I have a very simple rule when it comes to investing in stock market flotations, or initial public offerings (IPOs) as they are often called: don’t think of buying in unless the government is the selling shareholder, and stay away from everything else.

Following this rule will keep you out of some shares that can make you a fortune. But more often than not, it will keep you away from poor companies, or ones that are wildly overpriced; the ones that can leave investors nursing big losses.

In days gone by, the sponsoring broker(s) of an IPO used to see it as a key undertaking to ensure that there was a decent aftermarket in the shares once they had been listed on the stock exchange. In very simple terms, this meant leaving some money on the table for the new buyers of the shares.

That kind of attitude no longer seems to hold. For a long time now, the pricing of IPOs seems to have been all about maximising value for the selling shareholders, with the brokers pocketing a handsome fee in the process of doing so.

This is particularly true if the selling shareholder happens to be a private equity investor. The reason for this is that private equity firms often receive the bulk of their investment returns from the selling price of their investment. The higher it is, the better the rate of return on their investment and presumably the size of their fees and bonuses.

Sadly, it is the buyers of these private equity IPOs that often pay the price. As well as paying a very high cost to buy in, a business can often be loaded up with debt and have been managed for sale – a focus on short-term profits and cash flows at the expense of long-term profits growth. Investors are asked to pay up for a jam tomorrow story, but the jam often never turns up.

This may be a very cynical view, but it's one that has been sadly proved to be correct time after time. Not all private equity IPOs are bad eggs. Cineworld (CINE) and Hollywood Bowl (BOWL) have proved to be decent investments, but you only have to look at the experience of shares in businesses such as Saga (SAGA), AA (AA.), Debenhams, Premier Foods (PFD), Pets at Home (PETS) and Aston Martin Lagonda (AML) to see what I am going on about.

Being asked to pay a rich valuation based on a story that promises lavish rewards in the future is very much like hiring a builder to do a big job for you, paying for it upfront and hoping he turns up the next day. It can often end in tears.

Last week’s IPO of Trainline (TRN) – a middleman selling train and coach tickets – looks to have all the hallmarks of a flotation where the proceeds have been maximised for the seller at the expense of the buyer. I will now go on to explain why I think this.

The Trainline business

Trainline was set up in 1997 as part of the Virgin Rail business. It started selling train tickets in 1999. It has evolved over the years by buying up competitors and entering new markets. It tried to list its shares on the stock exchange back in 2012 for a rumoured price tag of £400m, but there were not enough interested parties willing to pay up for it.

Today it earns its money from three main business areas:

- UK consumers buying train and coach tickets over the internet and on their mobile devices using an app. This source accounted for 65 per cent of revenues in the year to February 2019.

- UK business customers. Trainline offers small and medium-sized companies a platform to organise their corporate rail travel needs. It also manages the online and app ticket buying platform for 10 train operating companies (TOCs) in the UK. This business accounted for 28 per cent of revenues last year.

- International. A platform for buying train and coach tickets in Europe and recently in Japan. The company is also currently trying to gain a foothold in the US market. International accounted for 7 per cent of revenues last year.

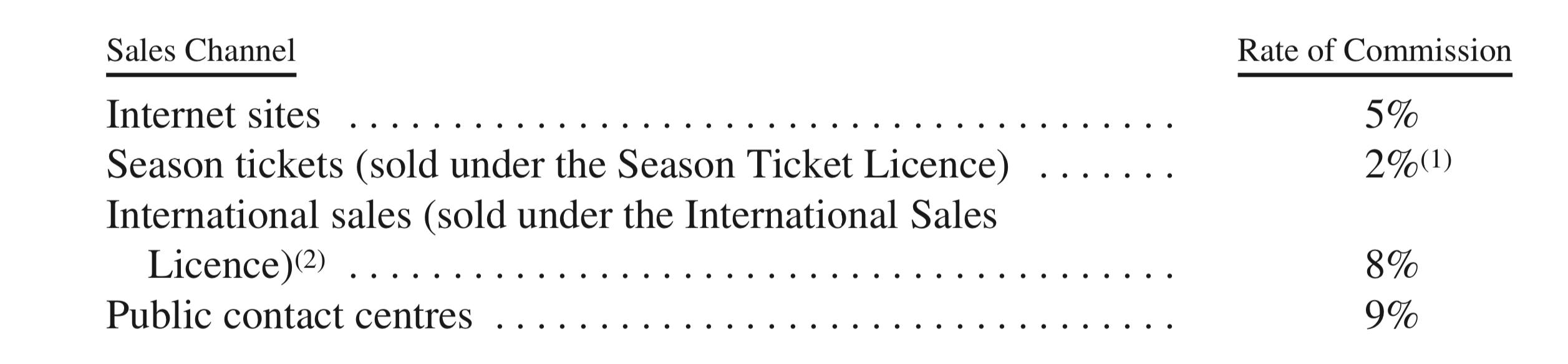

Trainline gets 60 per cent of its revenues in the form of commissions from train and coach companies. These are based on the selling price of the tickets and vary depending on the source of revenue and the ticket type.

Source: IPO Prospectus

Money is also earned from booking fees – which range from £0 to £1.50 per ticket – and service charges. The company is also looking to boost its ancillary income from mobile advertising, hotel bookings and insurance.

In order to sell train tickets in the UK, the company is reliant on a third-party retailing licence awarded to it by the Rail Delivery Group. This was last renewed in September 2018 and is on a rolling seven-year basis. The rates of commission are also fixed and will next be reviewed in April 2023. Coach commissions in the UK are largely derived from National Express, while the international licence is on a one-year rolling basis.

Trainline has invested heavily in its information technology over the past five years, with the aim of offering more information to customers and making the ticket buying and subsequent journey experience easier.

The company has benefited from growth in rail travel of 37 per cent between 2007 and 2017 and the shift in ticket buying to the internet in recent years. Between 2013 and 2018, online train ticket sales in the UK have doubled, with Trainline’s share of the market increasing from 42 per cent to nearly 53 per cent over the same time period. It has increased its dominance as it has arguably been the best at what it does.

Decent growth prospects…

Many selling shareholders of IPOs can be accused of selling out at the top as future growth opportunities fall away. This is certainly not the case with Trainline as there seem to be plenty of fundamental growth drivers for its markets still in place.

Rail travel is still expected to grow in both the UK and Europe. This will be driven by increasing levels of road congestion and investment in high-speed rail infrastructure. Long-distance coach travel remains a cheap alternative to rail and is very attractive to those on low incomes. An increase in awareness of the environmental impact of air travel may also shift more travel towards rail.

Yet it is the way that people buy their rail and coach tickets that suggests that there is still plenty of growth out there. Eticketing on mobile devices is still very much in its infancy and is likely to become the main way that people buy tickets in the future. Trainline, with its market-leading app, and its infrastructure – which supports a large number of existing UK TOCs – seems to be very well placed to exploit this.

…but also a growing number of threats

Yet, there is no guarantee that this positive fundamental backdrop to train and coach markets is going to lead to strong rates of sustainable profit growth for Trainline’s shareholders.

While it is currently the dominant player in the market, competition cannot be ruled out. For example, National Rail Enquiries has an app that provides timetables, journey updates and links to train operator websites to buy tickets – with no booking fees, unlike Trainline – which currently looks a bit lacklustre, but with a bit of investment could become a more serious competitor. Technology companies such as Uber or Lyft or even Google, Apple or Facebook could also potentially look to grab a share of the market.

However, the bigger risks look to come from industry and political interference. The government is currently looking at the structure of the UK rail industry, which might end up in a radical change of the current rail franchising system and Trainline’s source of revenue from it.

The Rail Delivery Group is currently reviewing fares on the UK network and might end up capping fares and the commissions that Trainline can earn from them.

The threat of a Labour government, which wants to renationalise the UK railways, cannot be completely discounted. It’s hard to believe that such a government would allow a private ticket seller to co-exist with a state-owned rail network.

Trainline’s current IT platform arrangements with TOCs also has risks. These have an average remaining life of seven years, but are subject to refranchising risk. Its biggest white-label customer, Virgin Rail, will see its West Coast franchise come to an end in 2020 and Trainline will have to rebid for the ticketing contract.

A sensible valuation of Trainline’s business should take these risks into account.

Financial performance

Trainline (£m) | 2017 | 2018 | 2019 | 2017-19 |

Revenue | 152.8 | 178 | 209.5 | 97.9 |

Gross profit | 111.6 | 129.8 | 155.4 | 43.8 |

Operating profit | -11.2 | -7.6 | 10.5 | 21.7 |

Pre-tax profit | -31.2 | -29.4 | -13.7 | 17.5 |

Post tax profit | -30.2 | -24.2 | -13.7 | 16.5 |

Capital invested | 568.6 | 548.1 | 542.9 | -25.7 |

Operating cash flow | 38.6 | 37.2 | 75.2 | 36.6 |

Free cash flow | 29.6 | 0.8 | 28.2 | -1.4 |

Capex | 17.3 | 28.5 | 32.6 | 15.3 |

Ratios | ||||

Gross margin | 73.0% | 72.9% | 74.2% | 44.7% |

Op margin | -7.3% | -4.3% | 5.0% | 22.2% |

FCF margin | 19.4% | 0.4% | 13.5% | -1.4% |

ROCE | -2.0% | -1.4% | 1.9% | N/a |

Op cash conv | -344.6% | -489.5% | 716.2% | 168.7% |

FCF Conv | -98.0% | -3.3% | -205.8% | -8.5% |

Capex to op Cash flow | 44.8% | 76.6% | 43.4% | 41.8% |

Capex to Sales | 11.3% | 16.0% | 15.6% | 15.6% |

Sources: IPO Prospectus, Investors Chronicle

Despite having been part of a growth market for quite some time now, and having a largely fixed – admittedly growing – cost base, making decent profits has proved to be elusive for Trainline. This is a business that should have a lot of operating leverage, where increases in revenue lead to bigger increases in profits because of lots of fixed costs. This seemed to be the case last year, but this effect seems to have been missing for much of the company’s life.

At the end of February 2019, its balance sheet showed cumulative retained losses of just under £100m. The business did make an operating profit of £10m last year, but the interest bill on £269m of borrowings meant that it made a post-tax loss of £13.7m.

It has been able to grow its sales and profits since 2017 without increasing the amount of money invested in the business, but operating margins of 5 per cent and a return on capital employed of just 1.9 per cent are a long way short of anything approaching a high-quality business.

The business looks to be very profitable if we just look at its gross profits and profit contribution.

Revenues as a percentage of ticket sales

Trainline (£m) | 2017 | 2018 | 2019 |

Net ticket sales: | |||

UK consumer | 1109.9 | 1338.4 | 1647.6 |

UK corporate | 1038.8 | 1123.8 | 1198.0 |

Total UK | 2148.7 | 2462.3 | 2845.7 |

International | 104.8 | 218.2 | 348.5 |

Group | 2253.5 | 2680.5 | 3194.2 |

Revenue | |||

UK Consumer | 97.6 | 114.4 | 136.7 |

UK Corporate | 50.3 | 54.4 | 58.4 |

Total UK | 147.9 | 168.8 | 195.0 |

International | 4.9 | 9.2 | 14.5 |

Group | 152.8 | 178.0 | 209.5 |

Revenue % of ticket sales | 2017 | 2018 | 2019 |

UK Consumer | 8.8% | 8.5% | 8.3% |

UK Corporate | 4.8% | 4.8% | 4.9% |

Total UK | 6.9% | 6.9% | 6.9% |

International | 4.7% | 4.2% | 4.2% |

Group | 6.8% | 6.6% | 6.6% |

Sources: Prospectus, Investors Chronicle

Its UK business is generating a reasonable percentage of revenue on the value of its tickets sold. This is producing decent gross and contribution margins (which take into account direct allocated overheads as well as the cost of sales).

Gross margins | 2017 | 2018 | 2019 |

UK consumer | 77.8% | 77.1% | 78.3% |

UK corporate | 64.5% | 65.2% | 69.6% |

Total UK | 73.3% | 73.3% | 75.7% |

International | 66.4% | 66.7% | 54.4% |

Group | 73.1% | 73.0% | 74.2% |

Contribution margins | |||

Total UK | 76.0% | 76.2% | 81.9% |

International | -228.1% | -199.0% | -124.4% |

Group | 41.3% | 38.7% | 44.8% |

Source: Investors Chronicle

The problem seems to be the unallocated costs that have to be paid, such as group central costs and the depreciation and amortisation associated with the IT platform. The company hasn’t been able to generate sufficient sales volume and gross profit growth to leverage these costs. You need to believe that it can for a long period of time going forward to justify the very lofty valuation that has been put on its shares.

Optimists may point to the company’s cash flow performance, but care is needed here. The company benefits from having a negative working capital position where its customers pay it before it has to settle its bills. The £28.2m of free cash flow generated last year can be largely explained by a £35m inflow from increases in its payables balance at the year-end.

This is a nice position to be in, but it is important to realise that this is a timing issue and is not a permanent source of value as the bills will have to be paid after the year-end. When push comes to shove, this is a business that isn’t making any real money for its shareholders at the moment. How can a market capitalisation of nearly £2bn be justified?

It’s difficult. This business should not be confused with immensely profitable IT platform businesses such as Rightmove (RMV), Hargreaves Lansdown (HL.) and Auto Trader (AUTO). It is good at what it does, but it is a middleman selling other companies’ products and is subject to competitive, regulatory and political risks. Yet its shares are arguably priced for perfection.

In my view, a business with a market capitalisation of £2bn should be capable of generating sustainable free cash flows of at least £100m a year in reasonably short order – within five years – and arguably more than that, excluding working capital inflows. Maybe Trainline will prove me wrong, but it is a long way from doing this.

The current year has apparently started well, with net ticket sales in the UK expected to grow in the high teens to low 20s per cent range. Revenue growth is expected to be lower than this as more ticket sales are made on the day of purchase and do not incur a booking fee – a trend that is expected to continue for a few more years.

International sales are expected to grow strongly from a low base, with the target of reaching a break-even contribution rate within three years. But corporate sales in the UK are expected to be flat following the loss of a contract. Future growth from this source is expected to be quite modest.

Yet whether this allows the company to generate a profit for shareholders this year remains to be seen. You’d think the operational gearing on a business like this would be massive. If it was and profits could increase substantially very quickly then I would ask why would the owners sell out now?

The answer is because they are getting paid for uncertain future performance now while the buyers will have to hope that it materialises. That’s a position that every seller wants and every rational buyer wants to avoid.