Last week ‘my’ M&S (as it bills itself) decided to withdraw its heavily packaged ‘cauliflower steak’ having been ridiculed by shoppers. The ‘steak’ was a horizontal slice of the vegetable, sold with an accompanying sachet of lemon and herb drizzle. Part of its new vegetarian range of convenience food, it cost twice as much as a loose, medium-sized head.

Admitting that they ‘’didn’t get it right’’, they are however on to something as many are questioning the food industry generally and animal husbandry in particular. My vegan niece has made me look carefully at the ingredients in products and she was delighted by last Christmas’s roasted whole cauliflower with a spicy tomato and basil coulis that I dreamt up because she could carve it at the table.

The western world’s nascent trend towards vegetarian and vegan diets is, however, balanced by emerging markets countries’ increased wealth and taste for meat; let’s not mention fast food and obesity, either. With this in mind, this week I’m looking at the outlook for wholesale meat and animal feed prices. The Chicago Mercantile Exchange is the premier derivatives market for cattle, pigs and soy beans; ICE Canada dominates canola futures, known in Britain as rapeseed.

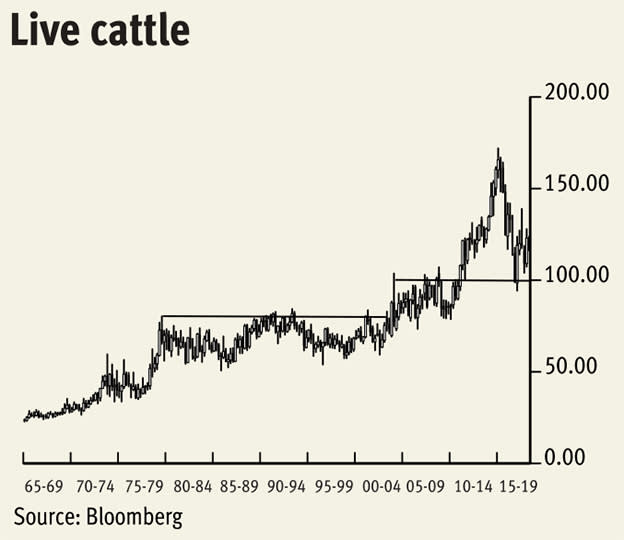

Live cattle futures have repriced to a new equilibrium, above the highs of 2003-2010 and well above those of the 1980s and 1990s. I think that the very broad range established early 2016 will continue, prices fluctuating randomly between $1.04 and $1.36 per pound. The risk, however, and is one we cannot rule out, is for another pop at the record high at $1.71 set in 2014.

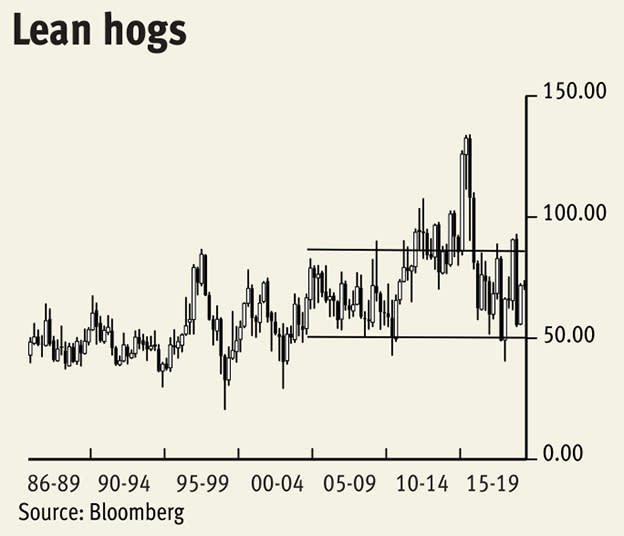

The US Department of Agriculture reports that the country’s overall inventory is at a record 73.23m pigs. The reason, say analysts Len Steiner and Associates, is because of "low feed costs, and the ability to lock in a healthy profit via the futures board, plus an increase in processing capacity". The charts would support this view with prices expected to hold between 50¢ and 85¢ per pound throughout 2018.

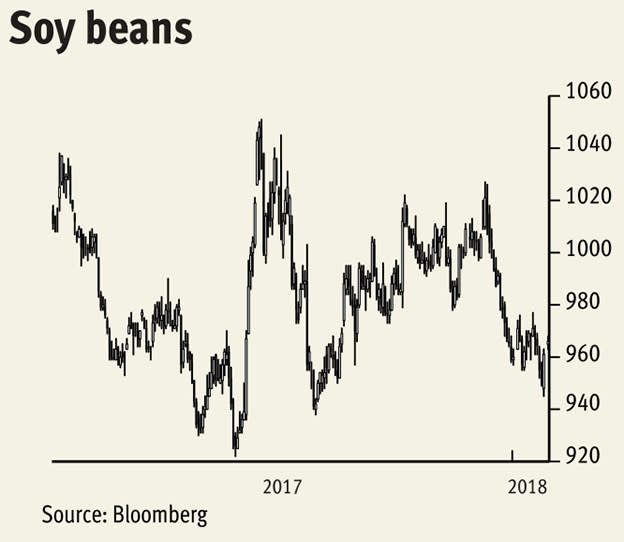

Soy bean prices are currently trading close to their lowest levels in a decade, well under the record 1,794¢ per bushel they reached in 2012 and the 1,663¢ in the commodities boom of 2008 when every banker worth his salt felt the need to buy these. Volume and open interest have increased steadily and considerably over the last 20 years, backing up the comments about feed and the recurring need for hedging. We expect prices to hold between 850¢ and 1,200¢ per bushel.

Canola on Canada’s Intercontinental Exchange Inc, which has a contract code of RS and March 2018 being the most active month, has seen some sizeable swings over the last decade, far greater than the 20 years before that; this is expected to continue as its edible and industrial uses hold sway. Part of the Brassica family, the oil is a biodiesel and, because it’s low in saturated fat with a high boiling temperature, is used increasingly for cooking. It is the most profitable oilseed crop for Canadian farmers, says the canola council of Canada. The meal left after crushing for oil is high in protein and very much in demand by cattle, poultry, swine and fish farmers – and likely to remain so.