Since early 2015, the US dollar index has been very steady – admittedly towards the more expensive end of the scale of the last decade. It’s held between 90 and 102 for five whole years, with a mean regression at 96, meaning the price saw a 6.25 per cent variation either side of here. Digging deeper into the detail it only held at or close to 102 for at best 5 months (in 2017), and dipped intermittently below 90 for a brief four months. Therefore, the bulk of the time it held between 92 and 100 taking observed volatility down to 4.15 per cent. Really low for the FX market, and yet another headache for the FICC (fixed income, currencies and commodities) departments at commercial banks.

The tone changed subtly early January, with an almost global trend to US dollar strength against both major and emerging market currencies. As the euro makes up about half of the weighting in the dollar index, we’re focusing on it today. From a record low EUR/USD historical close-to-close volatility of 2.5 per cent in Q4 2019, it rallied to 4.79 last Wednesday. What’s also changed since the beginning of this year is that one-month, ten-delta, at-the-money implied volatility for puts on the euro picked up from a multi-year low of 3.5 per cent

to 5.27 per cent last Friday – and would have been higher had the trend been less steady. Meanwhile calls on the euro remained relatively steady at 4.6 per cent implied volatility.

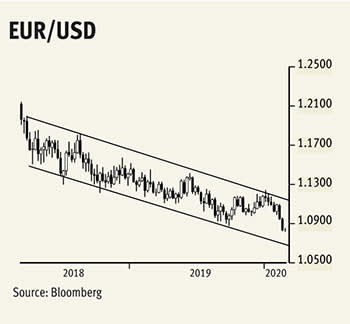

Today the exchange rate is a hair’s breadth above $1.0800, the weakest the euro’s been since 2017 when it made a secular low at $1.0340. The break below last year’s low at $1.0875, if confirmed by a monthly close below here, should mark the start of yet another descent in the trend channel to euro weakness which has moved at a glacial place since 2018. For those with memories as long as mine, the record low for this currency pair was set in October 2000 at $0.8225; it had slumped to this nadir mere months after launching at $1.1900 in 1999.

Another currency pair where puts have been consistently more expensive than calls – for a whopping decade - is the euro against the Swedish krona which, unlike the euro, is quoted as krona per euro. Some might put it down to cognitive bias or anchoring, but the reality is that Sweden’s unit has weakened very steadily since 2012, holding above the psychological 10 since 2018, a feat only achieved once during the great financial crisis of 2008-2009.

Hungary’s forint has less history but has been on a one-way street since 2009, this month getting to its weakest ever level against the euro at 340.30 forints. Onwards and upwards, as they say. It isn’t alone, the Romanian new leu managed its weakest ever at 4.8055 per euro late last year. Both nations’ inflation is roughly double the ECB’s 2 per cent CPI target.

Sterling also suffers from investor bias, calls on the euro versus the pound more expensive than puts for most, but not all, of the time since late 2015. The sharp drop in the value of EURGBP since August’s spike high looks like a whopping triple top, which would complete on a monthly close below £0.8300. Another one to watch!