Continuing this month’s theme on the commercial effects of climate change, where the big three culprits are transport, food and fashion, we ponder the conflicting shopping interests. Boutiques are elbowed out by fast-food joints while warehouses sprout up in unlikely places. Having picked up a parcel from a depot in deepest, ugliest south London on a dark winter afternoon, I can honestly say I feared for my safety.

Delivery vans and bikes scurry around dropping off stuff, carefully packaged in[EN1] big cardboard boxes filled with polystyrene or plastic bubble wrap – which then litter front gardens. Posters urge us to buy on impulse, and spend again on convenience items. Upmarket new residential developments include his and hers bathrooms and more fitted wardrobes than is good for one’s sanity.

This reminded me of my visit to Casa Milà in Barcelona. Built and decorated by Antoni Gaudi for a wealthy couple on the most important avenue in the smartest part of the city, the 30-room 1,300 square metre flat had, in the master bedroom, a single wardrobe measuring no more than six foot by five foot. Admittedly Mrs Milà had new outfits made for each of the four seasons, but at any one time she only had a morning dress, an afternoon outfit, and an evening gown.

Now, my millennial fashion victim of a daughter has three wardrobes, two chests of drawers, four large bathroom cabinets filled with clobber; she’s now started on the attic. I’m not advocating a life of deprivation, just frugality as a moral choice. Not a hair shirt, but nice fabrics that last, cut well and put together properly – and hopefully make one feel good.

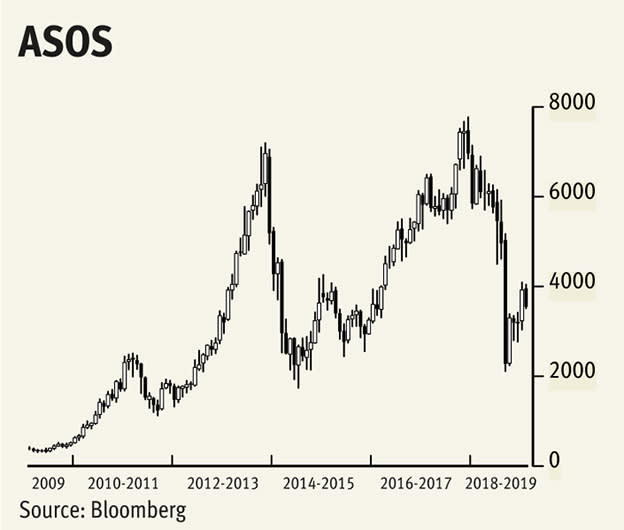

Our first chart is the share price of ASOS – As Seen on Screen – one of the first in the UK to latch on to fast fashion via the internet. Too much of a minnow to be affected by the stock market collapse in 2008, its value rose 10-fold between 2009 and 2013. Stellar stuff but the ride subsequently has been hairy indeed. Holding above 3,000p most of the time, investors have had to stomach four counter-cyclical swings between here and 7,000p; I’m not keen on rollercoasters.

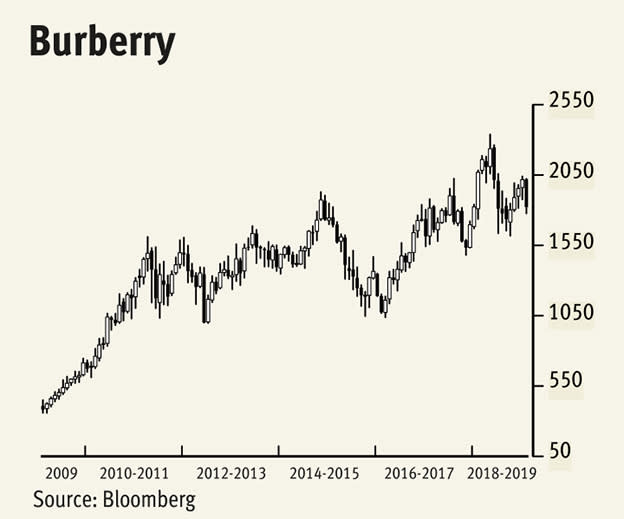

No longer a purveyor of mackintoshes, this century Burberry has become a fully-fledged high fashion house; men’s and women’s clothes and accessories holding their own against top French and Italian brands. A share price collapse in 2007-2008 has been reversed in line with the FTSE indices – and then some. Serious consolidation between 2011 and 2015 has allowed this patrician stock to hit new record highs. We predict further consolidation between 1,500p and 2,250p this year, and then more steady rallies to higher highs.

At the opposite end of the high street lies Associated British Foods, owner of the ultra-successful, dirt cheap Primark clothing stores. Just look at the size of the carrier bags people leaving the shops are lugging, and you’ll see they come from far and wide in search of a bargain. The effect of their clothing shops kicked in strongly in 2010, propelling it to a record high at 3,600p. Consolidation between here and 2,000p is preparation for a lunge towards 4,500p-5,000p.

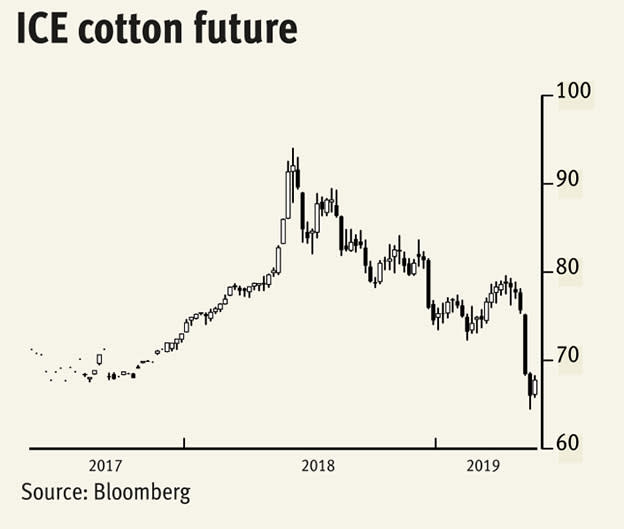

Finally cotton futures in the US and China tumbled over the last year. While the product is natural, growing it and turning it into material uses lots of water. Not as ‘green’ as you’d think.