Travis Perkins (TPK) is the UK’s largest distributor of building materials. With its customer base spanning large contractors, housebuilders and tradespeople, it is a key player in the construction supply chain and a good indicator of how the wider sector is faring.

Amid the Covid-19 lockdown disruption to its branches and the decline in national construction activity, the group’s revenue dropped by almost a fifth year-on-year in the six months to 30 June, to £2.8bn. Because its costs are largely fixed, the decrease in sales had a big impact on profitability – adjusted operating profit plunged by 81 per cent in the first half of the year to £42m. Throw in £129m of exceptional charges – largely from restructuring efforts – and Travis Perkins swung to a statutory operating loss of £92m, from a £62m profit a year earlier.

The group is seeking to demerge its Wickes retail business and instead focus on its trade merchant operations – although this process has been put on ice until market conditions stabilise. But the retail business has actually proved more resilient, benefitting from an acceleration in DIY sales as people undertake home improvement projects – like-for-like DIY revenue increased by almost 50 per cent year-on-year in June. Meanwhile, the recovery in merchanting has been slower – the repair, maintenance and improvement (RMI) market has picked up post-lockdown, but the group’s housebuilding and commercial construction customers have taken longer to bounce back.

Overall like-for-like sales in July and August came close to 2019 levels, suggesting an improving trajectory. But Travis Perkins has been careful not to overstate its prospects, particularly with regards to any RMI boost from increased housing transactions: “it is not yet clear whether this is a sustained trend or a release of pent-up demand.” The group says it “remains cautious on the volume outlook for building materials in the near term”.

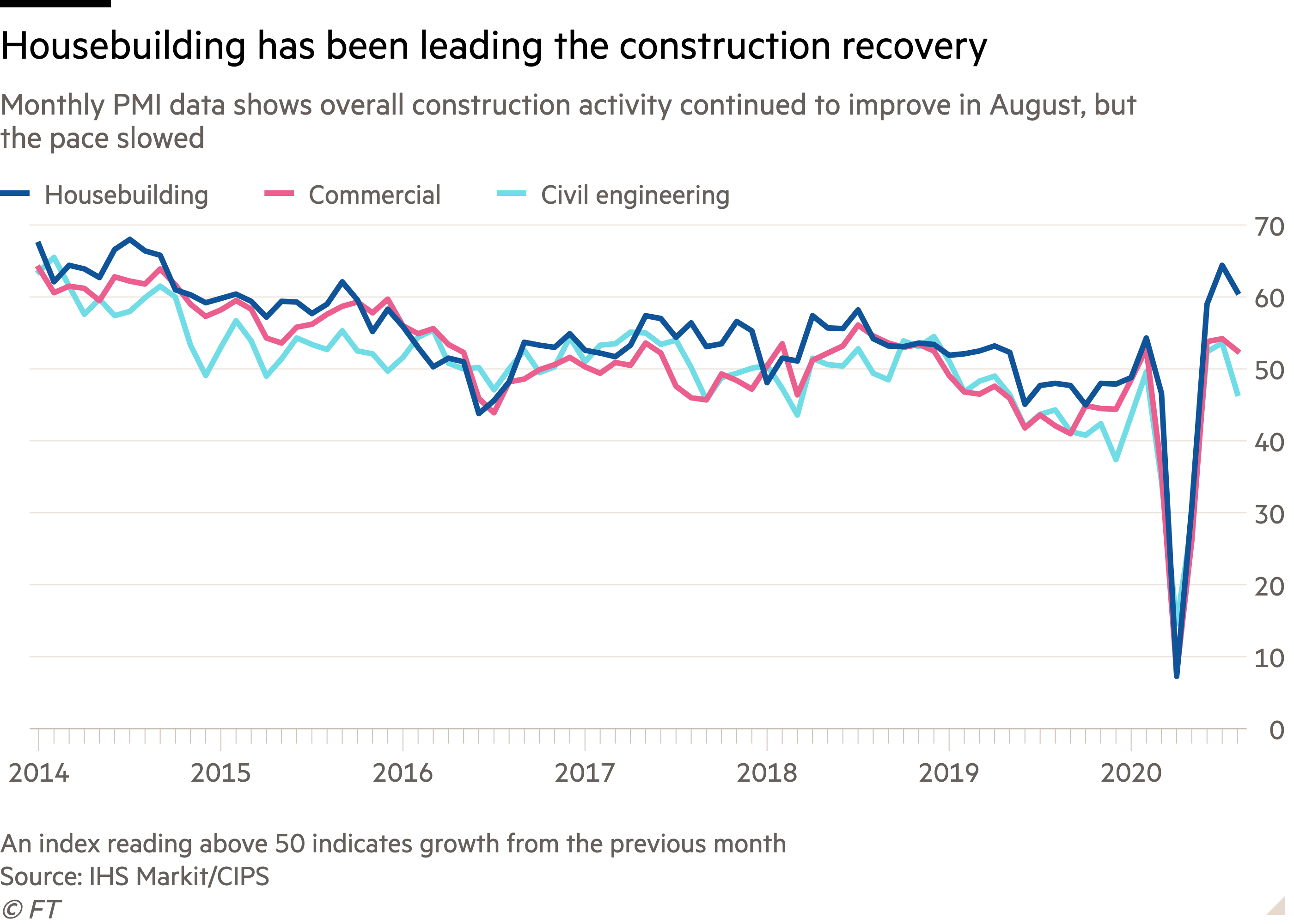

That caution is perhaps warranted when set against recent construction industry data. The latest survey from IHS Markit and the Chartered Institute of Procurement and Supply (CIPS) suggests the construction recovery could be losing momentum. The purchasing manager’s index (PMI) hit a near five-year high in July at 58.1, with growth led by housebuilding. But it slipped to 54.6 in August, below analysts’ expectations of 60. So, while total construction activity continued to increase post lockdown – a reading over 50 indicates growth – this latest expansion was the weakest seen over the past three months.

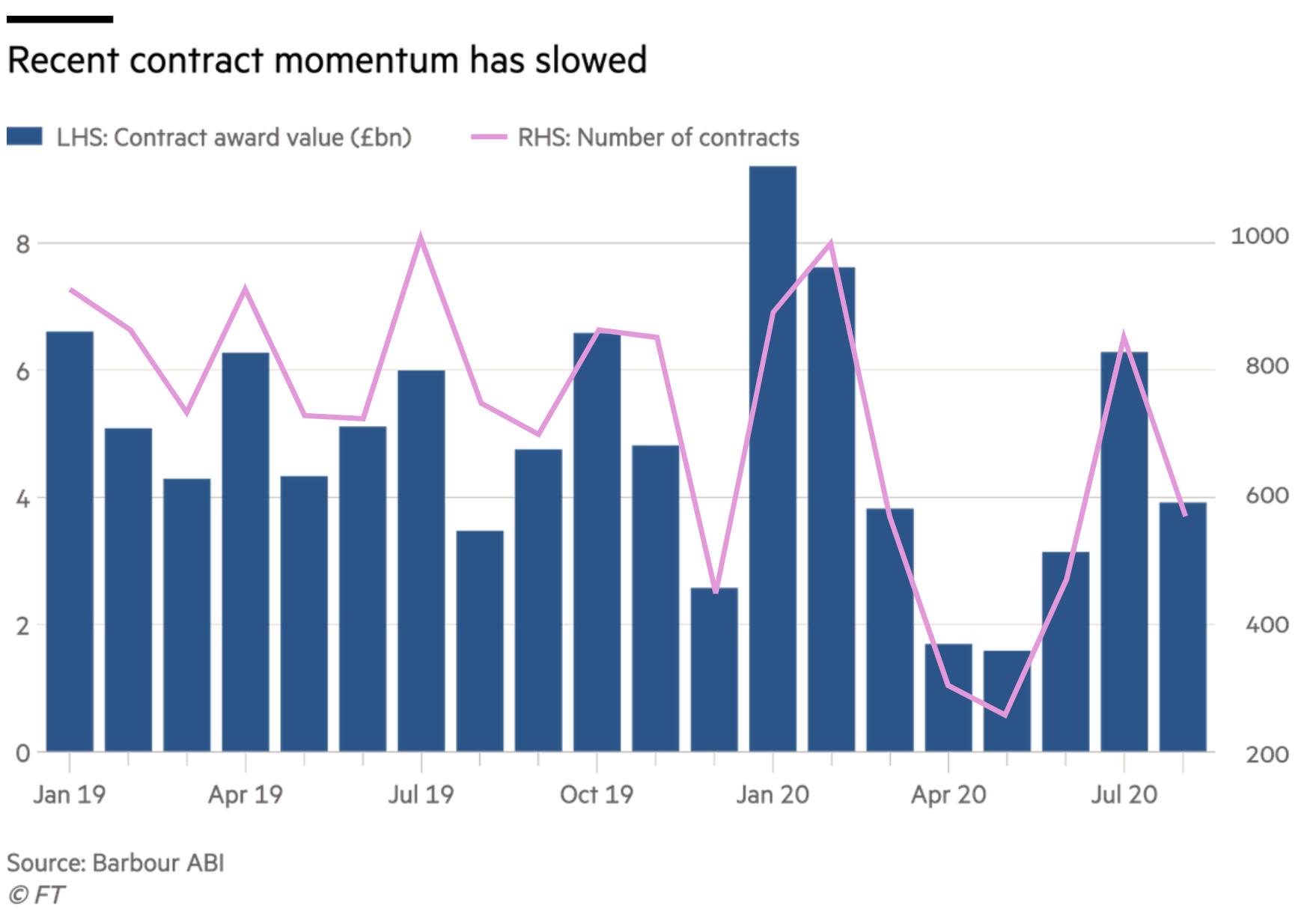

The slowdown was attributed to a shortage of new work to replace completed contracts. According to industry analysts at Barbour ABI, the total value of new contract awards jumped from £3.1bn in June to £6.3bn in July. But this fell back to £3.9bn in August and Tom Hall, chief economist at Barbour ABI says “it looks like July’s value included a backlog of projects that would have been approved while the UK was in lockdown.”

Construction companies have been playing catch-up to finish existing developments as around 50 per cent of projects were delayed by the shuttering of work sites. But as we saw with the overhang of Brexit last year, economic uncertainty means clients are adopting a ‘wait-and-see’ approach to greenlighting new projects. So, as current backlogs are depleted, output could fall moving forward.

“Output in the construction sector tends to track changes in orders after a lag of about three quarters,” says Samuel Tombs, chief UK economist at Pantheon Macroeconomics. “As a result, the adverse impact on output of the 45 per cent year-over-year drop in construction orders in Q2 lies ahead.”

There is a danger that if demand to bid for work outstrips the available tendering opportunities, we could see a return to old habits with a race to the bottom on prices. This would place further pressure on margins – according to the Construction Products Association, the UK’s ten largest contractors had an average pre-tax profit margin of negative 0.1 per cent in 2019. Balfour Beatty (BBY) has observed that some competitors are lowering their prices to secure contracts, but chief executive Leo Quinn says the group will not revert to the bad habits seen before he joined: “I doubt if you’d ever see us return to the terms and the conditions that were accepted back in 2013 and 2014.”

Brick by brick

Elsewhere in the building materials universe, specialist brick manufacturer Michelmersh (MBH) managed to stay in the black in the first half of the year despite the Covid-19 squeeze – statutory pre-tax profit for the six months to 30 June halved to £2m. The group’s operations were closed in the last week of March and much of April, but it returned to normal production levels by the end of May and revenue in June was ahead of a year earlier. It benefitted from some pent-up RMI demand following the end of lockdown as people added extensions to their houses, although trading has since normalised.

Michelmersh’s largest market is in RMI, followed by housebuilding – it supplies the likes of Berkeley (BKG) and Crest Nicholson (CRST). According to the Office of National Statistics (ONS), seasonally adjusted brick deliveries – which are an indicator of housebuilding activity – rebounded from just 23m in April to 140m July. While this is still below pre-pandemic levels, it implies that new residential build projects are ramping up. Housebuilders are no doubt being been spurred on by a buoyant housing market, underpinned by pent-up demand, the stamp duty cut and a rush to utilise the ‘Help to Buy’ scheme before restrictions are introduced in April next year. Housebuilder Vistry (VTY) is looking to take full advantage of the stamp duty holiday. “Where we’ve got build completions in April and May next year, I want them brought forward to March so that we absolutely capitalise on any house that can be sold within the stamp duty holiday,” says chief executive Greg Fitzgerald.

Trouble to come?

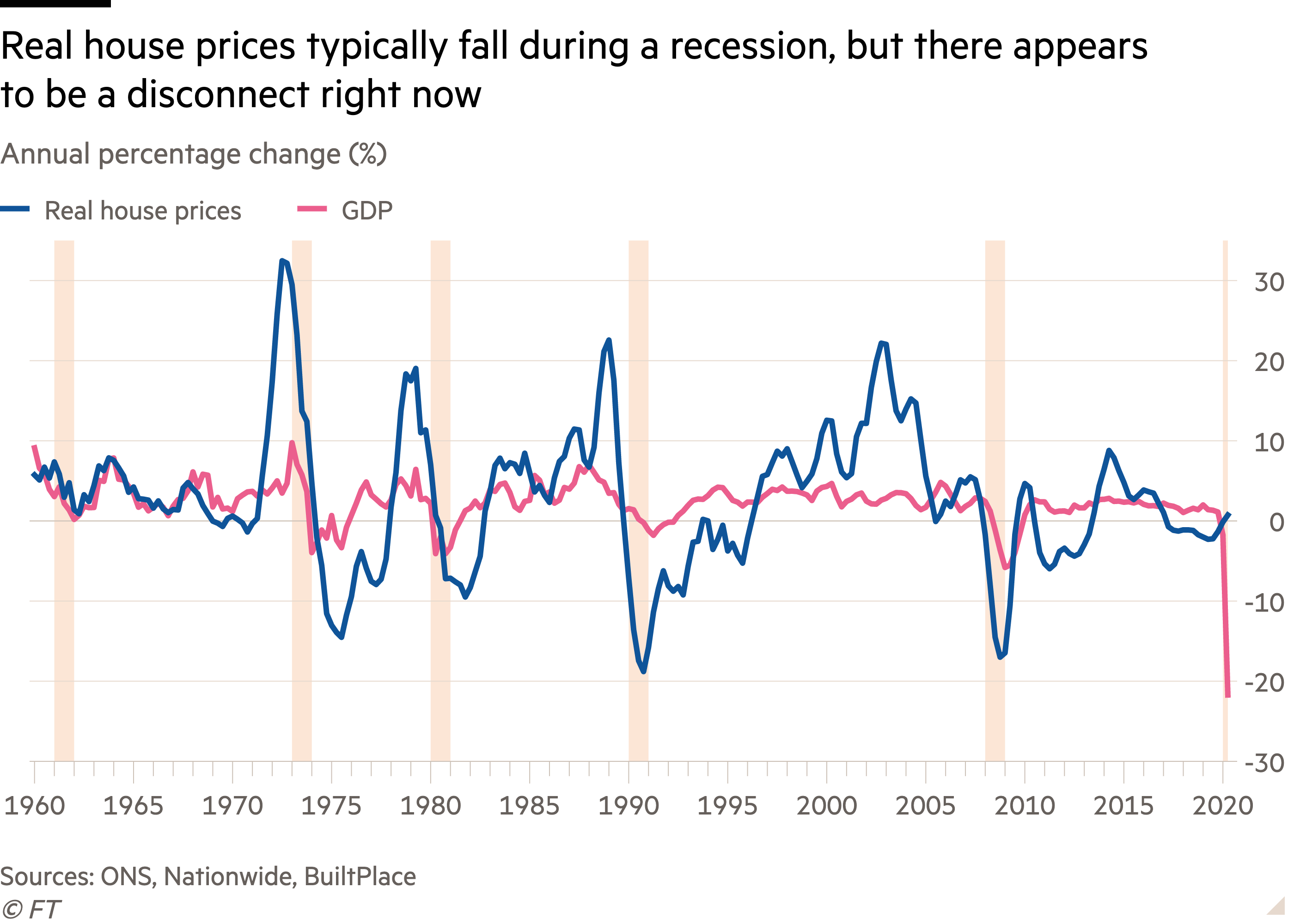

Despite the UK entering the deepest recession on record in the second quarter, Nationwide data indicates that average house prices rose at their fastest rate since 2004 in August, reaching an all-time high. Economic downturns tend to coincide with a decline in house prices, so the market appears to be detached from economic reality at the moment. Richard Donnell, research and insight director at property portal Zoopla believes this is down to the exceptional circumstances. “The ‘once in a lifetime’ re-evaluation of housing requirements on the back of the lockdown is a counter-weight to the impact of the recession on the UK housing market,” says Mr Donnell.

But the housing boom could start to unravel as the government’s ‘coronavirus jobs retention scheme’ (CJRS) comes to an end in October and unemployment is expected to rise. Concerns about job security mean people will think twice before making major spending decisions. Capital Economics predicts the unemployment rate will jump from 3.9 per cent in June to 7 per cent by mid-2021.

“Pent-up demand will soon be expended, while a weak economy, cautious lenders and the end of the stamp duty cut will weigh on prices,” says Andrew Burrell, chief property economist at Capital Economics. “We think house price growth will soon start to moderate, slowing to a standstill in 2021.”

If housebuilding activity tails off, the question is how much other areas of construction can compensate. Commercial activity will likely stagnate on lower business confidence, particularly as fears of a ‘no deal’ Brexit resurface. That would leave infrastructure to pick up the slack – the government will need to put ‘pounds in the ground’. HS2 officially started construction earlier this month but the sector is still waiting for the prime minister to fulfil his promise to “build, build, build”.