Equity investors, and especially those interested in mining stocks, should watch news in the next few days from the People’s Bank of China (PBOC), because this might be mildly encouraging.

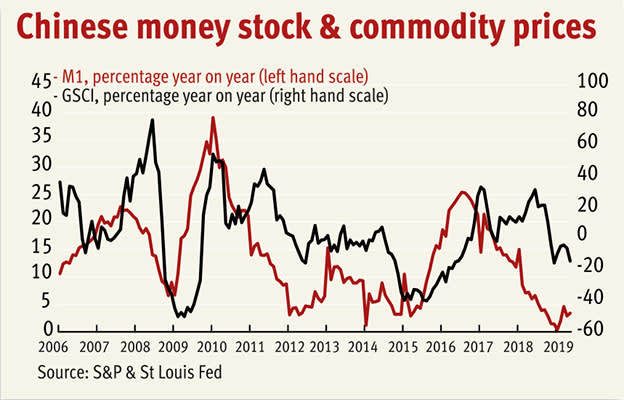

What matters here is the annual growth of the M1 money stock. The PBOC could report that this has increased recently, from a low-point of 0.4 per cent in January to around 4 per cent now. This matters because this growth is a nice leading indicator of annual changes in commodity prices. The correlation between M1 growth and the annual change in the S&P GSCI (formerly the Goldman Sachs Commodity Index) six months later since 2006 has been a hefty 0.59. That means that Chinese monetary growth alone can explain over one-third of the substantial volatility in commodity prices. Accelerations in M1 growth in 2006, 2009 and 2015, for example, led to rising commodity prices, and slowdowns in M1 in 2008, 2011 and last year led to falling prices.

Because commodity prices and mining stocks are correlated, this means that accelerations in Chinese M1 augur well not just for commodities but for mining stocks too.

There’s a simple reason for this. M1 growth is a lead indicator of output growth: the correlation between M1 growth and the manufacturing purchasing managers' index six months later has been 0.5 since 2006.

This is probably for the same reasons that M1 is also a lead indicator of eurozone output growth. M1 comprises money that can be easily spent, such as notes and coins and bank deposits that can be withdrawn at little notice. When households and companies get ready to spend, they first transfer assets from less liquid forms into M1. Alternatively, if people see their cash deposits increase for any reason, they are tempted to spend more. Either way, rises in M1 lead to rising output. And in the case of China, this means increased demand for commodities and hence rising prices of them.

For mining stocks, this is doubly good news. They benefit not just from rising commodity prices, but from the improved investor sentiment towards stocks that occurs when the Chinese economy does better, not least because this boosts other Asian economies. There is, therefore, a strong correlation (of 0.65 since 2006) between Chinese M1 growth and annual changes in the FTSE mining sector six months later.

With monetary growth looking like picking up since January, this might seem like good news for investors not just in mining stocks but also in emerging markets: the two assets are hugely correlated.

It is. But there’s a massive caveat here. Monetary growth is still so weak as to predict falls in both commodity prices and mining stocks: post-2006 relations suggest we need to see M1 growth of over 11 per cent if we are to expect mining stocks to rise. Nevertheless, the pick-up in M1 growth is mildly encouraging. As one notorious Chinese man said, a long march begins with a single step.