Data out yesterday morning show that another 141,000-people found work in the 3 months to November. This takes those in work to another new recent record high at 32.53 million, 75.8 per cent of those of working age, and those claiming unemployment benefit down to 4 per cent. Salaries grew by 3.4 per cent annualised and if one were to include bonuses the increase would be 3.3 per cent – highest since November 2008. The rates are in stark contrast to the Eurozone where only Germany comes close, and the Eurozone block remains stubbornly in double digits.

Fresh from Monday’s visit to Mrs May in Downing Street, New Zealand PM Jacinda Arden wrote yesterday in the Financial Times outlining her views on why current social and economic unfairness should not lead to ‘isolationism and the abandonment of global institutions’, proposing a ‘’wellbeing budget’’. Now she’s in Davos waving the flag against climate change, urging her counterparts to think carefully about the role they play in addressing global warming, CNBC reports. Like the carbon footprint getting them all up the Swiss mountainside.

DAX 30

Retreating from the half-way mark since the losses that started in October. Sorely tempted to re-sell but might give the commodity channel index another day or two to tuck itself back under the 100 level.

SHORT TERM TRADER: Square.

POSITION TAKER: Square.

FTSE 100

Momentum turned bearish yesterday with its harami candle – an inside one to Friday’s denoting instability. This adds weight to our view that we’re in the process of forming a new interim high.

SHORT TERM TRADER: Short at 6905; stop above 7045. First target 6600.

POSITION TAKER: Short at 6895; stop above 7045. First target 6600.

S&P 500

Very quiet as we retreat marginally from just under a Fibonacci 61 per cent retracement of Q4’s sharp losses. Data out yesterday afternoon showed that the number of existing homes sold in December dropped from an annualised rate of 5.33 million to 4.99 million, down from a peak of nearly 6 million in December 2017.

SHORT TERM TRADER: Square.

POSITION TAKER: Square.

BRITISH POUND/US DOLLAR

Sterling’s strengthened to 87.5 pence per euro, it’s best this year and close to December’s low at 87 pence. Merely small reactions to all the Brexit hot air and political manoeuvring.

SHORT TERM TRADER: Tiny long at 1.2870; stop below 1.2800. Target 1.3200.

POSITION TAKER: Long at 1.2860; stop below 1.2800. Target 1.3250.

EURO/US DOLLAR

Still clinging pointlessly to the down trend line.

SHORT TERM TRADER: Long at 1.1510; stop below 1.1345. Target 1.1750.

POSITION TAKER: Square.

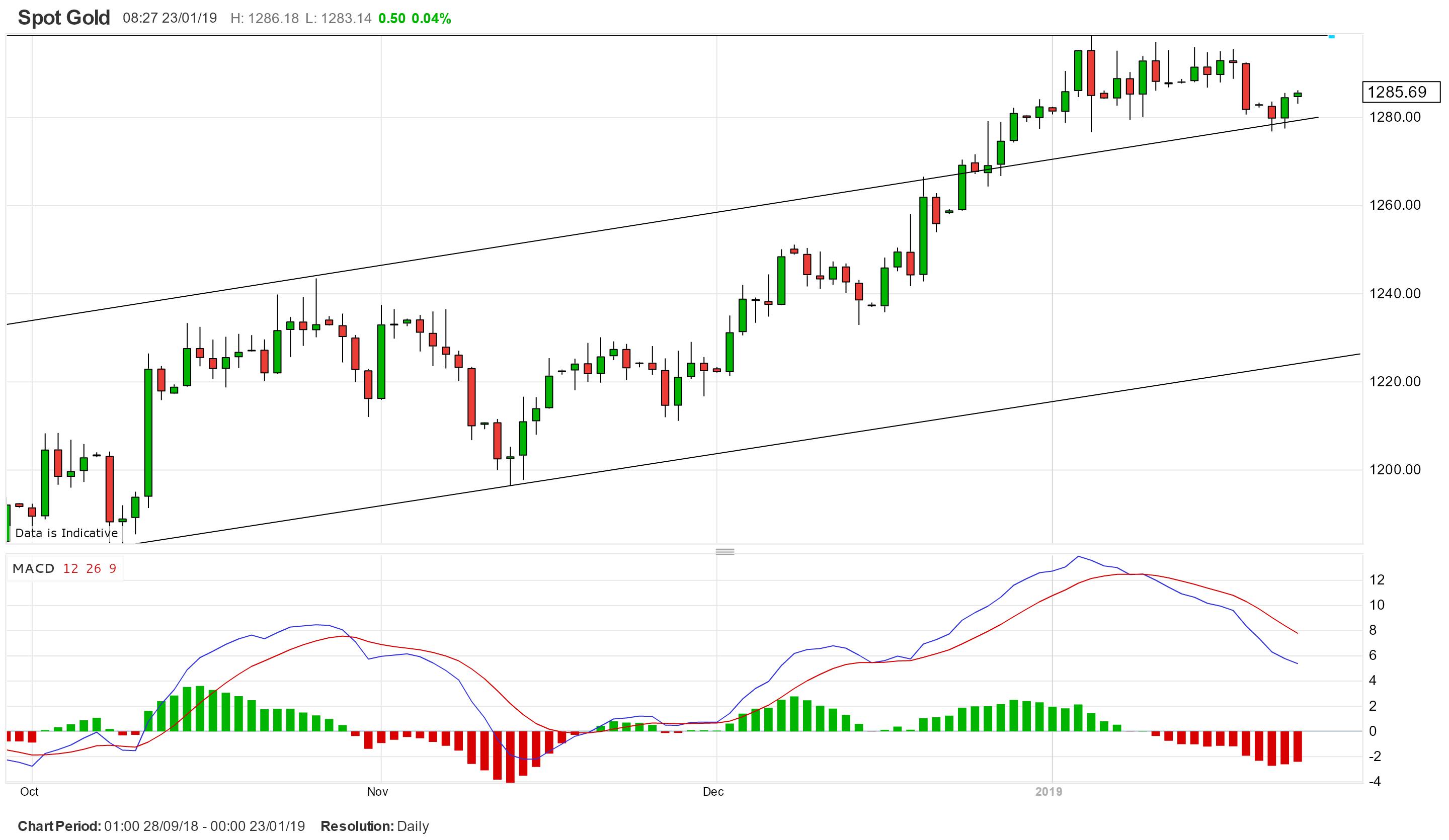

GOLD

Holding above the top of the trend channel that has dominated since August, but the MACD is pointing lower. Divergence.

SHORT TERM TRADER: Short at 1292; stop well above 1300. First target 1240.

POSITION TAKER: Square.