As climate activist teenager Greta Thunberg faced up to President Trump in Davos at this week’s World Economic Forum, climate change and the urgency with which this should be tackled was front and centre of official discussions. Founded 50 years ago, by Professor Klaus Schwab, this year’s theme was: "Stakeholders for a Cohesive and Sustainable World". He says: "People are revolting against the economic ‘elites’ they believe have betrayed them. With the world at such critical crossroads, this year we must… reimagine the purpose and scorecard for companies and governments".

In a world with increasingly polarised and vocal views, one must tread carefully when addressing sensitive issues. The extraction and use of fossil fuels is just one of the many topics under scrutiny, and focusing only on the economic impact and benefits is no longer sufficient. The switch to renewable sources of energy is well under way in some countries – the UK today often supplying over half its energy needs from these sources. But the debate doesn’t stop there, as to whether these are sustainable, cleaner, and really eco-friendly, only time will tell.

To that, one must factor in increasing instability in Africa and the Middle East, whether these nations can wean themselves off crude oil, and what will replace that source of income. All of this is playing out against a background of extreme wealth inequality, ballooning housing costs, and irregular employment.

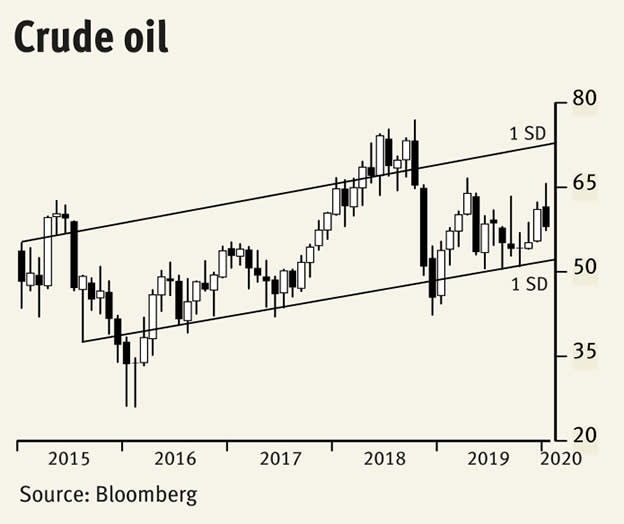

These explain in good part the relative stability of energy prices over the last five years or so, especially when compared with the decade before that. Nymex crude oil found a base at $26 per barrel early in 2016, had an initial mean regression of $45, rising to $61 today. Holding most of the time one standard deviation around the mean, price swings have largely been confined to $20. Over the next few months we expect a drift towards $50, maybe $45, and then a lot more work around there.

The oil majors probably support this view as they’ve been divesting upstream assets including oil fields, and have been notably absent from bidding at international auctions. At the downstream end, we see fewer petrol stations, in London their plots converted into ‘luxury loft-style’ apartments.

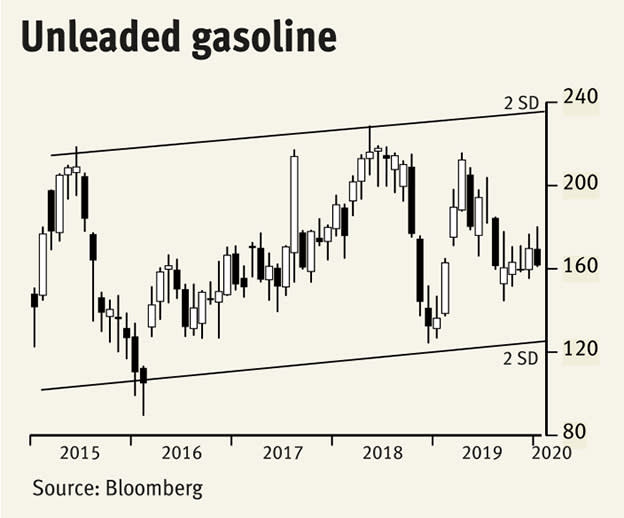

New York unleaded gasoline futures’ prices reflect crude oil ones, as one would traditionally expect. This suggests that demand is stable and that hybrid and electric vehicles have made only very small inroads into customer choices. What is significant is that petrol prices have bigger swings along the way, being constrained at two standard deviations around the mean regression. Here, too, we’d expect last year’s drift lower to continue this year, wholesale prices capped at the $2 per gallon and limited to $1.25 on the way down.

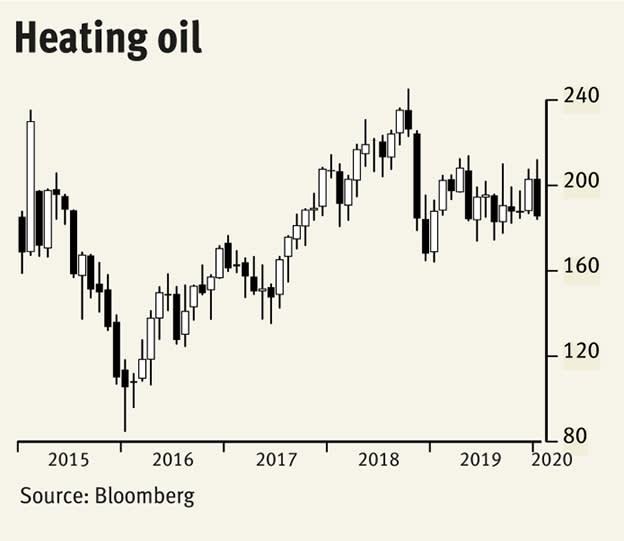

Heating oil futures for delivery at New York harbour were exceptionally steady in 2019, hovering 2¢ either side of the central level at $1.90 per gallon. We expect this to continue.

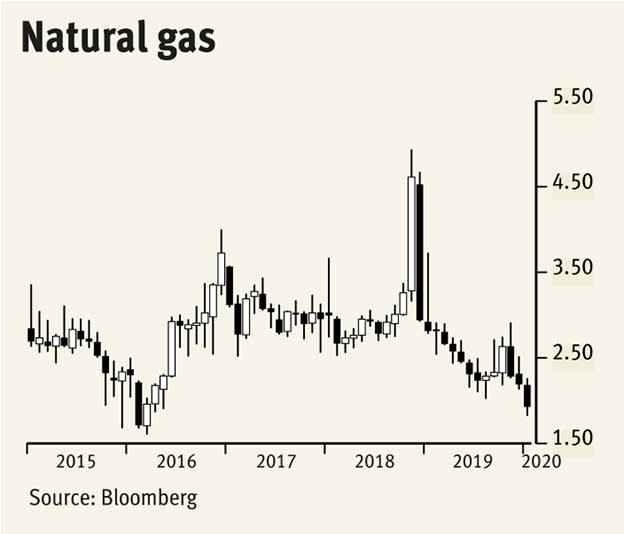

The outlier is natural gas, which has been in a gentle decade-long downtrend from $6.00 per gallon to $1.92 today. This is towards the very bottom of the historical range, at price levels that dominated in the 1990s, and only a little above the record low $1.04 set in 1992. If not that, then $1.50 beckons this year.