This morning City AM reports that the international director of the Financial Conduct Authority, Nausicaa Delfas, has said that about 1300 EU firms wanted to sign up in order to use the FCA’s temporary permission regime. This would allow them to do business in the UK under current terms, without impediment, for the next three years. City minister John Glen indicated he was ‘extremely confident’ that the two sides wold reach an ‘imminent deal’.

Also from City AM, the European Central Bank has closed Malta’s Pilatus Bank because of accusations of corruption, said the country’s financial watchdog. The processing of suspect payments was uncovered by murdered journalist Daphne Caruana Galizia, with the EU starting investigations only after her death in October 2017. The withdrawal of their banking licence is allegedly linked to money laundering on behalf of Azeri and Maltese nationals and rumours of Venezuelan public companies.

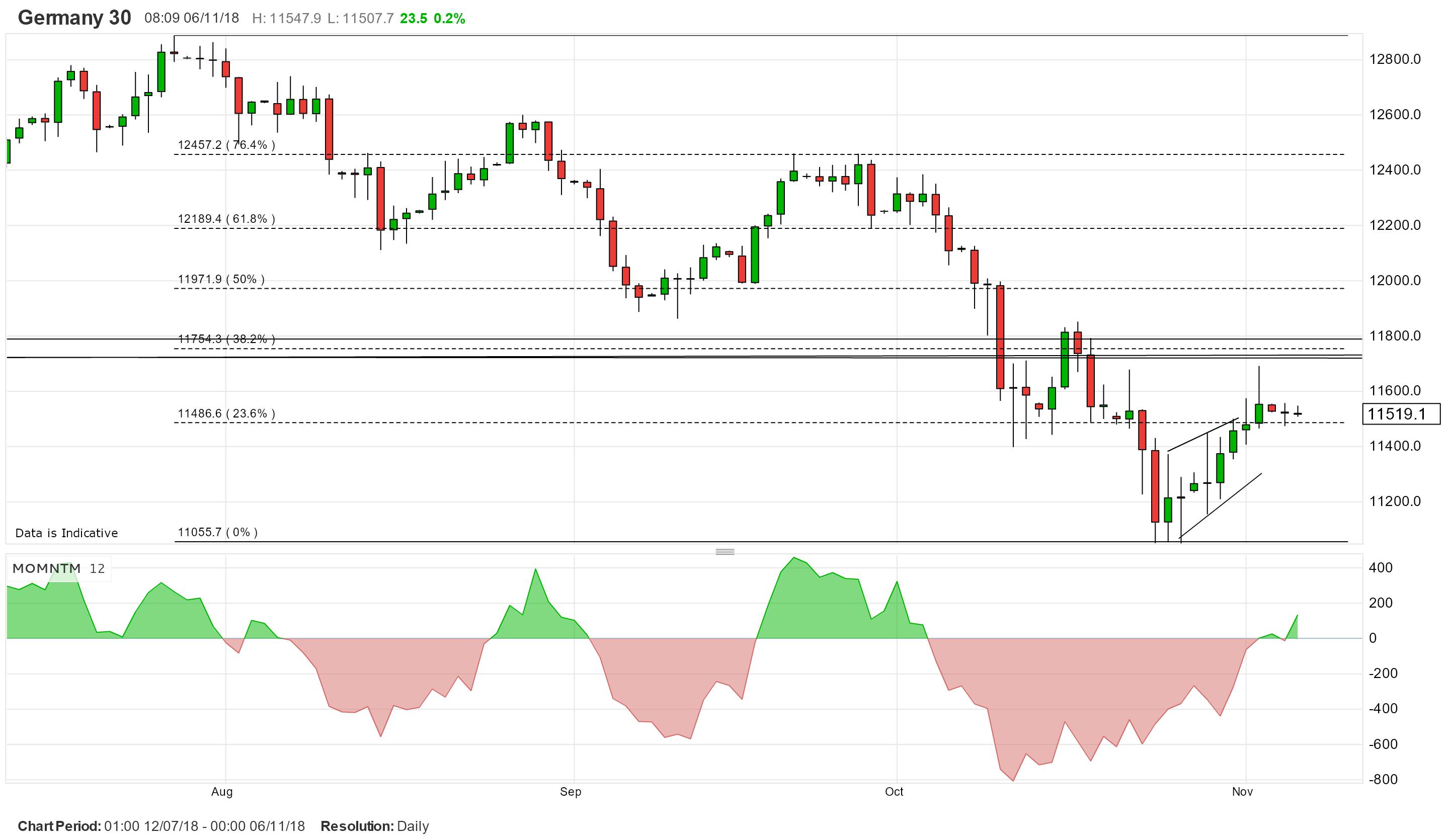

DAX 30

Zero price action and zero momentum yesterday as we hold below an important cluster of what is now resistance levels around 11755. Rumour has it that in an attempt to shore up a rather shaky German banking industry ailing NordLB (fourth weakest in stress tests) will be tacked onto Landesbank Hessen-Thüringen, just as Commerzbank and Deutsche Bank might merge. Slap two ailing banks together and what do you get?

SHORT TERM TRADER: Short at 11200; stop above 11755. Target 10400.

POSITION TAKER: Short; stop above 11700. Next target at 10700.

FTSE 100

A miniature version of Friday’s shooting star candle yesterday as the commodity channel index looks set to turn down.

SHORT TERM TRADER: Short at 7080; stop above 7200. First target 6865.

POSITION TAKER: New short at 7095; stop well above 7200. First target 6900.

S&P 500

Waiting for today’s US election results with ex-President Obama doing all the campaigning for the Democrats whose big guns are apparently unappealing nationally.

SHORT TERM TRADER: Short at an average at 2740; stop well above 2780. Target 2600.

POSITION TAKER: Square.

BRITISH POUND/US DOLLAR

Pushing up into the upper half of the range since August.

SHORT TERM TRADER: Took profit just ahead of target at 1.3100 and will sit and see what ‘Treason’ May has to say to her cabinet on Brexit today.

POSITION TAKER: Square.

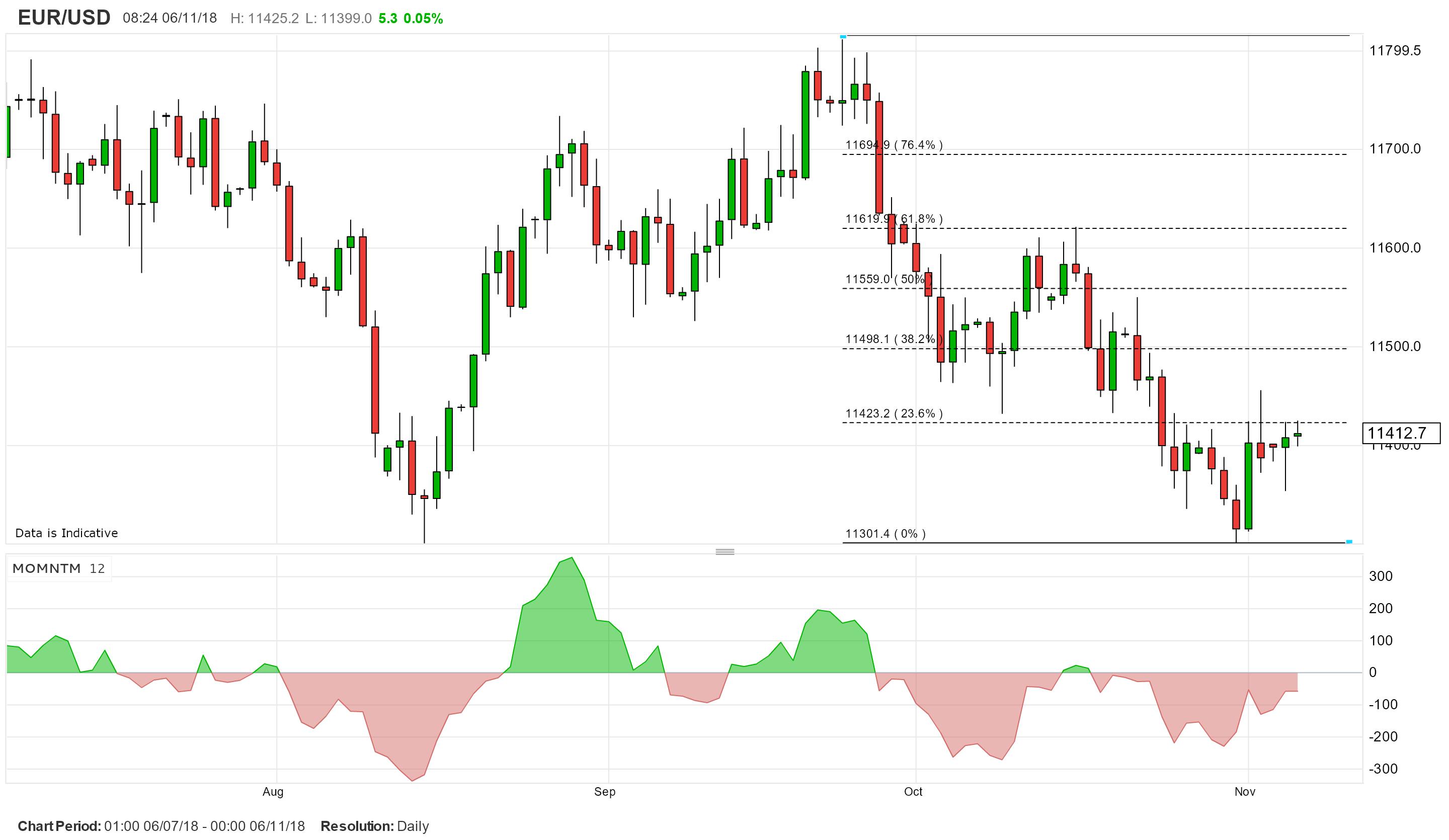

EURO/US DOLLAR

Slightly unconvincing but yesterday’s hammer candle has cut bearish momentum further.

SHORT TERM TRADER: Small long at 1.1440; stop below 1.1300. Target 1.1700.

POSITION TAKER: New small long 1.1415; stop below 1.1300. Target 1.1600.

GOLD

Bullish momentum negligible despite trading at the higher levels since this summer. It is said the President Nicholas Maduro of Venezuela is trying to repatriate gold bars held at the Bank of England because he’s worried these might get caught up in the US’s new international sanctions.

SHORT TERM TRADER: Tiny short at 1227; stop above 1240. Target 1190.

POSITION TAKER: Square.