Yesterday was Singles Day in China, a celebration dreamt up 10 years ago by internet giant Alibaba, always falling on the 11th November (because of all the ones of that date) and an antidote to Valentine’s Day. This compares to the latest Amazon Prime’s $4 billion and is bigger than all Black Fridays and Cyber Mondays put together, and the $7.8 million in its first year. China Internet Network Information claims there are 802 million internet users in the country.

Reuters reports that yesterday’s Corriere della Sera claimed that Italy’s retail deposit insurance bank scheme, FITD, is considering injecting between €220 million and €370 million into Genoa-based Banca Carige, the troubled lender which has struggled with credit rating downgrades for years. All Italian lenders voluntarily contribute to the FITD scheme to avoid breaching EU state aid rules. The bank is due to report Q3 2018 results today. Classed as ‘fragile’ in the latest stress test, the ECB gave it until the end of this calendar year to plug its capital gap.

DAX 30

A tiny little doji last week denoting instability at current levels – just under the neckline of a massive head and shoulders top. Reuters reports today that Q3 2018 European earnings have disappointed and are the weakest since Q4 2015.

SHORT TERM TRADER: Short at 11200; stop above 11700. Target 10400.

POSITION TAKER: Short; stop above 11755. Next target at 10700.

FTSE 100

Weekly momentum clearly bearish as we consolidate towards the bottom end of the massive potential broadening top that’s been building for almost 2 years.

SHORT TERM TRADER: Short at 7080; stop above 7200. First target 6865.

POSITION TAKER: Short at 7095; stop well above 7200. First target 6900.

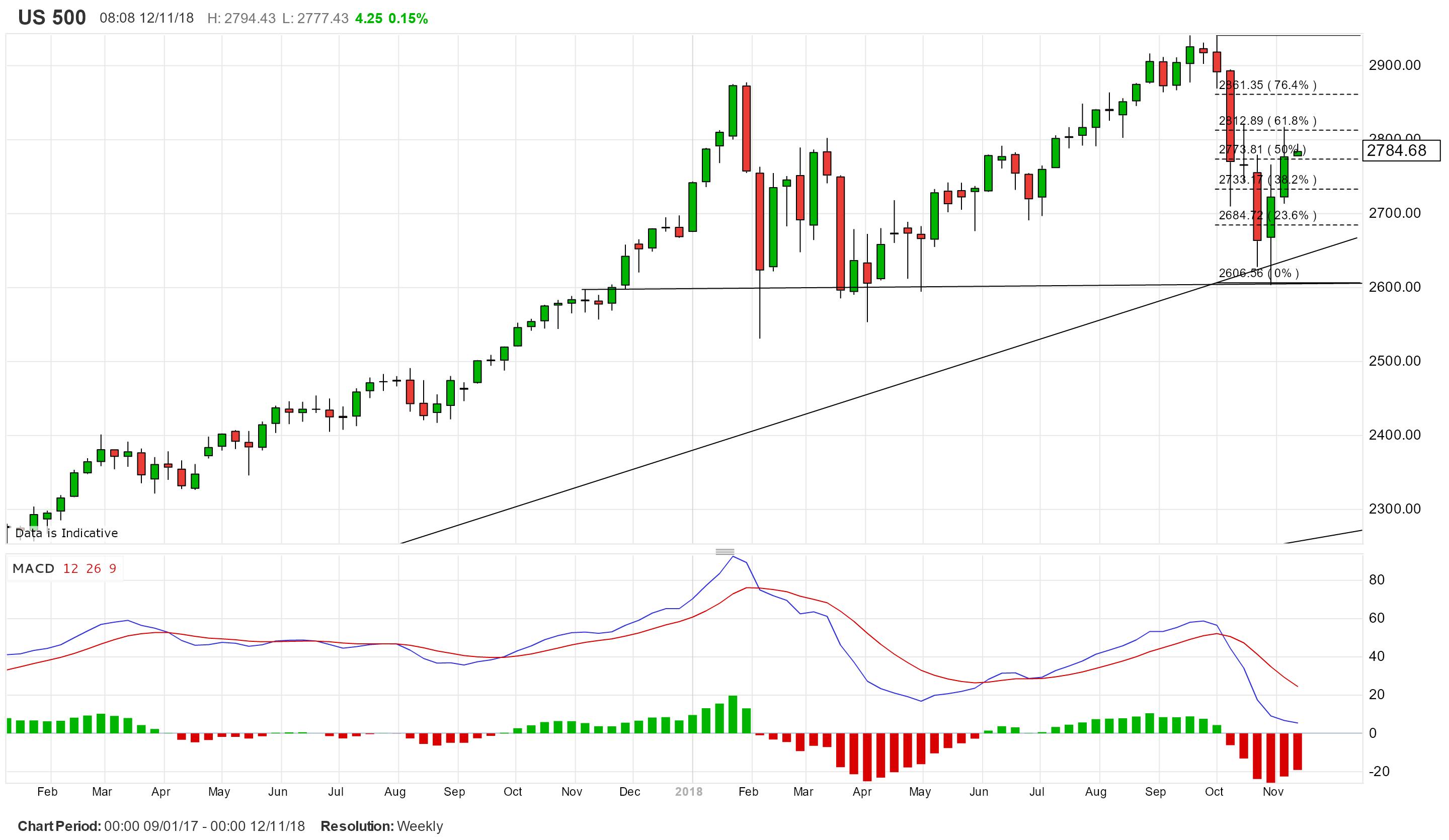

S&P 500

Another small spike high against the Fibonacci 61 per cent retracement resistance with the weekly MACD clearly bearish. Four thousand firefighters are currently trying to put out fires in Northern California as the death toll rises and hundreds of homes burn down; suggestions this is the worst ever in the state’s history.

SHORT TERM TRADER: Small short at 2798; stop above 2865. Target 2630.

POSITION TAKER: Square.

BRITISH POUND/US DOLLAR

Gapping lower this morning as Brexit rumours overshadow any feel good feelings generated by Remembrance Day celebrations yesterday.

SHORT TERM TRADER: Square.

POSITION TAKER: Square.

EURO/US DOLLAR

Almost oversold as the euro slips to this year’s weakest level with a handle to the price we haven’t seen in many moons.

SHORT TERM TRADER: Stopped out suddenly.

POSITION TAKER: Stopped out here too.

GOLD

Bullish momentum gone in a puff with a bearish engulfing candle last week following the previous week’s hanging man candle against 50 per cent retracement resistance.

SHORT TERM TRADER: Tiny short at 1227; stop above 1230. Target 1190.

POSITION TAKER: Square.