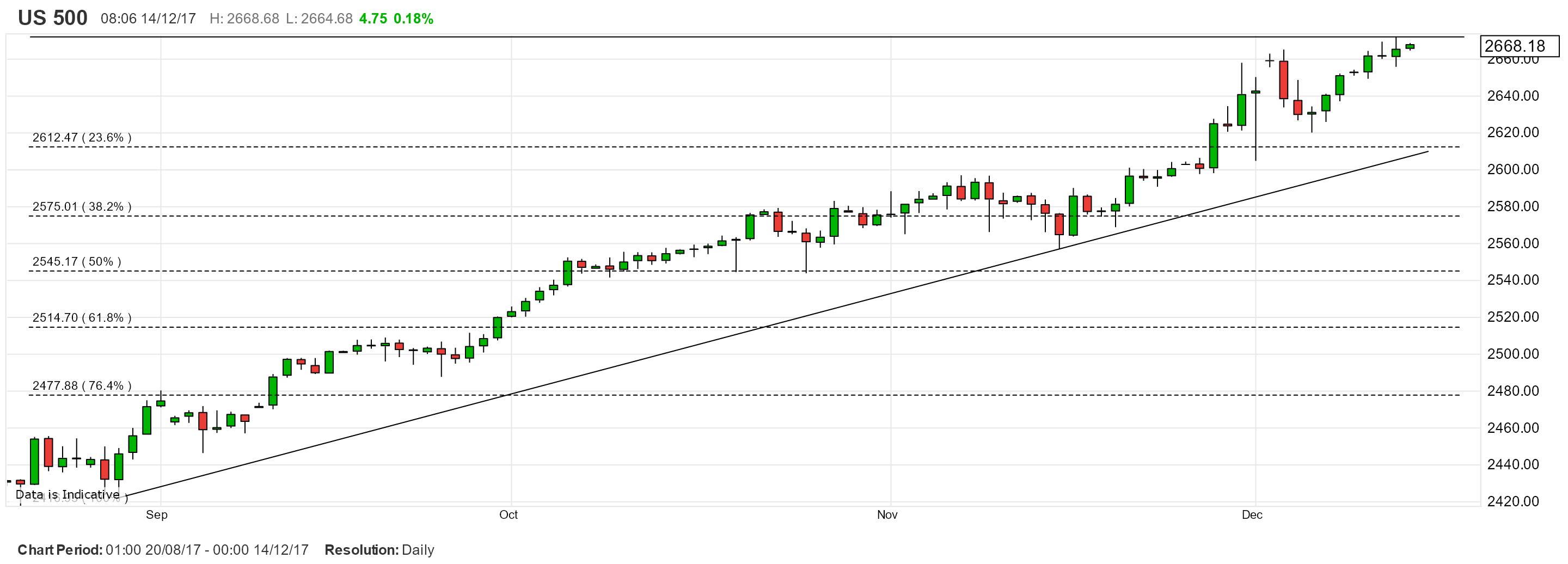

S&P 500

Still hovering at the record high.

SHORT TERM TRADER: Square.

POSITION TAKER: Square.

BRITISH POUND/US DOLLAR

Looking a little more interesting as prices bounce from the 50 per cent retracement support level and the top of what had been triangle consolidation. Would normally opt to go long but wary of comments from the Bank of England following their MPC meeting today.

SHORT TERM TRADER: Square.

POSITION TAKER: Square.

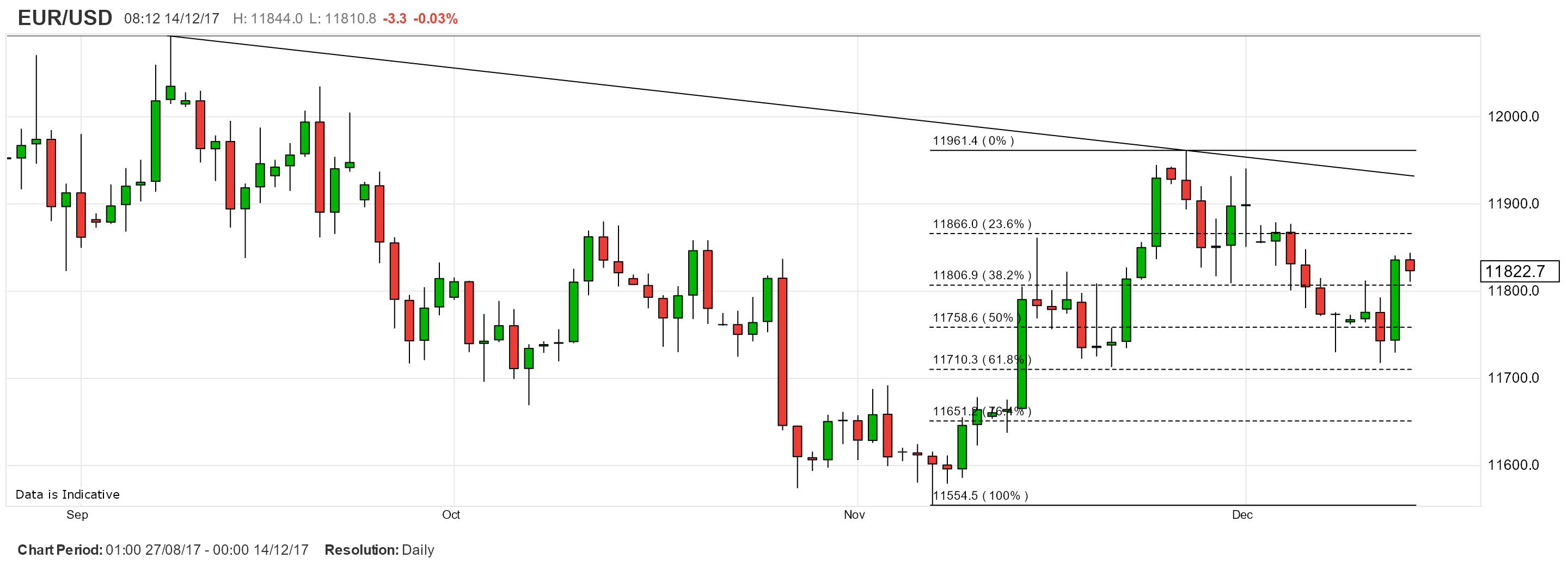

EURO/US DOLLAR

A proper bounce from 61 per cent Fibonacci retracement support to form a bullish engulfing candle yesterday.

SHORT TERM TRADER: New long at 1.1825; stop below 1.1700. Target 1.1940.

POSITION TAKER: Square.

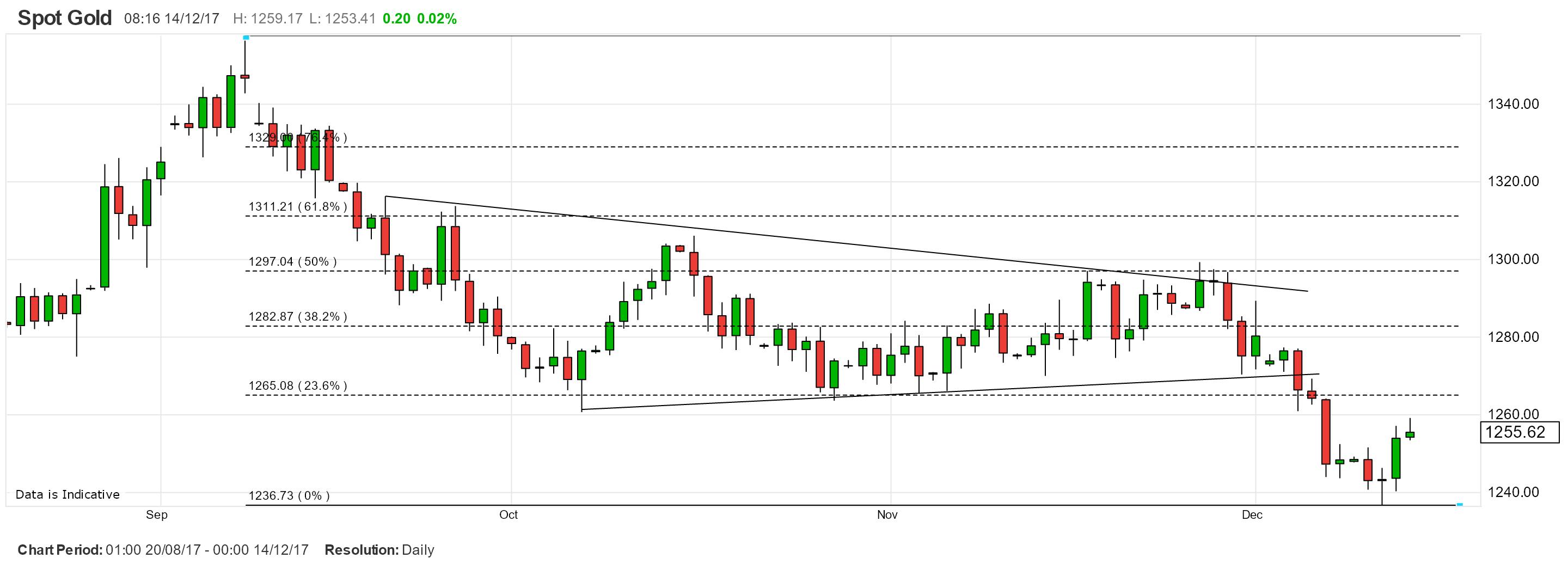

GOLD

A funny little bounce following Tuesday’s unconvincing dip below 1240 and a doji candle. Let’s see where this will fizzle out – hopefully around the 1265 area.

SHORT TERM TRADER: Square.

POSITION TAKER: Short at 1249; stop above 1270. First target 1215, and 1200.

Nicole Elliott is a long-standing Member of the Society of Technical Analysts and has taken over the IC’s trading coverage. She is regularly interviewed and quoted by the financial media, is a conference speaker, and author of several books on charting.