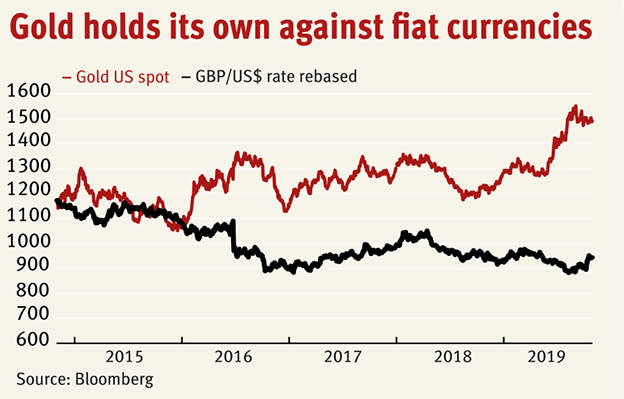

Gold miners hit the figurative gold mine in the second half of 2019. The yellow metal climbed to over $1,400 (£1,085) an ounce (oz) in June but really got going in July, when it fetched over $1,500 an oz – this was felt even more strongly in non-US-dollar currencies due to the greenback’s current strength.

Gold equities and exchange traded funds (ETFs) were well up on expectations that the price hikes would translate into improved cash flows, and have largely kept those gains as gold settles between $1,450 and $1,500 an oz.

Now that third-quarter (Q3) results have started to trickle in, miners are mostly looking good. There are some exceptions, where operational problems have diminished revenue gains – Centamin (CEY) the main example here – while forward sales or hedging also nipped away at some companies’ turnover. But across the mining world’s three big exchanges, in Toronto, London and Australia, earnings are up. Gold bullishness has already translated into improved valuations and more interest in precious metals – with silver climbing to over $19 an oz in September, a two-year high – and this could translate into bumper payouts when the final dividends for 2019 are announced next year.

London

It’s mostly the Russia-focused miners that have reported their Q3 production thus far, but they have plenty to show. Polymetal (POLY) and Polyus (PLZL) saw major increases (33 per cent and 20 per cent, respectively) in turnover quarter on quarter, with the higher price carrying directly over to average sales prices. Polymetal has a payout policy of 50 per cent of underlying net earnings and the combination of higher revenue and lower costs ($800 to $850 an oz for the full year compared with $904 in the first half) should see even more cash funnelled to shareholders. Smaller Russian miner Highland Gold Mining (HGM) did not provide a revenue figure in its third-quarter results, but said it produced 75,000 oz of gold and sold it on at an average price of $1,483 an oz, a 13 per cent increase on the second quarter. Helpfully, the company has a “no hedge” policy as highlighted in its half-year results and a dividend policy of 20 per cent net cash flow from operating activities.

Mining is a tough game, and not every London producer will see the full benefit of the higher prices. Petropavlovsk (POG) was less fortunate than its compatriots due to its forward sales programme in place, which knocked $89 an ounce from its average sales price for Q3, which would have been $1,477 an oz otherwise. Shanta Gold (SHG) lost 2,000 oz of its 22,000 oz of production to forward sales, but still managed an adjusted cash profit increase of over 50 per cent. Shanta does not publish revenue outside final and half-year results.

Centamin missed out on the sales bonanza because production at the Sukari mine dropped 17 per cent quarter on quarter, although revenue still climbed 9 per cent thanks to the gold price. The Egypt-focused miner has had a poor 18 months operationally, so the high gold price has provided a fillip for earnings while the company tries to get the Sukari mine back to its previous good form.

The final three months of the year are crucial for Centamin and could yet deliver major earnings – it has maintained guidance of 490,000 oz, but this will require production to climb to almost 160,000 oz, a 63 per cent quarter-on-quarter increase. While this massive increase in production is being attempted, Centamin’s operational management will be reviewing “all sections of the mine, including mining methodology and infrastructure”.

Across the pond

The world’s largest two gold miners, Barrick Gold (TSX:ABX) and Newmont Goldcorp (US:NEM), are both very different beasts from a year ago, making 2018 comparisons unhelpful. Barrick bought out Randgold Resources last year and put the gladiatorial Mark Bristow in the chief executive position, while Newmont and Goldcorp combined to form the world’s most prolific gold producer. Both companies will report their Q3 earnings in the first week of November, but consensus estimates compiled by Bloomberg put both Newmont Goldcorp and Barrick’s revenue for Q3 up 26 per cent compared with the three months to 30 June. Both major gold miners have flexible dividend policies, with payouts determined by their boards.

Further down the scale, Kirkland Lake Gold (TSX:KL) is unquestionably the biggest success story of the Toronto Stock Exchange (TSX) gold stocks in recent years. It was on a tear thanks to the Fosterville gold mine in Australia well before gold cracked $1,400 an oz; investors are sitting on a 250 per cent gain on shares bought two years ago. Kirkland is another November Q3 reporter, but analyst forecasts put its year-on-year revenue gains at 67 per cent and adjusted net income growth at 158 per cent. Kirkland pays a quarterly dividend, so the added earnings will flow through to investors sooner rather than later.

Will the run continue?

Gold’s all-time high is almost $1,900, reached in 2011 amid the US government debt ceiling crisis and eurozone jitters. The current run has seen a 21 per cent rise in three months, driven by low rates and poor economic confidence, before backing off in recent weeks. Macquarie analyst Marcus Garvey said gold would be likely to stay around current levels. “We think when gold got above $1,500 an oz, it was pretty fully priced,” he said at a briefing this month. The Australian bank says the yellow metal will stay around $1,525 an oz in the December quarter and stay around that level before averaging out at $1,606 an oz in 2021. That’s a thumbs up for gold stocks in the medium term. Mr Garvey said the usual arguments about gold not earning interest (as opposed to cash) didn’t hold water in such a low interest rate environment. “We are in a structurally lower interest rate environment than we were before the financial crisis,” he said. “That means you should have a structurally higher gold price because the opportunity cost of holding gold has fallen.”