Tighter ‘know your customer’ rules have meant that 8,000 international accounts operated by Lloyds Banking Group out of Jersey have been frozen as insufficient details of the individuals behind these accounts had been gathered over the last 3 years. Last week Deutsche Bank warned 1,000 corporate clients that they might have banking links axed, again due to money-laundering regulations.

The Erdogan-imposed re-run of the mayoral elections in the city of Istanbul was a resounding defeat for the President last night. Fifty-four per cent of voters cast their ballot in favour of opposition leader Ekrem Imamoglu of the Republican Peoples Party, so that they now control all of the country’s major cities.

DAX 30

Oddly low MACD readings on the weekly chart despite re-testing this year’s high on Thursday. Yesterday Daimler warned that Q2 earnings would take a big hit due to the fallout from the diesel emissions scandal.

SHORT TERM TRADER: Square.

POSITION TAKER: Square.

FTSE 100

Zero MACD and a dragonfly doji last week underline how unstable this index is at current levels.

SHORT TERM TRADER: Small short at 7385; stop above 7470. Target 7100.

POSITION TAKER: Square.

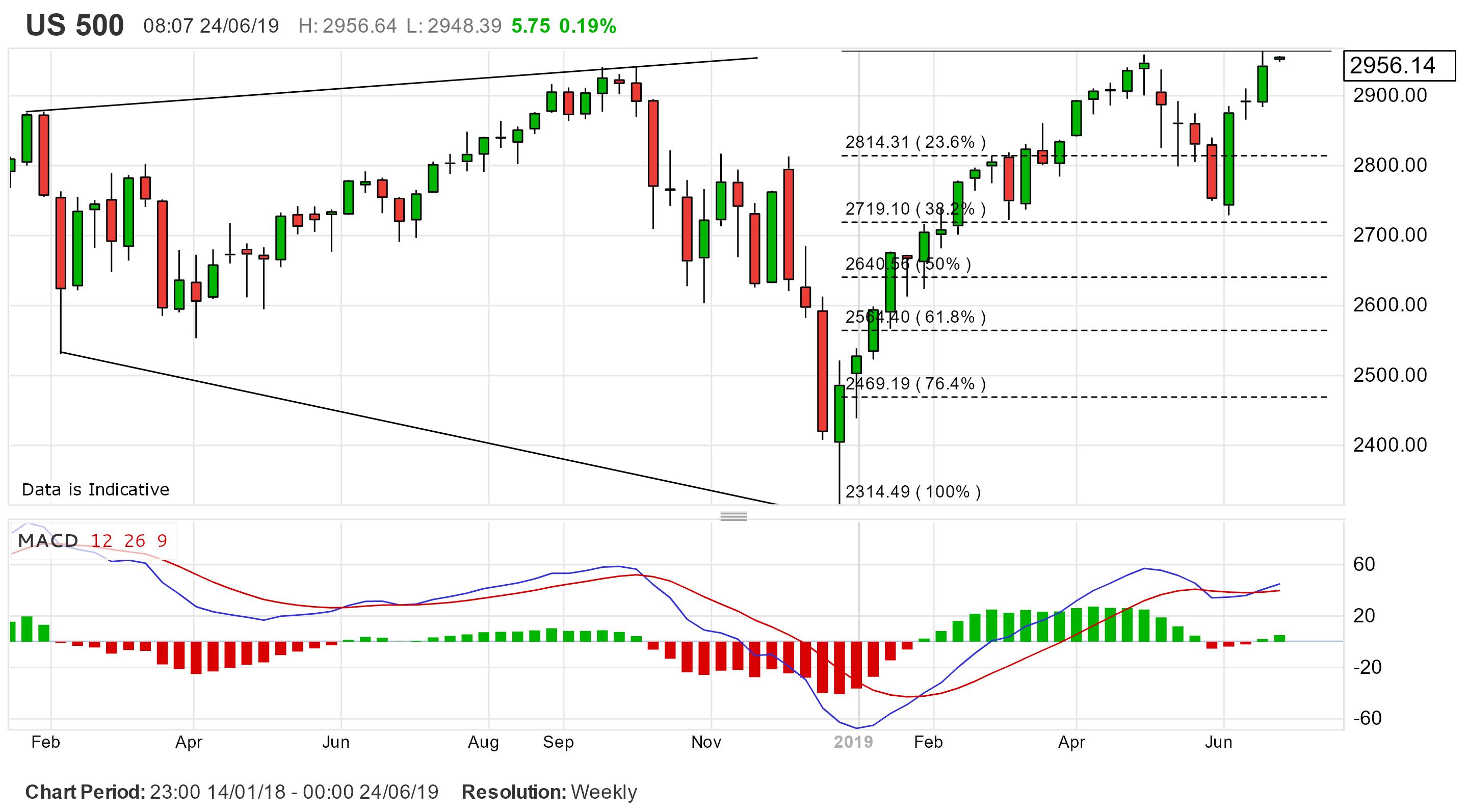

S&P 500

Almost the highest ever weekly close yet the MACD is mixed indeed. Today President Trump will announce further sanctions on Iran – ahead of the G20 leaders’ meeting in Japan which starts Friday.

SHORT TERM TRADER: Short at 2885; stop above 2960. Target 2800.

POSITION TAKER: Square.

BRITISH POUND/US DOLLAR

Still trying to put in a base around the 1.2600 area with the commodity channel index trying to turn up. Note that today at under 108.00 yen per US dollar the Japanese yen is at this year’s strongest and stronger than it’s been for 13 months. Just what PM Abe needed for this week’s G20 leaders’ meeting.

SHORT TERM TRADER: New long this morning at 1.2740; stop below 1.2600. Target 1.2900.

POSITION TAKER: Square.

EURO/US DOLLAR

Momentum turned bullish on the weekly chart with another close above trend line resistance. Helped in part by President Trump’s return to the currency manipulation theme, it might allow for a slow climb to 1.1500.

SHORT TERM TRADER: Square.

POSITION TAKER: Square.

GOLD

Crashing through the band of secular resistance to its strongest in almost 6 years and becoming, unsurprisingly, almost overbought.

SHORT TERM TRADER: Stopped out of short position for a loss.

POSITION TAKER: Stopped out here too.