Yesterday General Motors CEO Mary Barra announced that the (once upon a time) car giant will close 5 factories in North America, mainly in the so-called rust belt. It will lay off 8,000 employees in an attempt to save $6 billion per year; this is roughly 15 per cent of its total workforce with management suffering the biggest cuts. The firm was bailed out by the US taxpayer in 2009 and forced to cut 47,000 jobs globally.

Today Japanese newspaper Asahi Shimbun reports that jailed former chairman of Nissan, Carlos Ghosn, shifted trading losses in the 2008 financial crisis from his personal account to the car maker, thus avoiding millions of dollars of losses. The swap was discovered by Japan’s Securities and Exchange Commission during a routine inspection.

DAX 30

The little blip above 11400 this morning was a false break which looks set to be capped by the trend line since 2012, which should now act as resistance. Note that yesterday President Trump declared that Theresa May’s deal signed Sunday, ‘’sounds like a great deal for the EU’’.

SHORT TERM TRADER: Short at 11200; stop above 11425. Target 10400.

POSITION TAKER: Short; stop above 11600. Next target at 10700.

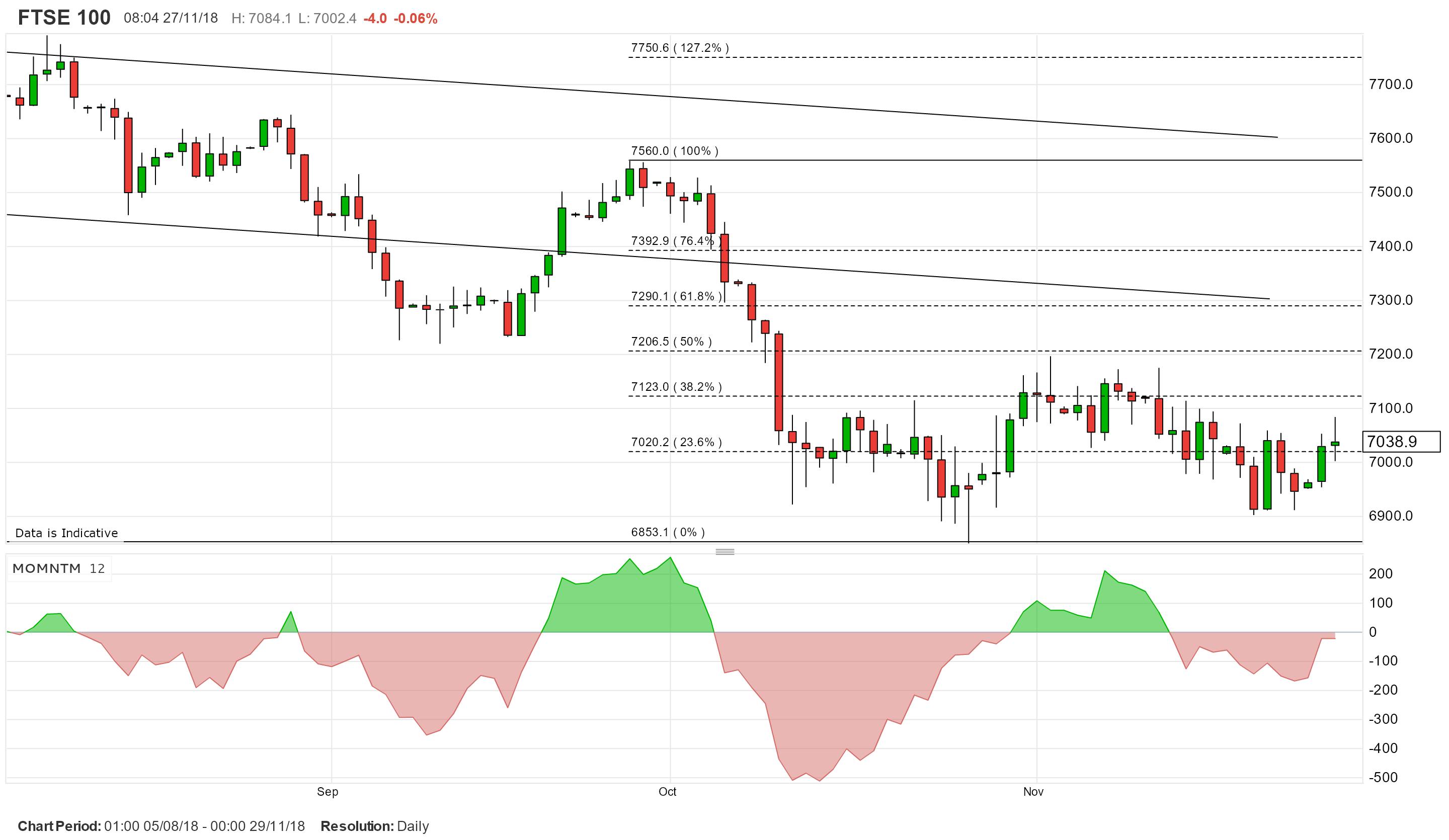

FTSE 100

Momentum’s still bearish despite price action going nowhere for the best part of two months.

SHORT TERM TRADER: Short at 7080; stop above 7120. First target 6865.

POSITION TAKER: Square.

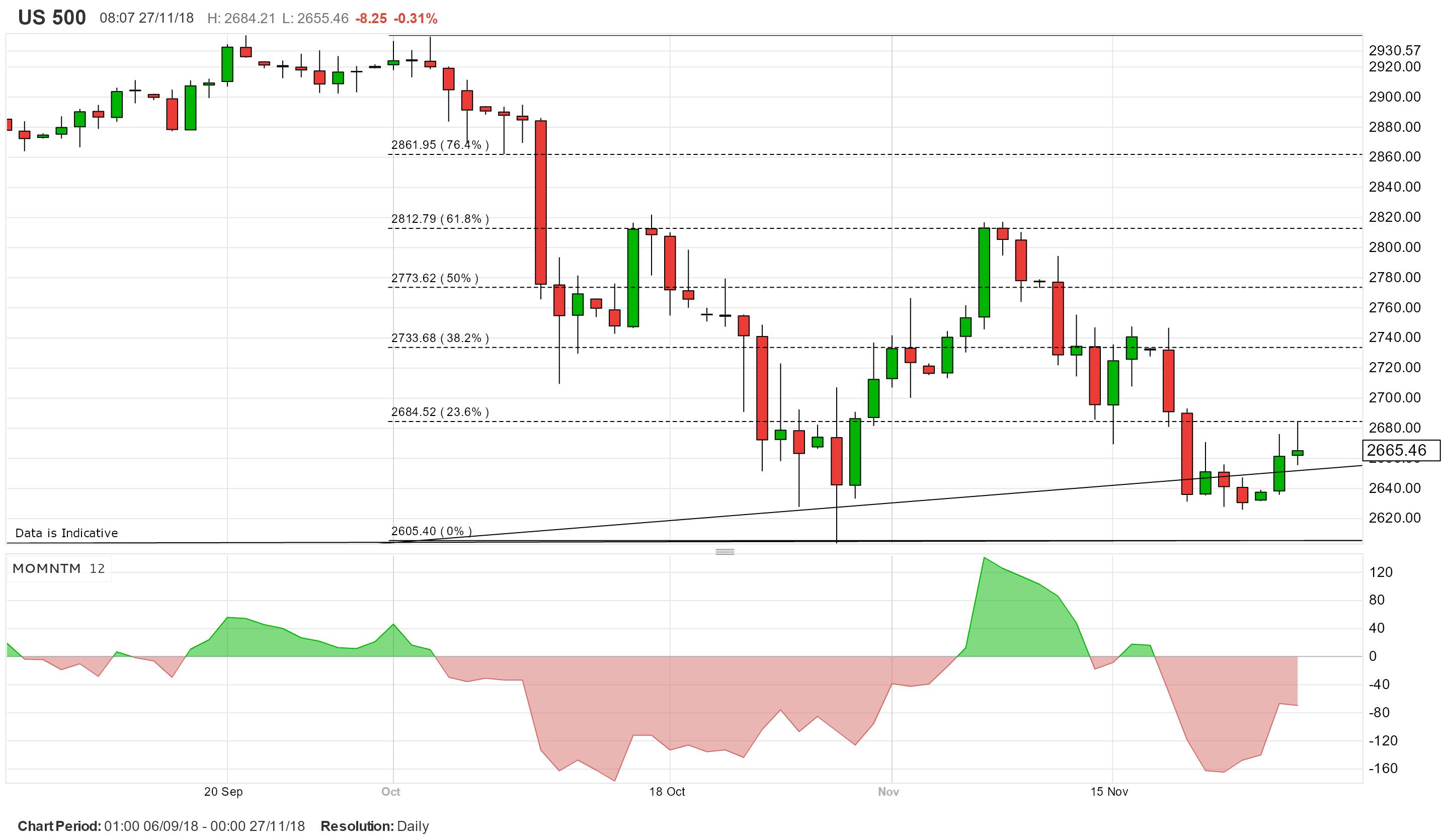

S&P 500

Hovering just above secular trend line support though momentum remains bearish.

SHORT TERM TRADER: Square.

POSITION TAKER: Short at 2630; stop above 2745. Target 2535.

BRITISH POUND/US DOLLAR

Approaching this year’s lows so we’re keeping an eye on the commodity channel index to see if the area will hold. Note that some in the US are beginning to fret about the strength of the US dollar.

SHORT TERM TRADER: Square.

POSITION TAKER: Square.

EURO/US DOLLAR

Drifting towards this year’s low.

SHORT TERM TRADER: Small long at 1.1345; stop below 1.1300. Target 1.1500.

POSITION TAKER: Long at 1.1420; stop below 1.1300. Target 1.1700.

GOLD

Possibly forming another gentle rounded top against 1230.

SHORT TERM TRADER: New tiny short at 1220; stop above 1230. Target 1200.

POSITION TAKER: Square.