Data out yesterday confirmed what many had feared: Italy saw a second consecutive quarter of negative growth in Q4 2018 (-0.2 versus -0.1 per cent in Q3), something which is unlikely to improve the rosy forecast for this year’s budget deficit presented in Brussels. This is at least the third time we’ve seen a recession since 2008; it is also the Eurozone’s third biggest economy. Economic growth for these countries was +0.2 per cent in Q4 2018, its slowest, and quite frankly a crawl, in 4 years. Italian Prime Minister Giuseppe Conte said he expected further contraction but that ‘’all the elements’’ were in place for a recovery in the second half of 2019. Manaña, jam tomorrow, it’ll be all right on the night-type of thinking that masquerades for economic policy these days.

I know one must take Chinese data with a pinch of salt, but it’s worth noting that this morning the Caixin Manufacturing PMI dropped to 48.3, its second consecutive reading below 50.0 and the weakest in 3 years.

DAX 30

A slightly unstable hanging man type candle yesterday as the commodity channel index turns down further. The media is reporting the Deutsche Bank has been given months to sort its turnaround out or be forced to merge with rival Commerzbank (which is also on a very precarious footing). The so-called ‘deal’ is being brokered by the German government. A bit like Spain did years ago, forcing ‘bad’ banks to merge to create a really big bad bank.

SHORT TERM TRADER: Small short at 11180; stop above 11400. First target 10600.

POSITION TAKER: Might sell on a weak close today.

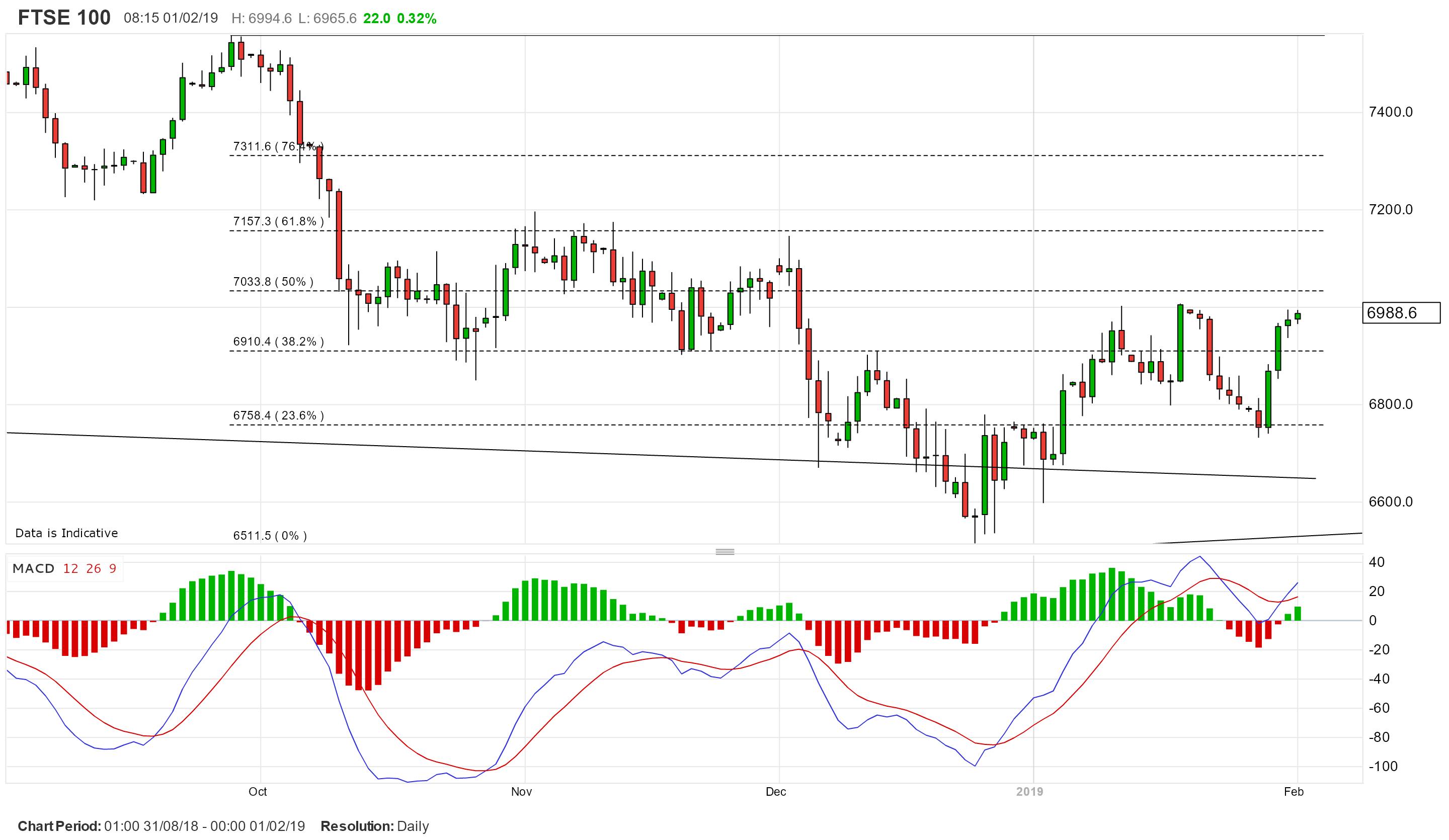

FTSE 100

Its third attempt at the psychological 7000 level.

SHORT TERM TRADER: Short at 6905; stop above 7005. First target 6600.

POSITION TAKER: Short at 6895; stop above 7045. First target 6600, and then probably an awful lot more.

S&P 500

Slightly worried as we eke out the rally from December’s low.

SHORT TERM TRADER: Short at 2666; stop well above 2700. First target 2450.

POSITION TAKER: Square.

BRITISH POUND/US DOLLAR

Consolidating fairly neatly in what might be a triangle at the higher levels of the last 6 months.

SHORT TERM TRADER: Square.

POSITION TAKER: Long at 1.2860; stop below 1.3000. Target 1.3250.

EURO/US DOLLAR

A fairly concerted rejection from the 1.1500 area – and the commodity channel index didn’t get a chance to suggest going short.

SHORT TERM TRADER: Square.

POSITION TAKER: Square.

GOLD

Overbought with a shooting star candle yesterday following a 5-month rally. Not bullish, but not decisive either.

SHORT TERM TRADER: Tempted to re-sell.

POSITION TAKER: Square.