Weekend elections in the east German states of Brandenburg and Saxony saw the two mainstream parties do better than feared, but right-wing Alternative for Germany made strong gains, with 23.5 per cent and 27.8 per cent of the electorate in the states, respectively. Brandenburg was won by the SPD with 26.2 per cent and Saxony was won by the CDU (Angela Merkel’s party) with 32.3 per cent; both are the worst result for each party in these states since Unification, reports the Financial Times.

It’s September and officially autumn in the northern hemisphere, and bang on time hurricane season started in the Caribbean. Slow-moving top-rated category 5 hurricane Dorian hit some of the islands in the Bahamas yesterday, with winds of up to 220 mph and the risk of flooding up to 7 feet and storm surge. Currently about 200 miles from Florida, it’s expected to move that way early this week and then on to Georgia and the Carolinas. Remember, today is the Labour Day holiday in the US marking the official end to summer.

DAX 30

Last week’s Marabuzo candle from 50 per cent retracement support shows his market has more oomph in it than we had credited it with.

SHORT TERM TRADER: Square.

POSITION TAKER: Stopped out at a small loss on Friday’s rally.

FTSE 100

Another bullish Marabuzo candle, this time from Fibonacci 61 per cent retracement support – yet like the Dax, the MACD is still clearly bearish.

SHORT TERM TRADER: Small short at 7145; stop well above 7200. Target 6850.

POSITION TAKER: Short at 7570; stop above 7325. Target 7000, maybe 6865.

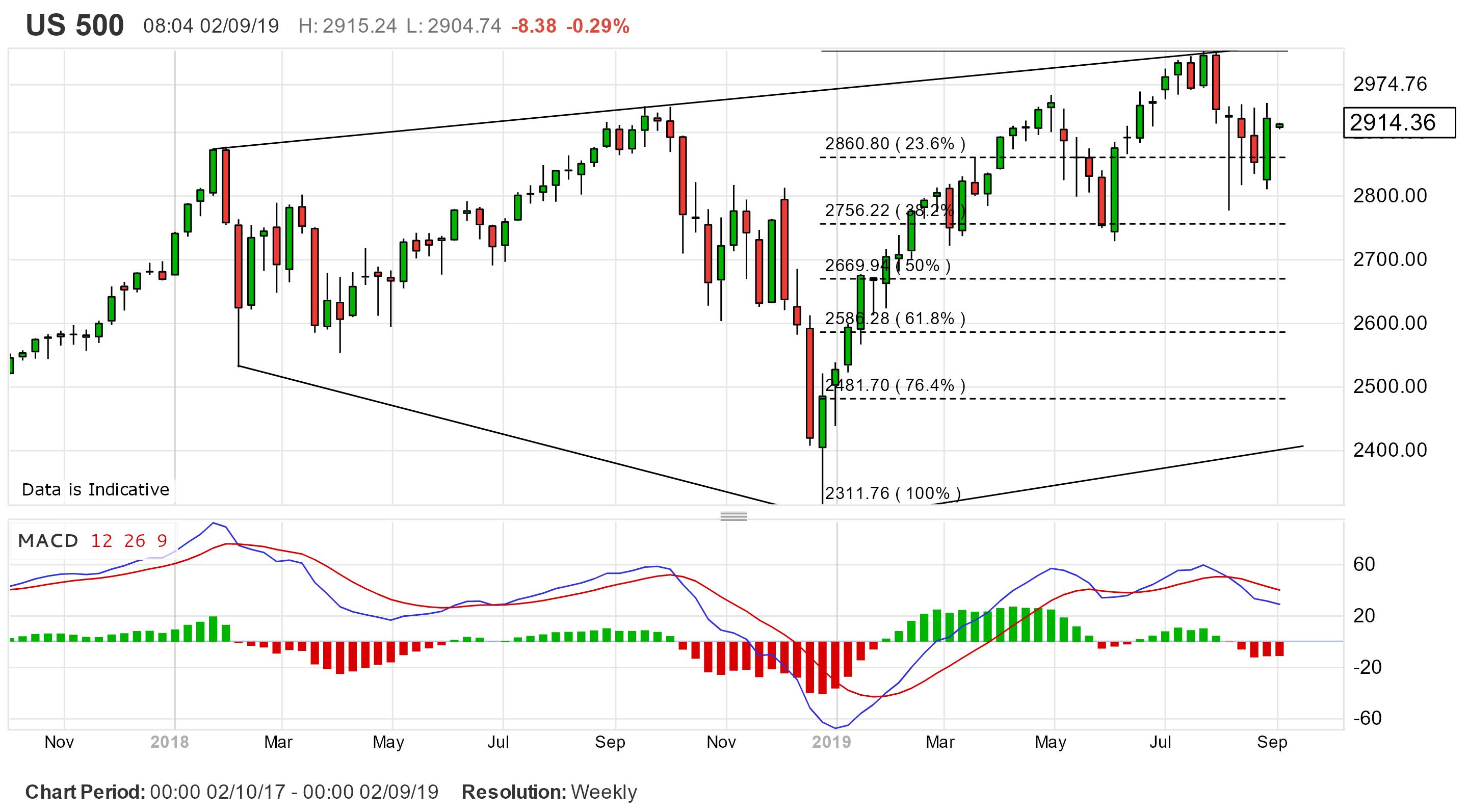

S&P 500

Ending the month in exactly the same weekly range as we started it off with. US tariffs on Chinese imports started yesterday and no doubt the fight between the two will continue. Watch also to see how the row between President Trump and head of the Federal Reserve Jerome Powell maps out ahead of the next FOMC meeting 17-18th of this month.

SHORT TERM TRADER: Small short at 2910; stop above 2970. Target 2820.

POSITION TAKER: Short at 2915; stop above 2970. First target 2820.

BRITISH POUND/US DOLLAR

Almost oversold again as we retreat from weekly trend line resistance.

SHORT TERM TRADER: Small long at 1.2135; stop below 1.2050. Target 1.2380.

POSITION TAKER: Small long at 1.2290; stop below 1.2000. Target 1.2580.

EURO/US DOLLAR

Dropping and ending booth the week and the month at its lowest level since April 2017. Not surprising perhaps as Italy tries to form another government, Spain has none since the election earlier this year, Germany faces a recession and France is France.

SHORT TERM TRADER: Square.

POSITION TAKER: Square.

GOLD

As overbought on a monthly basis as it was at 2011’s record high.

SHORT TERM TRADER: Square.

POSITION TAKER: Square.

Nicole Elliott is a long-standing member and Fellow of the Society of Technical Analysts and has taken over the IC’s trading coverage. She is regularly interviewed and quoted by the financial media, is a conference speaker, and author of several books on charting.