The UK regulator, the Financial Services Authority, fined Indian state-owned bank Canara £896,000 for failing to comply with anti-money laundering rules in its London office. Between 26 November 2012 and 29 January 2016 their systems were inadequate despite the FCA flagging issues to it, reports City AM. What is more unusual is that for the next 5 months it cannot accept deposits from new customers. Because the bank agreed to resolve the case they got off lightly, with a 30 per cent discount on the fine.

The Trader will be enjoying a long weekend so there will be no daily market outlook Friday 8th June. Normal service resumes Monday 11th June.

DAX 30

An inside day yesterday after the nasty little dragonfly doji/shooting star candle; also known as a pregnant pause.

SHORT TERM TRADER: Tiny short at 13145; stop above 13050. Target 12400.

POSITION TAKER: Short at 12935; stop above 13050. Target 12000.

FTSE 100

Yesterday’s price action is an irrelevance.

SHORT TERM TRADER: Tiny short at 7855; stop well above 7800. Target 7400.

POSITION TAKER: Small short at 7799; stop well above 7900. First target 7400.

S&P 500

Squeezing back up to what had been trend line support and what should now act as a resistance level. The commodity channel index has yet to turn down.

SHORT TERM TRADER: Square.

POSITION TAKER: Stopped out of short with a small loss.

BRITISH POUND/US DOLLAR

The gentle saucer-shaped base, or rounded bottom, is mapping out as expected with yesterday’s close (only just) above 1.3400 turning momentum bullish. Now it needs a close above first Fibonacci resistance at 1.3485 to complete. More generally, keep a wary eye on currencies because each one’s marching to its own beat.

SHORT TERM TRADER: Tiny long at 1.3275; stop below 1.3300. Target 1.3800.

POSITION TAKER: Small long on at 1.3350; stop below 1.3200. Target 1.4200.

EURO/US DOLLAR

A potential V-shaped base (which complete on a daily close above 1.1800) has given the euro more of a spring in its step than cable’s saucer, and again momentum has turned bullish. This despite Italy’s bond market where the problem of one of the world’s most indebted nations most certainly have not gone away.

SHORT TERM TRADER: Small long at 1.1685; stop below 1.1615. Target 1.2000.

POSITION TAKER: Long at 1.1660; stop below 1.1600. Target 1.2400.

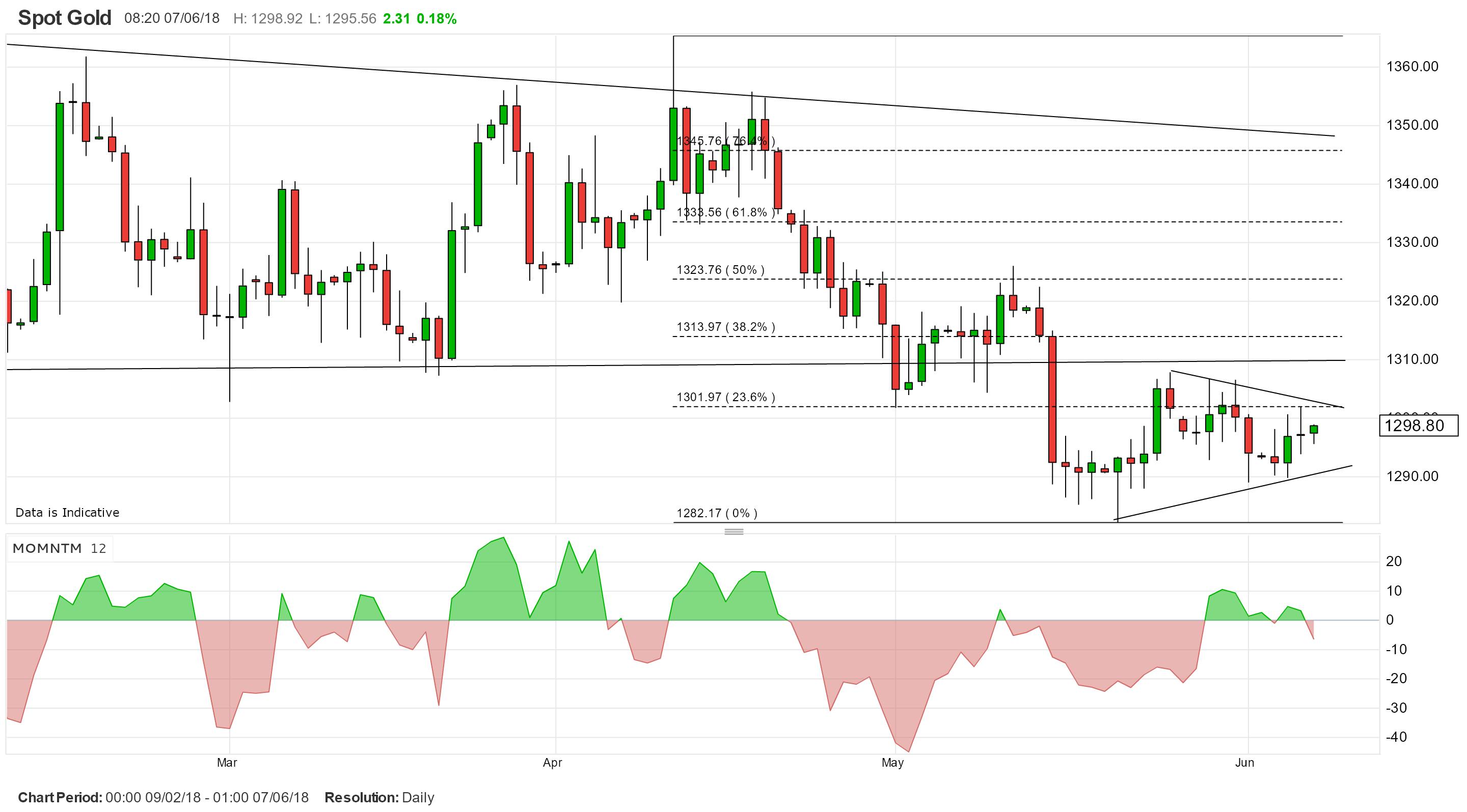

GOLD

Absolutely no momentum here.

SHORT TERM TRADER: Tiny short at 1294; stop above 1310. Target 1265.

POSITION TAKER: Square.

Nicole Elliott is a long-standing Member of the Society of Technical Analysts and has taken over the IC’s trading coverage. She is regularly interviewed and quoted by the financial media, is a conference speaker, and author of several books on charting.