Franchising businesses can deliver exceptional returns to investors. McDonald's (US:MCD) is one of the largest quick-service restaurant franchisors out there and has seen its rate of profitability soar in recent years as it has increased its number of franchised stores. Yet, as we have seen with Domino’s Pizza in the UK, these businesses are only as strong as the health and happiness of its franchisees. Has McDonald’s got the balance between keeping shareholders and franchisees happy right?

The business model

McDonald’s is one of the most established and popular quick-service restaurant brands in the world today. Its iconic golden arches logo is instantly recognisable the world over. The company sells a range of food and drink products such as the Big Mac, Filet o’ Fish, burgers, wraps, salads, desserts, breakfasts (sausage and egg McMuffins), soft drinks and coffee. Most restaurant menus are standardised across the world, with some local variations.

At the end of 2018, the company had 37,855 restaurants in 120 countries – 35,085 of which are franchised. McDonald’s has been steadily reducing its number of company-owned restaurants in favour of franchised ones in recent years. Just under two-thirds of its revenues in 2018 were generated outside the US.

McDonald’s is aiming to have 95 per cent of its restaurants franchised within the next few years.

McDonald's restaurant numbers

Year | Company owned | Franchised | Total | % franchised |

2018 | 2,770 | 35,085 | 37,855 | 92.7% |

2017 | 3,133 | 34,108 | 37,241 | 91.6% |

2016 | 5,669 | 31,230 | 36,899 | 84.6% |

2015 | 6,444 | 30,081 | 36,525 | 82.4% |

2014 | 6,714 | 29,544 | 36,258 | 81.5% |

Source: Company reports

The attraction of franchises is that a large chunk of the capital investment and operating costs are borne by the franchisee. McDonald’s tends to own the freehold land and buildings of its restaurants, while the franchisee pays for equipment, signs, seating and decor. The franchisee also has to commit to reinvest in the franchise over the length of the franchise agreement.

The costs of a franchise vary by geographic location and are not disclosed publicly, but in the US a main franchise can cost the franchisee an average of around $500,000 (£385,576) based on my investigations. The typical franchise length is 20 years. The franchisee pays rent to McDonald’s and a royalty based on a percentage of the restaurant’s sales (estimated at 4-5 per cent) plus an initial fee. The franchisee has some discretion over issues such as marketing and pricing.

Franchised restaurants give McDonald’s a regular and predictable source of cash flow without lots of capital investment. As we shall see shortly, this is also producing stellar levels of profitability and cash generation – a combination that is highly sought after by investors.

McDonald’s also operates some of its own restaurants. This has been done to test new ideas and to train franchisees, and then roll out best practice across the franchised network of stores.

My personal experience of McDonald’s

One of the best ways to learn about a business is to either work for it or be a customer of it. I had not visited a McDonald's restaurant for years until a few months ago, but have made quite a few visits recently with my children on our weekend walks into town.

I have to say, I am impressed. The food quality is good, with an increasing range of healthier options, and the service is quick. The coffee is surprisingly good for £1 per cup. Best of all is the price – the bill works out considerably cheaper than a visit to the local Costa Coffee, without the long wait to be served.

If this type of service and price is replicated across its network then I can see why McDonald’s may have an edge in a ferociously competitive market.

Franchises are immensely profitable for McDonald's

The profitability generated by the franchised restaurants is measured by the franchise margin. This measures the revenues paid by franchisees less McDonald's occupancy costs (rent and depreciation). The profit margins are very high.

Margins

Margins | Company | Franchised | Operating margin |

2018 | 17.4% | 82.4% | 43.1% |

2017 | 18.2% | 82.4% | 38.8% |

2016 | 17.0% | 81.6% | 31.8% |

2015 | 15.2% | 81.5% | 28.9% |

2014 | 15.9% | 81.7% | 29.0% |

Source: Company reports

You can see that as a percentage of revenues, franchised restaurants are much more profitable than company-owned ones (which have all the operating costs). The significant change in mix towards franchises in recent years has seen total revenues decline, but has had a big impact on McDonald’s operating margin, which has increased from 29 per cent in 2015 to a very impressive 43.1 per cent in 2018.

Franchise revenues are now bigger than company-owned revenues. Not only has McDonald’s benefited from this shift in mix, but it has also been able to consistently grow its global like-for-like sales over the past few years. This is a very encouraging sign of a business that is keeping customers happy and attracting new ones.

Revenues

Year ($m) | Company revenues | Franchised revenues | Total revenues | Like-for-like sales |

2018 | 10,013 | 11,013 | 21,026 | 4.5% |

2017 | 12,719 | 10,102 | 22,821 | 5.3% |

2016 | 15,295 | 9,327 | 24,622 | 3.8% |

2015 | 16,488 | 8,925 | 25,413 | 1.5% |

2014 | 18,619 | 2,972 | 21,591 | -1.0% |

Source: Company reports

The growth in underlying revenues and shift in restaurant mix is feeding through to the company’s financial performance across a broad range of measures. More franchising is not only boosting profits, but it is also reducing the capital intensity of the business. Average capital invested has fallen by $5bn since 2014 while operating profits have increased by more than $1bn. Return on capital employed (ROCE) is currently a very impressive 33 per cent.

McDonald's return on capital employed

Year | Revenues | Operating profit | Operating margin | Average capital employed | ROCE | FCF | FCF margin |

2018 | 21026 | 9062 | 43.1% | 27449 | 33.0% | 4225 | 20.0% |

2017 | 22821 | 8854 | 38.8% | 29272 | 30.2% | 3698 | 16.2% |

2016 | 24622 | 7821 | 31.8% | 31310 | 25.0% | 4239 | 17.2% |

2015 | 25413 | 7355 | 28.9% | 33261 | 22.1% | 4726 | 18.6% |

2014 | 21591 | 7968 | 29.0% | 32495 | 24.5% | 4147 | 15.1% |

Source: Company reports/my calculations

At the same time, there has been an increasing amount of investment in the business (more than its annual depreciation charge), which has been a drag on free cash flow (FCF). Yet FCF margins have increased to 20 per cent. When the investment in store remodelling and features such as digital menus and ordering, and improving the drive thru’ experience have finished (probably by 2022), then it’s not unreasonable to think that FCF margins could improve further.

McDonald’s clearly has the financial performance of an outstanding business but can a business that is already very big get much bigger?

Where’s the growth going to come from?

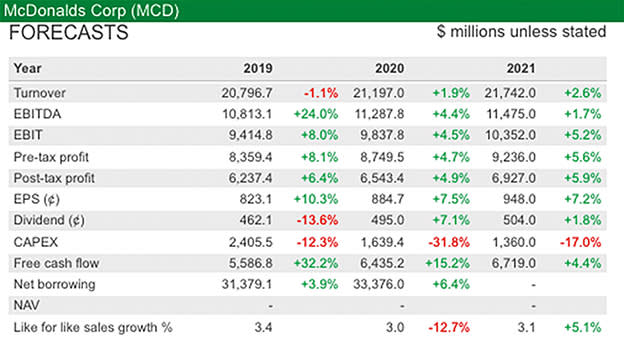

Source: SharePad

The company is targeting like-for-like sales growth of 3-5 per cent over the next few years. Sales growth will also be helped by more restaurant openings (a net 750 more are expected in 2019) with a focus on emerging markets. McDonald's plans to sell more products, more quickly to existing and new customers. Areas such as breakfast and McCafe coffee are seen as attractive growth areas. Investment in improved store layouts and digital customer experiences (in-store menus and mobile apps) is part of a project called the 'Experience of the Future' and is also seen as a way of getting more people through the doors of its restaurants.

Cost savings should also come through, with McDonald's getting close to achieving the $500m targeted reduction from its $2.6bn selling, general and administrative costs. This should keep profit margins in the mid 40 per cent range. However, cost pressures do exist in the form of commodity and labour expenses.

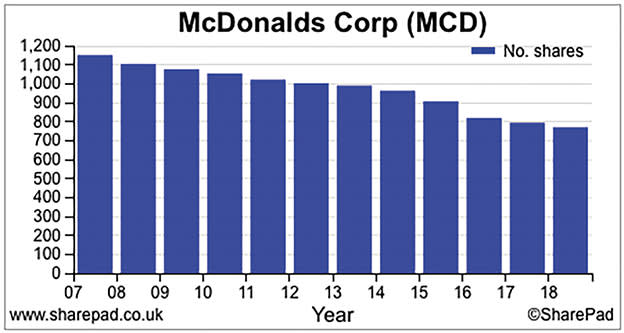

McDonald's has been buying back a lot of its own shares in recent years and has been prepared to take on more debt to do so. This should continue to support earnings per share (EPS) growth while keeping debt costs manageable.

Can McDonald's keep its franchisees happy?

As we have seen, McDonald's franchises make it a very profitable business. While this is undeniably attractive to investors, they often overlook the fact that this type of business is only sustainable as long as its franchisees can keep making enough profits to pay royalties and rents.

Friction between franchisees and the master franchisor have arisen in the UK with Domino’s Pizza (LSE:DOM) over the subject of franchisee profitability. It seems that some McDonald's franchisees in the US have been getting grumpy recently, too.

The company seems unconcerned about this, but around a quarter of US franchisees have formed a group called the National Owners Association. It has been complaining about issues such as the pressure on store profits, the lack of control over menu pricing and the costs they are having to take on in upgrading restaurants.

If we look at profitability, we can see that McDonald’s-owned restaurant profit margins fell in 2018, mainly due to higher staff costs.

McDonald's owned company profit margin

Company margin | 2018 | 2017 |

Revenue | 100 | 100 |

Cost as % of revenue: | ||

Food & paper | 31.5 | 31.7 |

Staff costs | 29.3 | 27.7 |

Occupancy & other | 21.8 | 22.4 |

Total costs | 82.6 | 81.8 |

Profit margin | 17.4 | 18.2 |

Source: Company report

Seventeen per cent is still a decent margin, but franchisees will not be making that. Assuming that company margin is representative of profit margins earned in the US (it might not be) franchisee margins will be lower.

When royalties (4-5 per cent of sales) and higher occupancy costs are deducted, it’s not difficult to think that some franchisees could be into single-digit profit margins. According to my calculations, the average annual sales of the US franchised restaurants was around $380,000 in 2018. If operating profits are less than $40,000 per year, then that does not look like a great return on investment and may discourage franchisees from opening more stores.

It’s difficult for an outsider to know what is going on. The company has not flagged it as an issue, but it is a risk of investing in McDonald's shares that needs to be considered.

Are McDonald’s shares cheap or expensive?

Quick-service restaurant and fast-food shares are highly rated and trade on high price/earnings (PE) ratios on a one-year rolling forecast basis. McDonald’s shares are not cheap on a PE ratio of 21.4 times, but they are arguably not expensive for a business with its quality and dependable cash flows.

Some investors will view McDonald’s as falling into the quality bond proxy category, which should warrant a high valuation. On that basis, the shares may still look to be reasonable value.

McDonald's compared with US peers

TIDM | Name | Price ($) | Market cap ($m) | Forecast PE roll 1 |

DPZ | Domino's Pizza | 286 | $11,916.7 | 29.3 |

JACK | Jack in the Box | 81 | $2,095.9 | 18.1 |

MCD | McDonald's | 178 | $136,801.9 | 21.4 |

QSR | Restaurant Brands International | 63 | $15,745.2 | 22.5 |

YUM | YUM Brands | 95 | $29,518.8 | 24.9 |

Another way to look at the valuation of a business is on the basis of a rolling earnings yield if EPS can be taken as a reasonable proxy for owner earnings. I am going to argue that in the case of McDonald's they are.

What we are looking at here is the earnings yield a buyer of the shares would get over the next three years if current analysts’ forecasts are met. The projected yield would go from 4.6 per cent in 2019 to 5.3 per cent in 2021. That’s not particularly high, but those bullish on the shares would argue that compared with 10-year US Treasuries yielding 2.7 per cent currently, the outlook for McDonald's would suggest that shares remain reasonable value for a business of proven quality. I have some sympathy with that view.

McDonald’s rolling earnings yield

Share price ($) | EPS 1 | EPS 2 | EPS3 |

177.5 | 8.23 | 8.84 | 9.48 |

Earnings yield | 4.6% | 5.0% | 5.3% |