Acadata reported last night that London house prices fell 2.6 per cent to an eye-watering average of £593,396 in the year to January, the fastest pace since August 2009. The biggest annual drop of 14.9 per cent was in the borough of Wansdworth, followed by Southwark at 12.2 per cent and Islington’s 8.8 per cent fall. Swedish house prices have fallen by 10 per cent since peaking last summer, yet demand from immigration means the ruling Social Democrats have increased construction as a key policy directive.

City AM reports that Claudio Borio, head of the monetary and economic department at the Bank for International Settlements said recently that markets and the economy are ‘sailing in uncharted waters’ and that it was ‘unrealistic to expect no further market ructions’. Despite strong fundamentals he urged central bankers to tread a ‘narrow path’ in taking interest rates up to more normal levels to avoid derailing growth.

DAX 30

Bouncing once again from a dip below horizontal support at 12000 and momentum becoming a lot less bearish. Perhaps we can once again ‘look forward’ to months of sideways trading between here and 128000 as we saw in Q2 and Q3 2017.

SHORT TERM TRADER: Stopped out of my short position this morning for a small profit.

POSITION TAKER: Also stopped out of my short position.

FTSE 100

Messy little chart as we fumble around the bottom of the range of the last year. Note that momentum remains decidedly bearish.

SHORT TERM TRADER: Stopped out of my short position this morning at a negligible loss.

POSITION TAKER: Short at 7250; stop above 7325. Target the 6675 area.

S&P 500

Redrawing slightly 2016’s trend line to capture the bodies of recent weekly candles, noting that the index is currently not overbought. Keeping a close eye on the US dollar.

SHORT TERM TRADER: Stopped out of my short on Friday’s rally for a small loss.

POSITION TAKER: Square.

BRITISH POUND/US DOLLAR

Neat consolidation in a right-angled triangle belies the latest Brexit apocalypse warnings from management consultants Oliver Wyman and lawyers Clifford Chance suggesting leaving the EU will cost all countries a total £58 billion. A poster campaign urging the British to ‘leave post-Brexit fears behind’, to ‘vote with their feet’ and move to France was banned by London Transport because it could be controversial.

SHORT TERM TRADER: Small long at 1.3835; stop below 1.3700. Target 1.4100.

POSITION TAKER: Small long at 1.3775; stop below 1.3700. Target 1.4250.

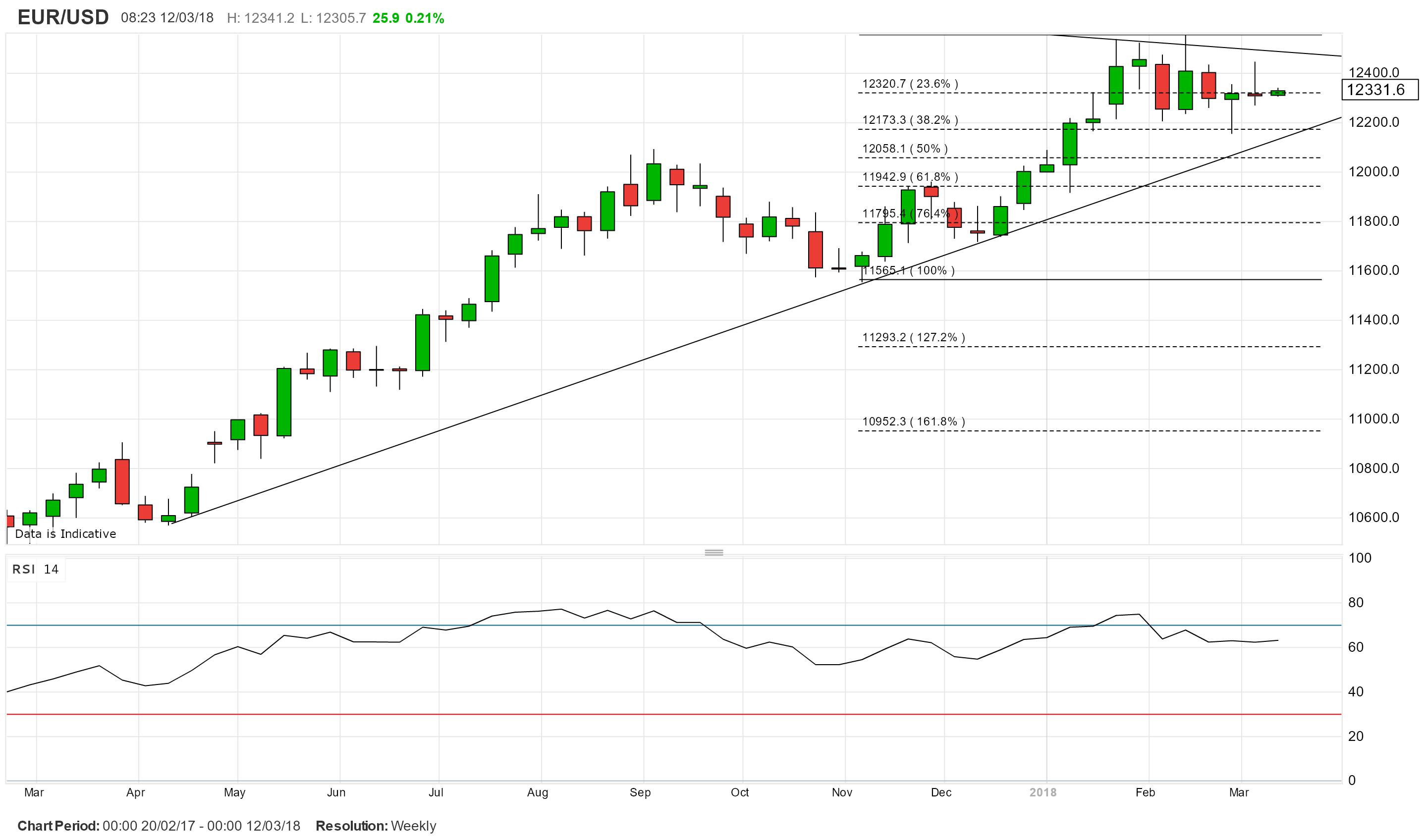

EURO/US DOLLAR

Very much in wait-and-see mode at the highest levels in quite a while. Slightly worrying little dragonfly doji last week yet the euro is no longer overbought.

SHORT TERM TRADER: Small long at 1.2267; stop below 1.2250. Target 1.2500.

POSITION TAKER: Small long at 1.2270; stop below 1.2200. Target 1.2500.

GOLD

Hovering slightly unsteadily at the top edge of the massive triangle that has dominated for almost 2 years.

SHORT TERM TRADER: Will sell on a close clearly below the trend line tonight.

POSITION TAKER: Square.

Nicole Elliott is a long-standing Member of the Society of Technical Analysts and has taken over the IC’s trading coverage. She is regularly interviewed and quoted by the financial media, is a conference speaker, and author of several books on charting.