Last Friday the European Banking Authority (EBA) announced the results of the impact a severe adverse scenario might have on the common equity tier one (CET1) ratio at the 48 most important banks in the region. The exercise started on 31 January 2018 using data from balance sheets at the end of 2017, so it does not take into account this year’s developments, such as the loss in value of Italian sovereign debt; the authorities’ blatant lack of urgency and expediency evident.

Their summary of results noted that capital ratios remain high at an average of 14.5 per cent and that the quality of their loan portfolios continues to improve, with non-performing loan ratios dipping to 3.6 per cent. Although the return on equity rose to 7.2 per cent from 6.8 per cent, profitability remains a concern for the whole sector. An increase in deposits saw the loan to deposit ratio drop to 116.2 per cent, with the liquidity coverage increasing very marginally to 148.2 per cent.

All fine and dandy, maybe, but the trouble is that there is no pass or fail cut-off point – hence this year’s success. What did come as a surprise to some in Britain was that Barclays plc saw its CET1 halve (by 6.6 per cent), putting it at the lowest of all participants at 6.37 per cent – even lower than Italy’s Banco BPM (6.67 per cent). Next, they’ll be blaming it on Brexit.

As an ex-banker, I understand these ratios. Considering the tattered reputation of the Financial Reporting Council and the auditing industry at large, I’m not sure I trust any of the figures supplied. Clever accounting can be creative indeed when reputations and solvency are at stake.

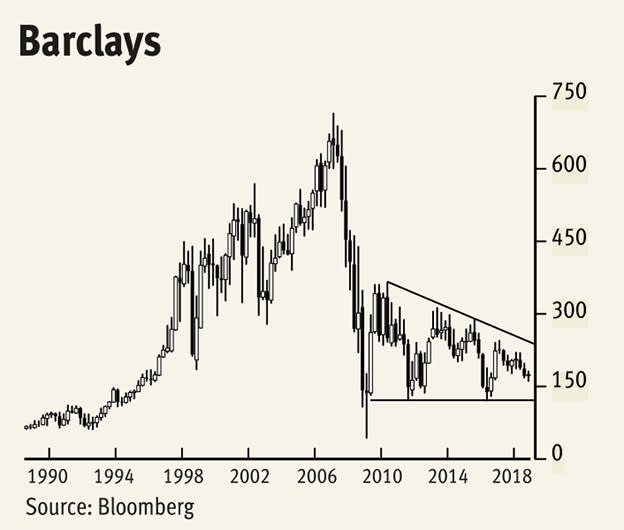

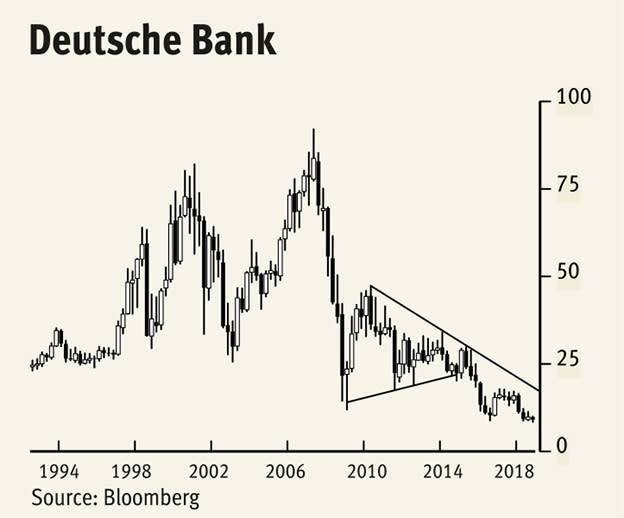

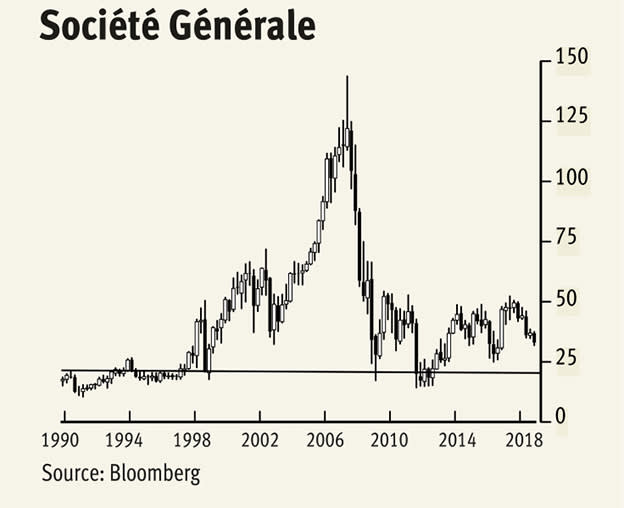

So, I turn to my share price charts to see whether they back up this latest report. I have deliberately not picked on the weakest – and I’m not convinced that Barclays should be placed at the bottom of the heap – nor the ones with the worst names.

Barclays is a shadow of its former self, a series of lower interim highs since 2009’s rally. It is just a matter of time before we retest the psychological 100p and, third time unlucky, probably drop towards 50p.

Deutsche Bank is clearly an ex-banking giant trading at one-tenth of peak. It’s one step ahead of its British counterpart, both dragged down by investment banking arms, and has broken below triangle consolidation since 2009. Descending highs suggest it will fall some more.

Spain’s Banco Sabadell has also consolidated in a triangle since 2010, a right-angled one, while holding below 2009’s low most of the time since. Testing penny-share status at just one euro, the chances of it being chucked into the bargain bucket on Black Friday’s shopping sales is a distinct possibility.

France’s Societe Generale, the EBA’s seventh weakest, has been trapped between 20 and 50 euros since 2009, a tiny fraction of its especially dramatic peak in 2007. Sadly, it too looks set to drift back down to the lower edge of this band – and a level at which our chart starts in 1990. With President Macron’s poll ratings dropping below those of Marine Le Pen this week (ahead of European Parliament elections) 71 per cent of the French electorate say they have no confidence in him. Let’s see if his grand Armistice Day celebrations in Paris help.